Bitcoin Cash Rallies Pre-Halving, Hits Yearly High – $600 Next?

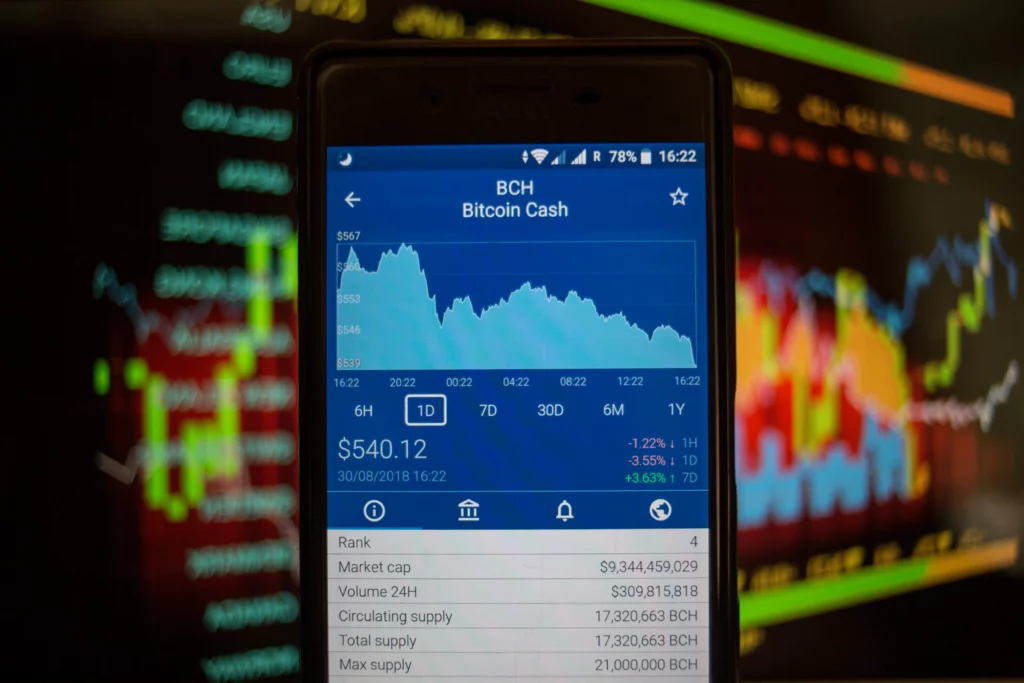

Can BCH Price Reach $600? | Credit: Getty Images

Key Takeaways

- Bitcoin Cash’s halving will occur on April 3, cutting block rewards to 3.125 BCH.

- The BCH price reached a new yearly high of $586 earlier today.

- Will the bullish BCH trend lead to new price highs in April?

The second Bitcoin Cash halving will take place on April 3. It will occur at block height 840,000 and cut block rewards in half from 6.25 to 3.125 BCH per block. The first Bitcoin Cash halving occurred on April 8, 2020.

The BCH price has increased markedly in the past two weeks in anticipation of the event. The increase culminated with a new yearly high of $586 today. Due to the lack of overhead resistance, will BCH reach $600 and $700 next?

BCH Price Reaches New Yearly High

The BCH price has increased since falling to a low of $90 on June 2023. While the increase was initially rapid, leading to a high of $329 the same month, the rally then stalled for more than six months.

This all changed with a breakout in February 2024. Last week, the BCH price moved and closed above the $460 resistance area and reached a new yearly high of $586 today. This is the highest price since 2021.

The weekly RSI and MACD are both bullish, supporting the continuing of the upward trend. Even though the RSI is in overbought territory, it is still increasing and has not generated any bearish divergence. The next closest resistance area is at $780.

BCH Price Prediction: What Are Next Targets?

The daily time frame wave count insinuates the BCH price is nearing the end of wave three (white) in a five-wave upward movement that started with the aforementioned June 2023 low. The sub-wave count is given in black, showing the price is in the final portion of this increase.

A potential target for the high is at $642, created by the 1.61 external Fib retracement of the most recent drop. A high at the level will also confirm the developing bearish divergence in the daily RSI (green) and start wave four. The corrective wave four can take the BCH price back to the $460 area, validating it as support.

The BCH price has rallied in anticipation of its second halving, clearing an important horizontal resistance area in the process. The upward movement can take the BCH price above $600 before a significant correction ensues.