Microsoft Stock Split: MSFT Share Price Surge After Sam Altman Hire From OpenAI Sets Stage for Ballmer-Era Repeat

Microsoft shares rose in 2023, can a stock split further boost MSFT stock? | Credit: Shutterstock

Key Takeaways

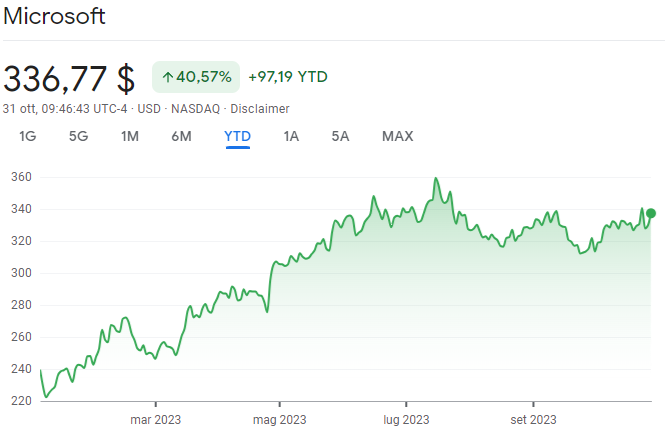

- Microsoft stock is up by 58% since the start of 2023.

- Activision deal, investments, and old-fashioned products boosted the shares so far.

- Now, also the OpenAI-Altman news may impact the shares.

- What’s ahead for MSFT stock?

The 58% surge in Microsoft share price since the beginning of 2023 has stirred discussions about a potential stock split, a move reminiscent of the Ballmer-era strategies. As MSFT stock continues to climb, investors and enthusiasts alike are curious about the company’s next moves, after it closed a deal to buy Activision.

What caused Microsoft stock’s notable rise? And how risky is it to invest now in MSFT? But, more important, is a stock split on the horizon?

OpenAI-Altman Case Explained

Cloud Computing & Azure

The global need for a robust and modern work infrastructure, underscored by the pandemic, highlighted Microsoft’s Azure as a leader in the cloud computing platform arena.

Azure has proven to be a game-changer, offering a wide array of services. These vary from cloud-hosted virtual machines to machine learning capabilities and serverless computing.

Its appeal is further enhanced by a flexible pay-per-use model, which charges businesses based on actual computing usage.

This approach makes Azure an affordable and comprehensive cloud computing platform, covering Infrastructure, Platform, and Software as a Service, ultimately earning its reputation as Microsoft’s crown jewel and the largest contributor to the company’s total revenue.

Productivity & Business Processes

Microsoft’s productivity and business processes segment encompasses a suite of software products, including the globally recognized Office suite, SharePoint, and Teams.

Office, with its extensive range of products such as Office 365 and Microsoft Word, is a staple for both individuals and businesses worldwide, facilitating document creation and collaborative work. The interconnected Office ecosystem, combined with SharePoint, streamlines processes, project management, and real-time document collaboration.

Windows

Microsoft’s flagship operating system, Windows, continues to play a pivotal role in the company’s earnings. Despite the shift towards alternative platforms like Apple‘s MacBook, Windows remains a dependable source of revenue, primarily due to its significant enterprise customer base.

Many enterprises rely on Windows for fundamental operations such as document processing and database management. Microsoft’s recent focus on Windows-related products, aimed at improving user experiences and expanding revenue streams, includes innovations like Microsoft Defender and Windows Hello biometric authentication, addressing cybersecurity needs.

Gaming

Microsoft’s gaming division offers a range of products, including Xbox consoles, games, accessories, and Xbox Live subscriptions. Coupled with gaming on Windows computers, Microsoft has secured a substantial share of the gaming market over the years.

First-party intellectual properties like Halo, Gears of War, and Forza Motorsport have been key drivers of Xbox hardware sales.

While Microsoft scaled back its offering of exclusive titles in recent years, it has taken steps to recapture its gaming audience.

This includes making its Xbox Game Pass subscription service highly affordable and acquiring additional gaming studios like Bethesda and Mojang. Microsoft remains committed to regaining its gaming-first positioning in the PC and console space.

Although gaming division revenue has moderated from the peaks seen during the pandemic, it still ranks as Microsoft’s fourth-largest revenue contributor. Xbox services revenue experienced growth due to the popularity of the Xbox Game Pass subscription service.

Why Is Microsoft Share Rising?

Analyzing a company’s financial performance during the Global Financial Crisis (GFC) provides valuable insights into its resilience.

Despite widespread challenges like dividend cuts and price declines for numerous businesses, Microsoft consistently grew, except in 2009. Notably, this stands out, considering the 2008 Global Financial Crisis was a major economic downturn, unlike the expected milder recession in 2024.

