Here’s Another Damning Chart That the Fed-Fueled Recovery Will Implode

Fed Chair Jerome Powell has implemented policies that widen the chasm between Wall Street and Main Street. But that disparity won't last forever. REUTERS/Jonathan Ernst/File Photo

- The Federal Reserve’s monetary policy fueled the recovery since the crash in March.

- After hitting all-time highs on September 2, the U.S. stock market has undergone correction amid a tech selloff.

- The implications of the Fed’s accommodative policies are taking effect in the form of significant distortions in the real economy, signaling a growing disparity between Wall Street and Main Street.

Ever since the U.S. stock market crashed in March, the Federal Reserve has bootstrapped equities into a mind-boggling recovery. This recovery has taken place along with an unprecedented rise in the Federal Reserve’s balance sheet and continued near-zero rates.

The rally has undergone a correction after hitting all-time highs on Sept. 2 as tech stocks started to unravel .

The Fed’s efforts have made sure the stock market staged a V-shaped recovery. Watch:

But, implications on the real economy have been devastating.

This Chart Shows the Real Implications of Fed-Fueled Recovery

The Federal Reserve ramped up its “accommodative policy” to stimulate economic activity, but all it did was cause significant distortions and boost wealth disparity.

Historically, whenever the Fed has resorted to interest rate cuts, quantitative easing, and stimulus spending, the top-earning tier has experienced an explosion in their net worth.

More than 80% of U.S. stocks are held by the top 10% of U.S. households, according to Edward Wolff, an economics professor at New York University.

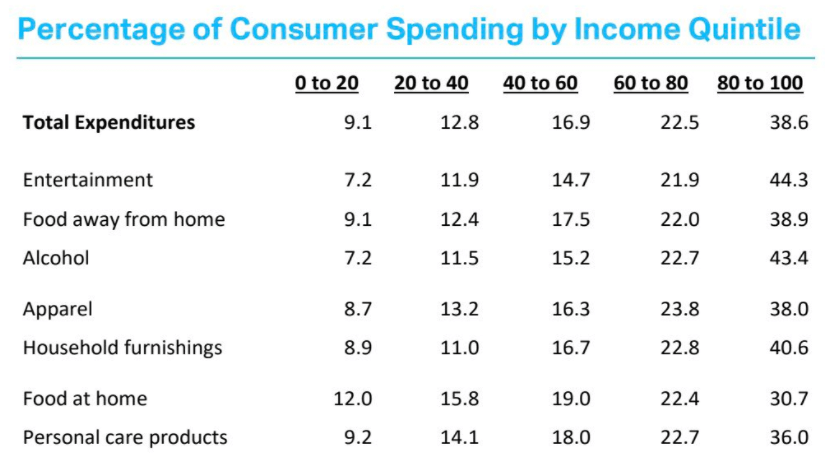

Liz Ann Sonders, Chief Investment Strategist at Charles Schwab & Co., tweeted out damning data on Thursday depicting tremendous distortions in consumer spending.

The rich are the ones doing most of the consumer spending, according to the data.

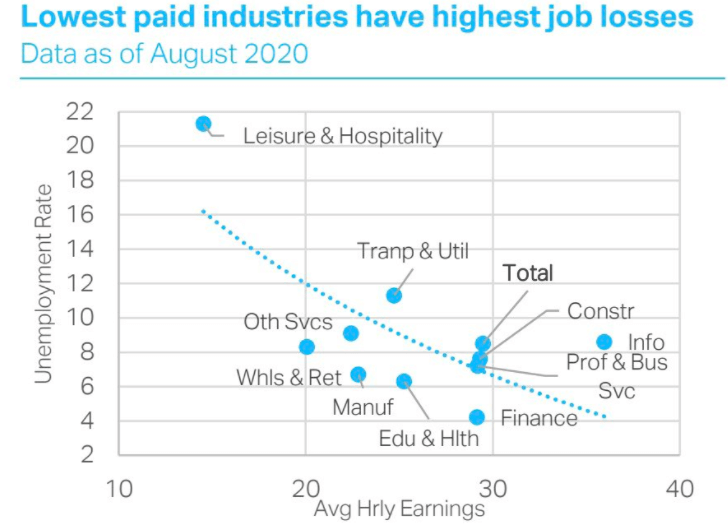

While the top earners are spending the most, low-income industries have suffered the majority of job losses. According to these data, the top 20% are responsible for 38.6% of overall consumer spending.

Distortions With the Real Economy Are Soaring

While the Fed keeps pumping the U.S. stock market, the situation on the ground has worsened.

According to a report from Labor Department data, almost 25% of prime-age workers remain unemployed compared with pre-coronavirus levels.

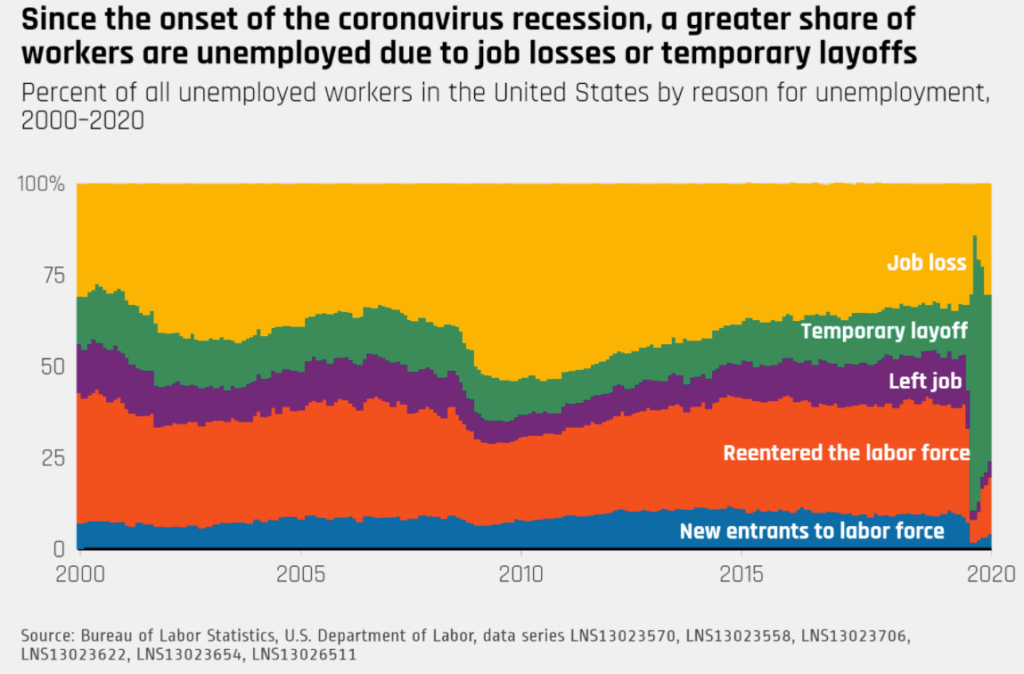

Meanwhile, among the job losses because of the shutdown, 30.6% are permanent.

Combined with the fact that the GDP to total market cap ratio has flown off the handle, this situation paints a grim picture for the real economy.

According to his assessment, Jerome Powell reckons the Fed cannot keep debt and equity assets stabilized while the real economy keeps floundering. Businesses continue to go bankrupt , and the middle and lower class continue to get kicked out of their own homes. These effects will soon spread to Wall Street, which will finally feel what Main Street has been enduring the past few months.

Disclaimer: The opinions expressed in this article do not necessarily reflect the views of CCN.com.