Pandora Price Prediction 2024: Is ERC-404 Hype Over for PANDORA?

What's next for Pandora? | Credit: Hameem Sarwar/CCN.com

Key Takeaways

- PANDORA is an ERC-404 token, meaning it combines traditional crypto with NFTs.

- It came out in early 2024 and aims to provide liquidity to the NFT market.

- Can Pandora build on early growth?

- One Pandora price prediction says the token can reach $28,284 next year.

Pandora is a crypto that aims to combine traditional tokens with non-fungible tokens (NFTs). Coming out in early 2024, PANDORA has gained interest as it attempts to provide liquidity to the NFT market.

However, the project’s future will depend, at least in some part, on whether it can get its ERC-404 token standard officially approved by Ethereum (ETH).

As the crypto world recorded a slowdown in the second half of March, the same happened to PANDORA.

On March 26, 2024, Pandora was worth about $11,208.

Pandora did not immediately respond to a request for comment.

But what is Pandora (PANDORA)? How does Pandora work? Let’s see what we can find out, and also take a look at some of the Pandora Price Predictions that were being made as of March 26, 2024.

Pandora Coin Price Prediction

Let’s examine some of the Pandora price predictions being made on March 26, 2024. It is crucial to bear in mind that price forecasts, particularly for a potentially volatile asset like cryptocurrency, often turn out to be inaccurate. Additionally, please remember that many long-term crypto price predictions are generated using algorithms, which means they can change at any time.

| 2024 | 2025 | 2030 | |

|---|---|---|---|

| Prediction #1 | $23,866 | $28,284 | $81,465 |

| Prediction #2 | $10,307 | $10,823 | $13,813 |

| Prediction #3 | $14,983 | $22,813 | $149,419 |

Pandora Price Prediction for 2024

DigitalCoinPrice had a short-term Pandora price prediction that said it would be worth $23,866 this year. Meanwhile, Bitget said the token would trade at $10,307 then. PricePrediction.net thought PANDORA would reach $14,983 by the end of 2024.

Pandora Price Prediction for 2025

Moving on, DigitalCoinPrice’s Pandora price forecast said the crypto would reach $28,284 in 2025, while Bitget had it at $10,823 then. PricePrediction.net said it would trade as high as $22,813 next year.

Pandora Price Prediction for 2030

Looking at a more long-term Pandora price prediction, DigitalCoinPrice said that the token would reach $81,465 in 2030. Meanwhile, Bitget said it would reach $13,813 then. PricePrediction.net’s PANDORA price prediction said it would reach $149,419 at the start of the next decade

Google Gemini AI Price Prediction for Pandora (as of March 26)

Google’s Gemini AI platform gave the following price prediction for Pandora on March 26. Please remember that the exact price prediction of an asset or cryptocurrency in the future is nearly impossible to achieve. Additionally, artificial intelligent price predictions are predicated on past performances and are in no way entirely accurate.

It said: “Unfortunately, I cannot provide financial advice and making future price predictions for any asset, including Pandora (PANDORA) tokens, is inherently risky and uncertain. However, I can share some information and considerations that may help you form your own opinion.”

Recent Price Movement:

- Pandora’s price recently experienced a significant surge due to the implementation of the ERC404 standard, with some traders reporting large gains.

- This rapid increase should be treated with caution, as it could be driven by hype and speculation rather than long-term fundamentals.

Technical Analysis:

- Currently, the technical analysis indicates a neutral trend for Pandora, with the price hovering between the 50-day and 200-day moving averages.

- This makes it difficult to predict the future direction with certainty.

Fundamental Analysis:

- The potential of the ERC404 protocol to improve NFT liquidity is promising, but its long-term impact on Pandora’s price is yet to be seen.

- The overall health of the cryptocurrency market and broader economic factors will also play a significant role in determining Pandora’s future price.

