$185 Billion: Bitcoin Price Rally Carries Crypto Market Cap to New All-Time High

It’s been a record-setting week for the cryptocurrency markets. For three consecutive days, the bitcoin price has achieved a new all-time high, eventually extending above $6,600 Tuesday morning.

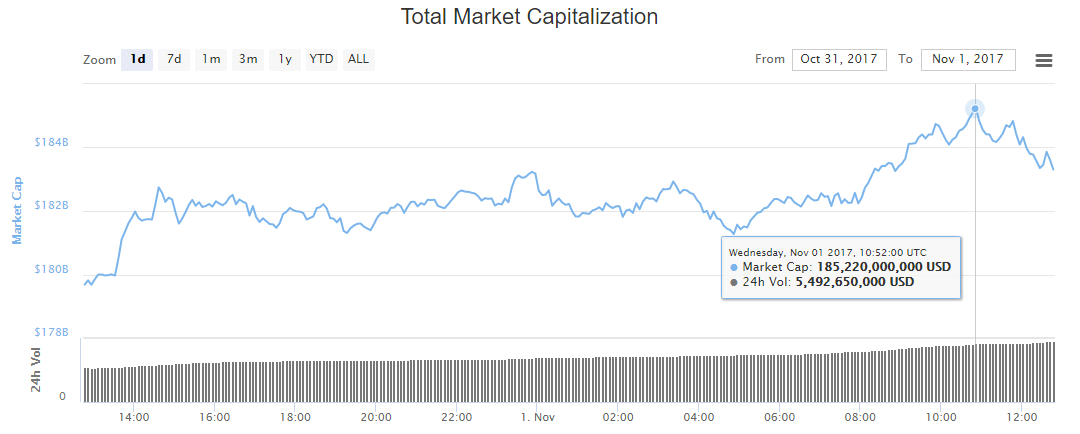

Although many altcoin prices declined as traders consolidated their holdings into bitcoin, the rally nonetheless lifted the total cryptocurrency market cap to $185.2 billion — a new record. In the past month, the crypto market cap has grown by nearly $40 billion; for reference, the crypto market cap did not even reach the $40 billion threshold until the beginning of May.

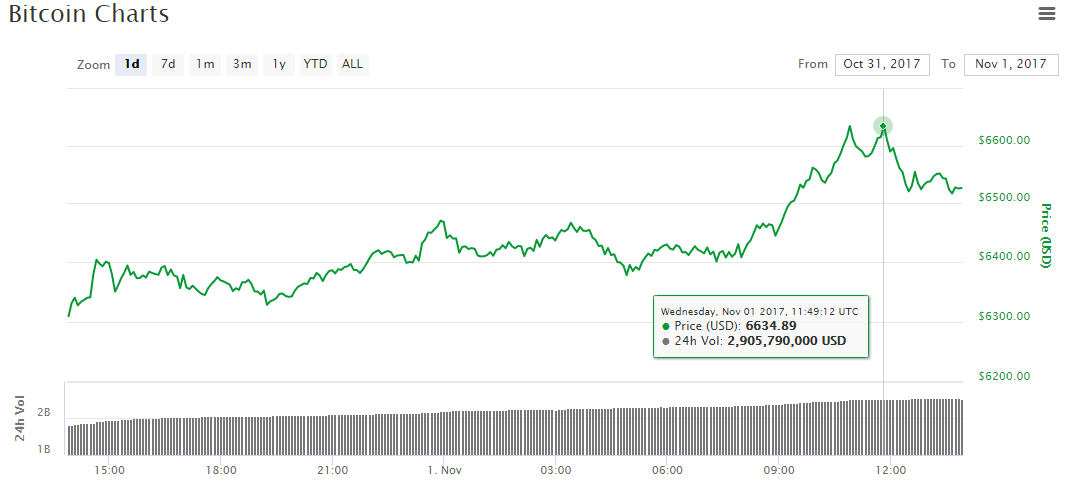

Bitcoin Price Crosses $6,600

Bitcoin was the primary catalyst that carried the crypto market cap to $185 billion. The bitcoin price soared past the $6,600 mark following CME Group’s Tuesday announcement that it will list bitcoin futures contracts for professional traders before the end of the year. Enthusiastic traders carried the global average bitcoin price to a new all-time high of $6,634. The bitcoin price has since tapered to $6,539, but this still represents a 7-day gain of 18% and translates into a $108.9 billion market cap.

Ethereum Price Sinks Back to $300

Bitcoin’s rally came partially at ethereum’s expense. The ethereum price spent the bulk of October stagnant at the $300 mark, but it ended the month on a slight incline, climbing to $309 Tuesday morning. Bolstered by this week’s Devcon3 Ethereum Foundation Developers Conference, many people expected the ethereum price to break out of its slump and begin to regain some ground on bitcoin. However, traders appear more bullish on bitcoin, as the ethereum price declined by 3% on Wednesday to settle back down to $300.

Nevertheless, a significant Devcon3 announcement could incite a rally, so investors should remain apprised of what transpires at the conference.

