Arthur Hayes: Bitcoin Will Slump Around The Halving Due To Changing Narrative and Economic Environment

Arthur Hayes believe Bitcoin's price will face a slump around the halving, as macroeconomics pose an unfavorable environment .

Key Takeaways

- Halving may not boost BTC due to economic shifts.

- Critical period leading up to May 1 impacts BTC.

- BTC’s technical patterns hint at potential correction.

In the ever-turbulent sea of cryptocurrency markets, few events stir as much anticipation and speculation as the Bitcoin halving. This event occurs approximately every four years and is known for its significant impact on Bitcoin’s supply mechanism and, historically, its price.

However, Arthur Hayes, a well-regarded figure in the crypto space, presents a contrarian view that challenges the prevailing optimism surrounding the upcoming halving.

In his latest blog post , Hayes articulates a compelling argument, suggesting that Bitcoin will experience a downturn around the halving, attributing this to a shift in narrative coupled with a changing economic environment. Based on his extensive experience in crypto trading and macroeconomic analysis, Hayes delves into the intricacies of market dynamics, liquidity flows, and investor psychology, providing a nuanced perspective on why this halving might not follow the bullish trajectory of its predecessors.

Macros Are Different This Time

Hayes argues that the convergence of changing market expectations and a challenging macroeconomic landscape could lead to a downturn in Bitcoin’s price around the halving.

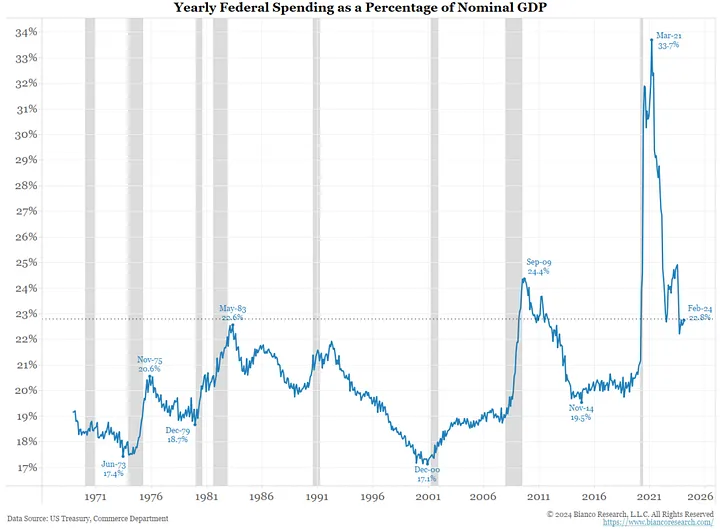

Expanding on the economic conditions, Hayes points to a critical period leading up to May 1st, where factors such as the cessation of the Bank Term Funding Program (BTFP), adjustments in banking regulations, and the specific dynamics of dollar liquidity could play a pivotal role.

He underscores the impact of tax payments and the continuation of the Federal Reserve’s quantitative tightening (QT), which has been removing approximately $95 billion worth of liquidity monthly from the market, as key elements that could strain market liquidity, thereby influencing Bitcoin’s performance negatively.

These aspects create a backdrop where the positive momentum usually seen around Bitcoin halvings could be significantly muted. Moreover, Hayes critiques the prevailing optimism about the halving’s impact on Bitcoin’s price, suggesting that the narrative may overlook crucial economic and regulatory developments leading up to and beyond May 1st.

BTC Price Analysis

On March 13, 2024, Bitcoin reached a high of $73,800, after which we saw a decline of 17% to $60,800 on March 20. The price movement of Bitcoin began to shape an ascending triangle, indicating consolidation. This formation suggested that the upward trend could be nearing its conclusion, with a reversal on the horizon, but can also mean the price is at a temporary stop before it advances higher.

Per our wave analysis, we have been anticipating a correction. Furthermore, since the price has been in a major uptrend since September 12, 2023, rising over 190%, this would be a logical price progression.

We could have seen three waves developed within a five-wave pattern from its November 2021 low of $15,600. If this is the case, BTC could enter its corrective stage for wave 4 before moving upward.

In this scenario, the correction already started with the current ascending triangle structure being its first sub-formation and will lead the price to a downside breakout. If this happens, our next likely target would be $51,900.

Alternatively, BTC could see a new all-time high around the halving if we see a breakout to the upside from the ascending triangle. This scenario isn’t as likely. On March 13, we saw the completion of the previous impulse wave, and the ascending triangle that followed can not be this anticipated wave 4 due to its shallow nature.

In conclusion, there is a correlation between what Arthur Hayes expects, drawing from the fundamental factors, and what the BTC price chart analysis points out. Will this play out we are just going to wait and see, but the ascending triangle’s breakout direction will provide first hints.

Disclaimers

Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.