Wealthy Investors Brace For 6 Weeks of Stock Market Turmoil

Smart money investors are bracing for a fresh wave of volatility in the stock market. | Image: AP Photos/Bebeto Matthews

- Multi-billion dollar institutions expect a significant downtrend in the U.S. stock market.

- Uncertainty around the pandemic and its potential impact on the economy are rattling investors.

- Federated Hermes’ Phil Orlando expects a 10% drop in equities.

High net-worth investors are preparing for a steep downturn in the U.S. stock market. Hedge funds see too many risks to re-enter into equities with confidence.

Phil Orlando, chief equity market strategist at Federated Hermes—a $2.3 billion investment firm—says the June “swoon” may continue for a few weeks.

Emphasizing the need for diversification, Orlando told CNBC:

Maybe you want to play defense a little bit. You want to be a little cautious here because the market could experience a continuation of this June swoon over the course of the next few weeks.

Orlando’s sentiment echoes that of JPMorgan, whose strategists said the dynamic of the U.S. stock market would likely change.

Another 10% Drop is Possible, Strategists Say

High profile investors anticipate a correction in the stock market for two reasons: pension funds taking profit and a resurgence in the pandemic.

Since the first week of May, President Trump pushed for the reopening of the economy . At first, Wall Street seemed jubilated by the Trump administration’s aggressive approach.

Then, more data related to the virus started to emerge.

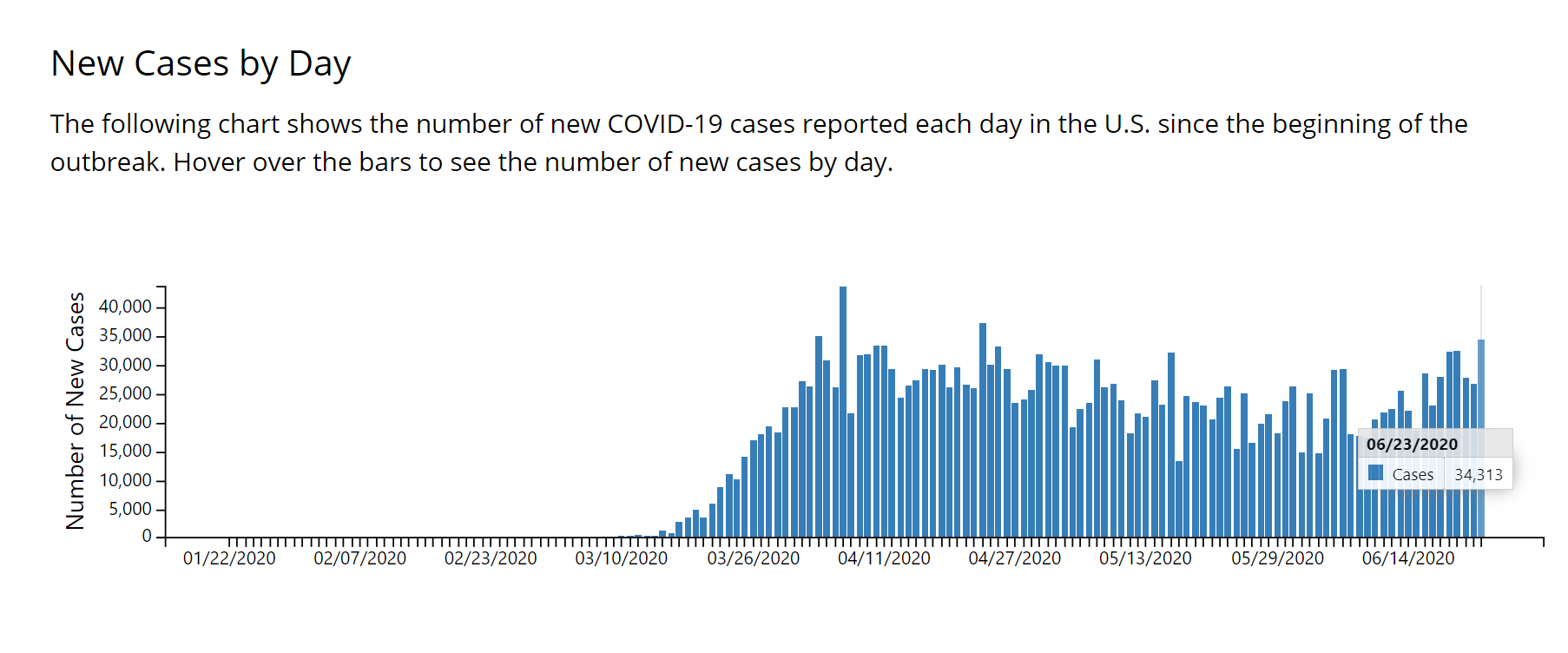

According to the U.S. Centers For Disease Control and Prevention (CDC), the U.S. recorded 34,313 new infections on June 23, 2020.