Therefore, instead of predicting specific prices, I suggest considering these factors:

- Short-term (Days to weeks): High volatility is likely due to the recent price surge and continued speculation around ERC404.

- Medium-term (Months): Price movement will depend on adoption of ERC404, team execution, and broader market sentiment.

- Long-term (Years): Success of ERC404 and its integration into the NFT ecosystem will be crucial for sustained price appreciation.

It added: “Remember, investing in any cryptocurrency carries significant risks. Always do your own research and consider your financial situation before making any investment decisions.”

Recent Updates from Pandora

Pandora said that teams have started to incorporate 404 mechanics. Ether Orb is a PvP game of skill that uses ERC 404 v2 to enable wizards to battle their Orb in a zero-sum strategy game.

PANDORA Price History

Now, let’s examine the, admittedly brief, Pandora price history . While we should never take past performance as an indicator of future results, knowing what the token has achieved can provide us with some very useful context if we want to make or interpret a Pandora price prediction.

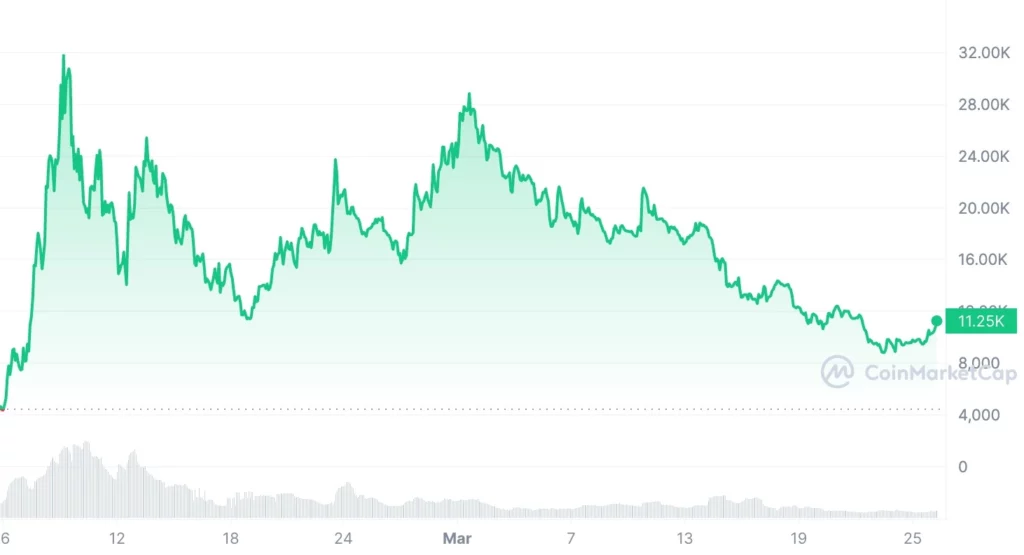

When PANDORA first hit the open market on February 5, it traded at an all-time low of $4,018.12. However, it soon moved up, breaking past $10,000 on February 7. By February 9, it was at an all-time high of $31,956, but it soon moved down to trade at around $28,640 later that day.

It then decreased further, being worth $11,208.50 on March 26, 2024.

At that time, there were a self-reported 10,000 PANDORA in circulation, representing the total supply. If that figure were correct, it would give Pandora a market cap of around $112.4 million, which would make it something like the 461st largest crypto by that metric.

Pandora Price Analysis

When it came out on February 23, PANDORA was worth about $14,500. It quickly started an uptrend, leading the price to an all-time high of $30,000 on March 1. Since then, PANDORA has been in a downward trend. On March 23, it fell below $9,000 briefly but made an upturn.

A breakout took place, with the price coming to a high of $13,500 at its highest point today, March 26. This was likely its third wave out of a five-wave pattern.

The price has dropped by around 14% since today’s high, indicating that wave three has ended and that wave four has started. Another higher high should reach its horizontal level of $14,500 as wave five should develop.