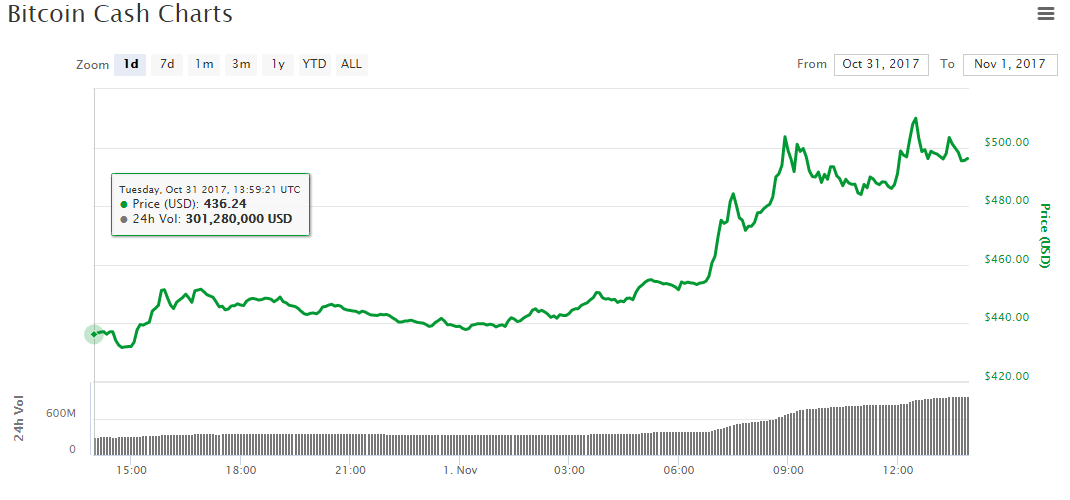

Bitcoin Cash Price Surges to $500

Bitcoin’s record run is grabbing all of the headlines today, but the bitcoin cash price has quietly surged by 13% to $496 and appears poised to extend its bull run past the $500 mark. Bitcoin cash now has a market cap of $8.3 billion, making it the third-largest cryptocurrency by market cap.

There are two apparent factors contributing to this present rally. First is the failure of bitcoin gold — another altcoin created from a bitcoin fork — to gain traction on exchanges during pre-release trading. Although it has made moderate gains this week, the bitcoin gold price is still trading at just $150.

Additionally, traders have responded positively to the announcement of a hard fork that is intended to upgrade bitcoin cash’s difficulty adjustment algorithm (DAA) and make the network less volatile. Although some developers have been critical of the process used to introduce and promote the specific upgrades implemented by the fork, miners have begun to express support for the proposal, making it appear unlikely that bitcoin cash will splinter into competing blockchains following the fork.

Altcoins Shed Billions as Bitcoin Rallies

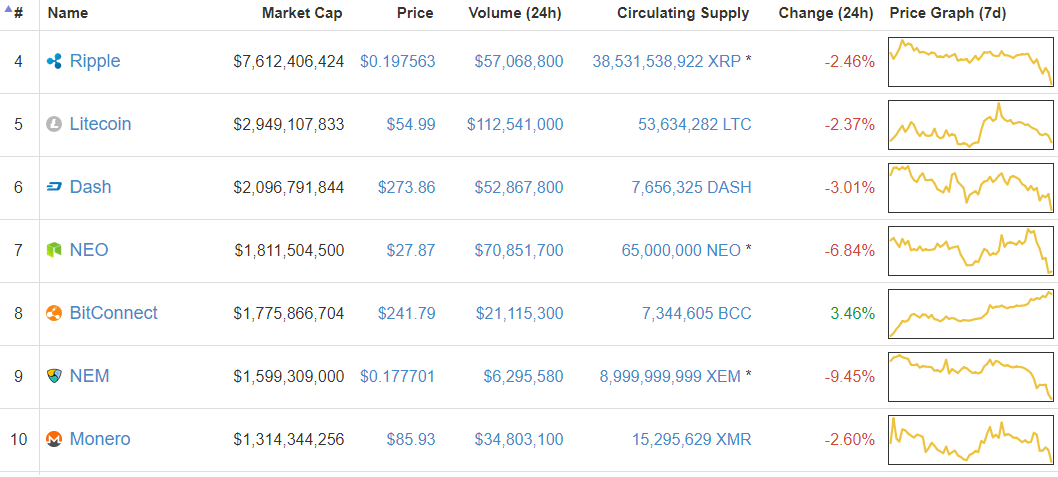

Although a few altcoins managed to make gains on Wednesday, most fell into decline as traders liquidated their holdings to inject more capital into bitcoin. Altogether, the total altcoin market cap lost about $2 billion, enabling bitcoin to raise its dominant market share to a present value of 59.3%.

The ripple price declined 2%, causing XRP to drop to fourth in the market cap rankings. Litecoin also declined by 2%, reducing its price to $55. The dash price declined by 3% to $274, while the NEO price dropped by 7% to $28. Aside from bitcoin cash, bitconnect was the lone top 10 altcoin to raise its value against the dollar; its price rose 3% to $242. Ninth-ranked NEM posted the worst performance among top-tier cryptocurrencies, plunging more than 9% to $0.178, and monero rounded out the top 10 with a 3% decline to $86.