The curve of infections, which was seemingly slowing down, began to increase once again.

Uncertainty surrounding the pandemic places significant pressure on the stock market because it directly affects the unemployment rate.

If jobless claims surge again, it could have negative implications on the economy. Combined, these forces would cast a dark shadow over the stock market.

For that reason, Orlando said he believes the U.S. stock market could pull back by 10% in the next six weeks.

“It looks like we’re going to see some more weakness,” Orlando noted, adding that investors want to play “defense.”

IMF Cuts Forecast Again

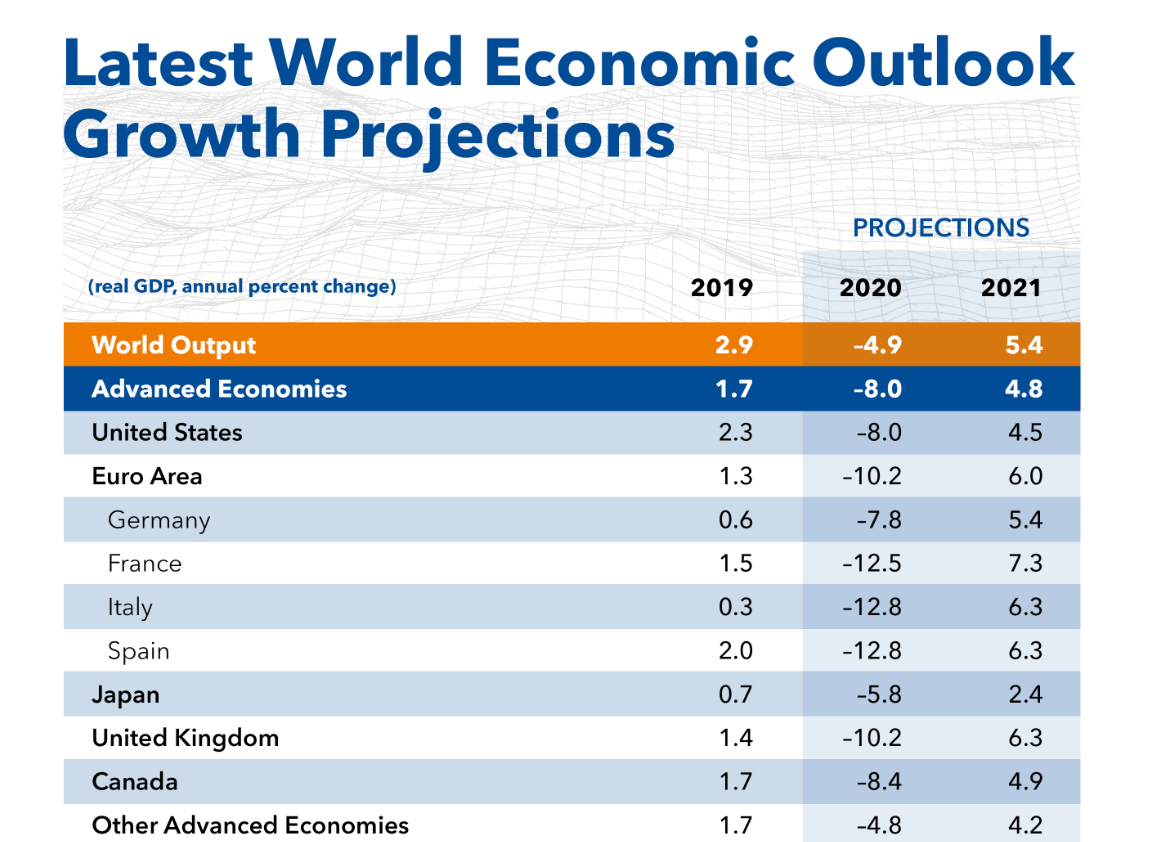

The International Monetary Fund (IMF) says it expects a 4.9% drop in global economic growth this year.

In its June World Economic Outlook Update , the IMF said:

Global growth is projected at –4.9 percent in 2020, 1.9 percentage points below the April 2020 World Economic Outlook (WEO) forecast.

The pandemic has slowed down business activity and productivity across the world, the IMF said. It expects a worse impact on low-income households:

The adverse impact on low-income households is particularly acute, imperiling the significant progress made in reducing extreme poverty in the world since the 1990s.

The U.S. stock market has seemingly priced in a smooth reopening of the economy and global economic recovery.

If the bearish projections materialize over the next few weeks, the probability of a significant market pullback can sharply increase.

Disclaimer: The opinions expressed in this article do not necessarily reflect the views of CCN.com.