If this happens, we will see a retracement to a higher low than March 23, potentially $11,000. That would signal a larger starting bull phase for PANDORA, and a setup for a sustainable uptrend would be in place.

Is Pandora a Good Investment?

It is hard to say. The token has only been traded for a few days, and we don’t know if it can maintain its momentum. A lot will depend on whether or not plans to make it official get approved.

As ever with crypto, you will need to make sure you do your own research before deciding whether or not to invest in PANDORA.

Will Pandora go up or down?

No one can really tell right now. While the Pandora crypto price predictions are largely positive, price predictions have a well-earned reputation for being wrong. Keep in mind, too, that prices can, and do, go down as well as up.

Should I invest in Pandora?

Before you decide whether or not to invest in Pandora, you will have to do your own research, not only on PANDORA, but on other, related, coins and tokens such as ApeCoin (APE). Either way, you will also need to make sure that you never invest more money than you can afford to lose.

Who are the Founders of Pandora?

Pushkar Vohra is the founder of Pandora. He founded Pandora in Jan 2021.

Fact Box

| Supply and distribution | Figures |

|---|---|

| Maximum supply | 10,000 |

| Circulating supply (as of March 22, 2024) | 10,000 (100% of maximum supply) |

From the Whitepaper

In its technical documentation, or whitepaper , ERC-404 says of itself to be an experimental, mixed ERC-20/ERC-721 implementation with native liquidity and fractionalization. While these two standards are not designed to be mixed, this implementation strives to do so in as robust a manner as possible while minimizing tradeoffs.

In its current implementation, ERC-404 effectively isolates ERC-20 / ERC-721 standard logic or introduces pathing where possible

says it was developed to enable real economies and open trade in the next generation of video games.

With Xai, potentially billions of traditional gamers can own and trade valuable in-game items in their favorite games for the first time, without the need to use crypto-wallets. Anyone can support the Xai network by operating a node which allows them to receive network rewards and participate in governance.

Pandora (PANDORA) Explained

Pandora has its origins in Emerald, a project which would combine traditional crypto tokens with NFTs. Although that project got hacked, in early 2024 a group of anonymous developers teamed together to use the technology behind Emerald to create the PANDORA token.

How Pandora Works

Pandora is an ERC-404 token. This means that it combines the features of traditional tokens with NFTs. People who buy a PANDORA token get a token, but also get a so-called replicant NFT with it. This NFT is artificially generated and can, crucially, be sold. However, holders can also sell their main PANDORA token, which is then burned, or taken out of circulation.

This means that, at least in theory, Pandora can provide liquidity to the NFT market.

Pandora is based on Ethereum. This means that it is a token, rather than a coin. You might see references to such things as a Pandora coin price prediction, but these are wrong.

Pandora Attention Tracker

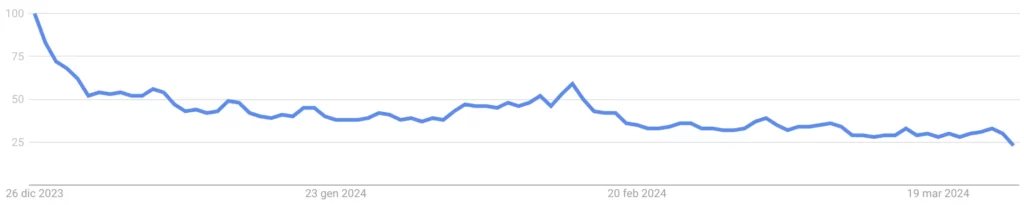

Here is a chart for the Pandora crypto Google search volume for the past 90 days. This represents how many times the term “Pandora crypto” has been Googled over the previous 90 days.

FAQs

It might do, but not for quite a long time. PricePrediction.net thinks Pandora can reach six figures in 2030. The PANDORA cryptocurrency aims to provide liquidity to the NFT market.Will Pandora reach $100,000?

What is Pandora used for?

Disclaimer

Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.