35% Leap: DigixDAO Price Makes Lonely Advance as Market Retraces

The DigixDAO price rose 42 percent on Friday, making it the lone cryptocurrency in the top 100 to resist the deepening market correction and achieve an advance against the value of the dollar.

DigixDAO Price Makes Lonely Advance as Market Retraces

First launched in 2016, DigixDAO was one of the first decentralized autonomous organizations (DAOs), and it provides the backbone for the gold-backed Digix (DGX) ecosystem.

Simply put, while each DGX token is backed by one gram of gold stored in reserve, DGD tokens float according to market demand, which is based primarily on the fact that DGD holders accrue dividends derived from DGX transaction fees.

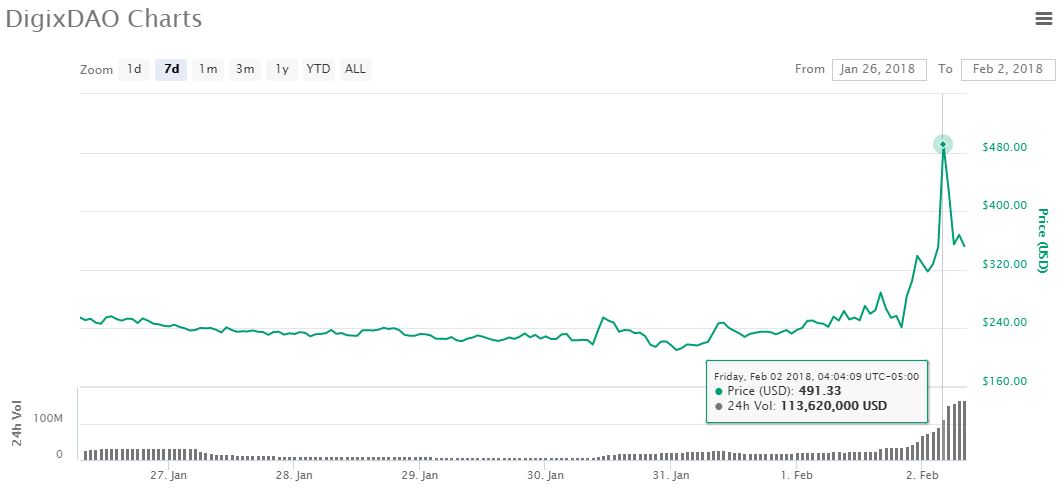

The DigixDAO price began the year near $180, and it gradually ticked up through the month of January. On Jan. 31, though, DGD began to hasten its climb, and on Feb. 2 it briefly spiked to an all-time high of $491 before sinking back down to a present value of $361. Despite this moderate pullback, the DigixDAO price is still up 42 percent for the day, which is all the more remarkable considering that every other top 100-cryptocurrency is in decline. DGD now has a $723 million market cap.

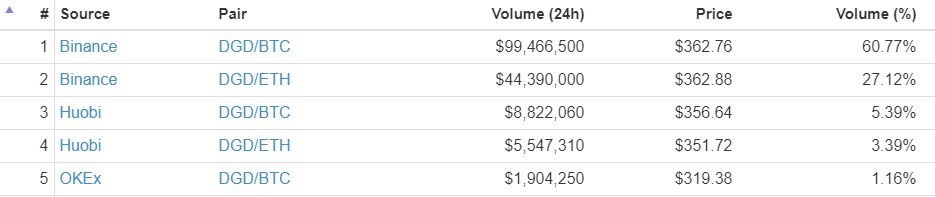

The vast majority of DGD volume is centralized on Binance, where the token’s BTC and ETH pairs account for approximately 88 percent of its global trading volume. Huobi’s BTC and ETH pairs add another nine percent, and OKEx is the only other exchange that has processed more than $1 million worth of DGD volume in the past day.

Digix Partners with MakerDAO to Produce ‘Stablecoin’

The DigixDAO price rally appears linked to the Jan. 31 announcement that Digix had formed a partnership with MakerDAO to help produce the latter’s so-called “stablecoin” — a cryptocurrency whose price is stabilized to the value of the US dollar. According to Digix, MakerDAO will use DGX tokens as collateral in its portfolio and, in its words, “be a driver of billions of dollars of DGX demand.”

Since DGD holders reap dividends from DGX transaction fees, speculators immediately began purchasing DGD to profit from this development.

Featured image from Shutterstock.