Why Nasdaq’s Real-Time Crypto Data Portal Might Soon List Ripple

There's a strong chance that the Nasdaq will add a ripple (XRP) index to its growing list of crypto indexes. | Source: Shutterstock

Ripple (XRP) is on a winning streak right now.

Yesterday, the world’s third-largest cryptocurrency jumped 12% higher after Coinbase confirmed it would list XRP on its Coinbase Pro platform.

Now there’s an XRP index in the works, and there’s a good chance it will be listed on the Nasdaq, the world’s second-biggest stock exchange.

Bitcoin and Ethereum Indexes Now Live on Nasdaq

On February 25, Nasdaq launched the long-awaited bitcoin and ethereum indexes on its platform.

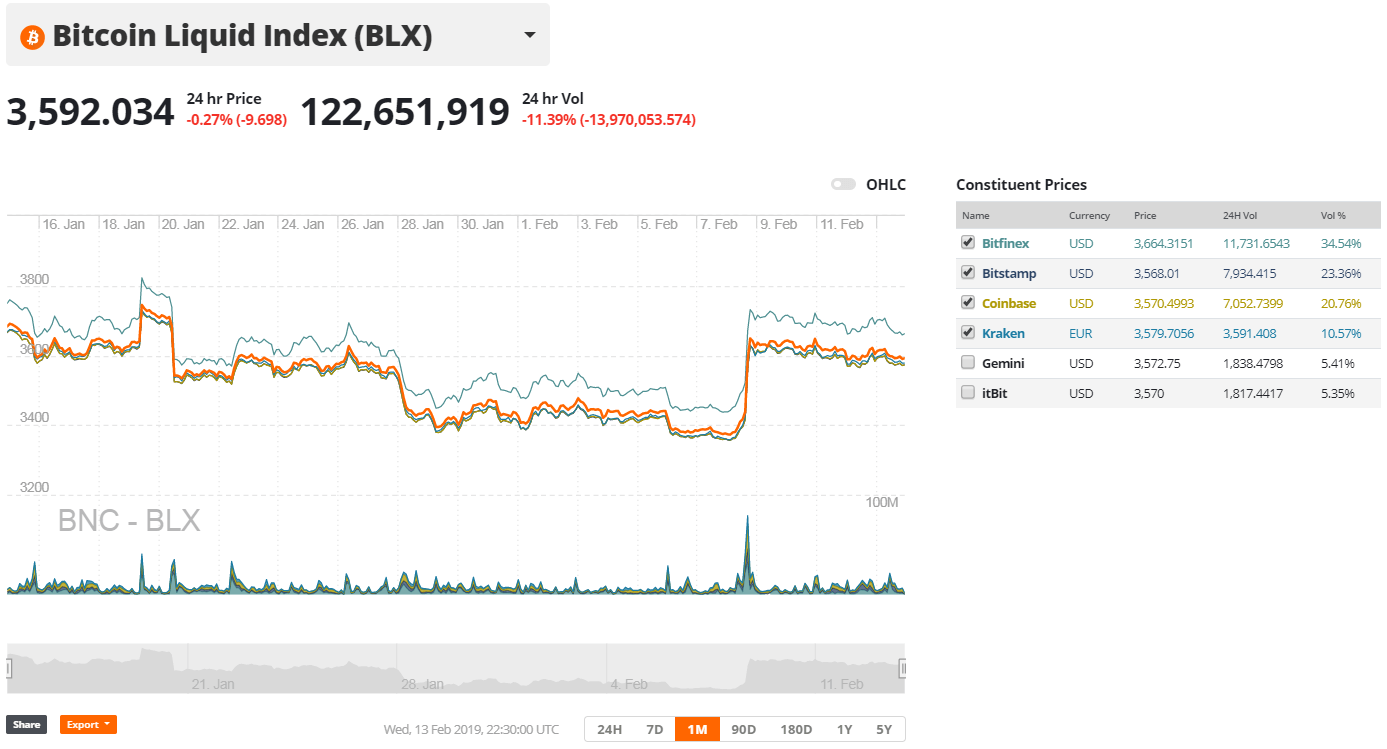

The indexes, powered by Brave New Coin , aim to provide a stable, accurate spot price for the cryptocurrencies. The listing on Nasdaq is a huge step forward for the crypto industry and a nod of approval from Wall Street.

Hidden in yesterday’s announcement, Brave New Coin confirmed that it was in the “final stages ” of launching a Ripple Liquid Index. With Nasdaq already on board as a partner, it seems inevitable that the XRP index listing will follow.

A Springboard to a Bitcoin ETF?

Traders have mostly brushed over the launch of crypto indexes on Nasdaq, but it’s a huge development.

As CCN.com previously reported, the approval of crypto indexes could fast-track approval of bitcoin investment products, like a bitcoin ETF. The Bitcoin and Ethereum Liquidity Indexes (BLX and ELX, respectively) will bring price transparency and stability to the market. As Brave New Coin’s CEO explains:

“There is still great price disparity between exchanges and countries, diverging by as much as US$1,000 at any time.”

The indexes on Nasdaq will fix this by creating a composite price from multiple exchanges. The listing will also integrate Nasdaq’s surveillance technology to help identify and stamp out price manipulation.

The move will help address the SEC’s main concerns of manipulation and price disparity in crypto. The forthcoming ripple index will only expand the transparency and trust in cryptoassets.

A Benchmark Ripple (XRP) Price

Brave New Coin’s ripple index will launch under the ticker RLX and take into account multiple exchange prices. At the time of writing, Coinbase Pro isn’t part of the participating cryptocurrency exchanges, but that could change as liquidity grows.

Like the bitcoin and ethereum indexes, RLX will fully comply with regulations set by the International Organization of Securities Commissions (IOSC). This will further guarantee institutional trust in the indexes.

“BNC’s ‘Liquid Index’ (LX) indices are part qualitative and part quantitative, factoring in the stability and quality of constituency as well as the volume, book depth, tick size and other factors from the qualified market participants, to calculate a fair global value for the price of Bitcoin and Ethereum, expressed in USD, every 30 seconds.”

A Huge Week for XRP

After years of rumors, Coinbase finally confirmed that XRP would be made available to traders.

As of Monday, Coinbase Pro is accepting XRP deposits. When sufficient liquidity is reached, trading will be switched on in the US (excluding New York), Canada, Singapore, UK, Australia, and other European nations.

Traders responded positively, sending the price up 12%. After a brief retreat, XRP is currently trading at $0.32, according to the CCN.com price index.

Featured Image from Shutterstock