End-Device AI Is the Most Underrated Opportunity: How to Profit From AI-Related Stocks

End-device AI has notable advantages and is a big opportunity for investors too.

Key Takeaways

- End-device AI is a rapidly growing and potentially lucrative market.

- There are several companies well-positioned to benefit from the growth of end-device AI.

- Investors should consider investing in stocks of companies that are involved in this sector.

- Bank of America unveils which these stocks are .

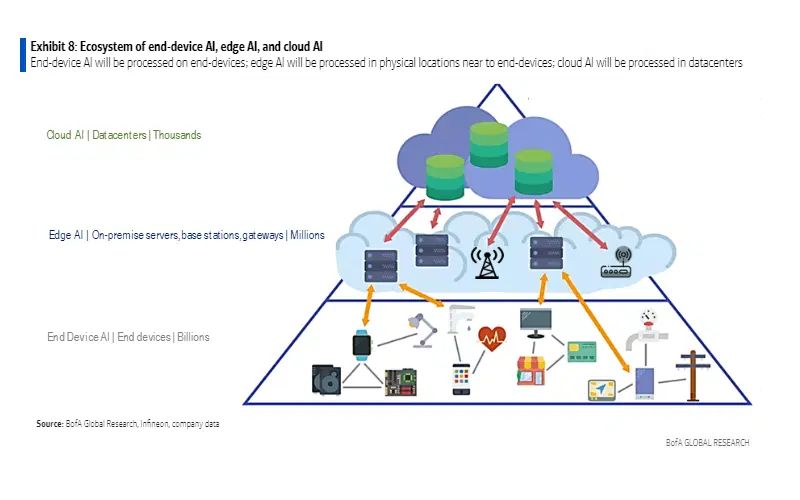

In the realm of artificial intelligence (AI), the term “end-device AI” has emerged as a significant and often overlooked investment opportunity. While cloud-based AI has garnered widespread attention, end-device AI is quietly revolutionizing the way we interact with technology, offering a host of benefits that are poised to transform various industries.

At the heart of end-device AI lies the ability to process AI tasks directly on the device itself, eliminating the need for data transmission to and from remote servers. This shift towards localized processing brings about a multitude of advantages, including enhanced privacy, reduced latency, and improved user experience.

As AI algorithms become increasingly sophisticated, the need for more powerful hardware on end devices is growing. This demand is creating a lucrative market for companies that design and manufacture chips specifically for AI applications.

Disclaimer

Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.