Despite a price drop, Microsoft remained steadfast throughout the 18-month-long crisis. Their stock price declined by nearly 38%, but they managed to achieve double-digit growth in revenue, operating income, and net income from 2007 to 2008.

Revenue surged by 18%, jumping from $51.1 billion to $60.4 billion. Net and operating income experienced growth rates of 22% and 25%, respectively, during the same period. Although Microsoft faced a setback in 2009 when the recession was officially declared over, it swiftly rebounded.

Activision Deal And New Investments

In 2010, revenue reached $62.4 billion, with net and operating income surpassing $24 billion and $18.7 billion, respectively. This resilience suggests that if a recession were to occur, Microsoft is well-prepared to overcome the challenges.

Moreover, the company continues to reinvest in its own growth, exemplified by its recent acquisition of Activision, which received approval earlier this month. Management anticipates immediate benefits for the gaming segment, with Xbox content and services revenue expected to grow significantly.

Microsoft also plans to allocate $3.16 billion to Australia, marking the company’s most substantial investment in the country’s history. This investment aims to expand Microsoft’s focus on artificial intelligence (AI), cloud computing, and cybersecurity.

As AI becomes increasingly prominent across various industries, Microsoft is poised to be at the forefront of this transformative technology.

One reason for Microsoft’s investment in Australia is the country’s relatively fewer regulations and rules concerning AI. In the first quarter, Microsoft reported introducing AI-driven features across all its businesses.

Additionally, the company recently signed a substantial deal with Amazon. It has a value of $1 billion for its cloud productivity tools, over a five-year period.

17 Years Of Dividends

Microsoft, while not as long-established as some other blue-chip companies, has earned its reputation with 17 years of uninterrupted dividends and 13 years of growth.

It offers both dividend growth and capital appreciation potential, making it a versatile stock for various market conditions. Over time, Microsoft has consistently raised its dividend, from $0.08 in 2003 to the current $0.75, including a recent 10% increase last month.

Despite an increase in capital expenditures – known as CAPEX in the financial sector – due to recent investments in artificial intelligence, Microsoft’s free cash flow comfortably covers these expenses.

In the world of large, well-known companies like Apple, Disney, Amazon, and Alphabet, investors sometimes rush to invest without delving into the financial details, which can lead to unexpected setbacks. Even for a trillion-dollar market cap company like Microsoft, there are financial risks to consider.

However, Microsoft has not only consistently covered its dividend obligations in recent years but has exceeded them. This trend may continue for many years. Since 2018, Microsoft has generated over twice the amount of free cash flow compared to the dividends paid out. This resulted in a conservative average payout ratio of 33% over a six-year period.

At the beginning of 2023, Microsoft’s free cash flow surged by 22% year-over-year to reach $20.7 billion. This is a figure substantial enough to cover the entire annual dividend amount in just one quarter.

Stock Split On The Horizon?

Microsoft’s stock price has shown consistent growth over the past year, and even over the last five years, it has soared by over 200%. For those who may not be aware, Microsoft has a history of splitting its stock.

In the 1990s, Microsoft had multiple stock splits, the latest being a 2-for-1 split about 21 years ago. Experts do not foresee an immediate stock split due to the need for Microsoft to integrate the Activision acquisition and ensure its accretive effect. But the current price of $335 could attract a broader investor base through a stock split. This is a tactic other large companies like Alphabet and Amazon recently used.

Experts believe that once the market stabilizes and investor sentiment turns positive, Microsoft’s stock could experience further upward momentum.

It may potentially prompt management to consider another stock split. Since its initial public offering, Microsoft has undergone a total of nine stock splits, primarily during the 1990s. During the last split, Microsoft’s stock was trading at $48.30 and subsequently traded at $24.96.

In 2003, Microsoft aimed to broaden its investor base, a potential driver for a future stock split. Furthermore, Microsoft’s buyback strategy in the past decade, reducing outstanding shares, positions it favorably for a possible future stock split. If it happens, many investors may choose to include Microsoft in their portfolios.

Is Investing In MSFT Risky?

The company faces several potential risks in its path, including heightened competition from industry peers like Google, Amazon, and Apple. With numerous businesses venturing into the AI landscape, this growing competition may pose challenges for Microsoft in the future.

Another risk is the potential decrease in free cash flow due to rising capital expenditures for AI investments. However, this is less concerning for MSFT, given its substantial cash reserves to cover dividend payments in case of FCF challenges.

If a more severe economic recession occurs, the company’s financial outlook may worsen as interest expenses increase with rising interest rates.

According to several analysts, one of the most significant risks lies in the potential for class-action lawsuits. Large companies like Microsoft often contend with such legal challenges. This happens especially as they continue to integrate AI into their business models.

Additionally, the regulatory landscape in Australia may evolve to impose stricter laws concerning AI in the future. This could impact Microsoft’s recent investments in the country and warrant careful consideration.