Weak US Economy Flashes ‘Risk On’ Signal for Stock Market Bulls

For stock market bulls eager to watch the S&P 500 record a new all-time high, the weak US economy is a "risk on signal." | Source: AP Photo / Mark Lennihan

The S&P 500 extended its recovery on Friday, adding to Thursday’s solid bounce following an intense two-day stock market correction.

The bullish price action prompted many traders to predict that the market’s bellwether index had already bottomed out.

These traders are not alone in their optimistic outlook. Fundstrat co-founder Thomas Lee remains mighty bullish on the stock market.

He believes that the S&P 500 will print new highs despite faltering economic data published earlier in the week.

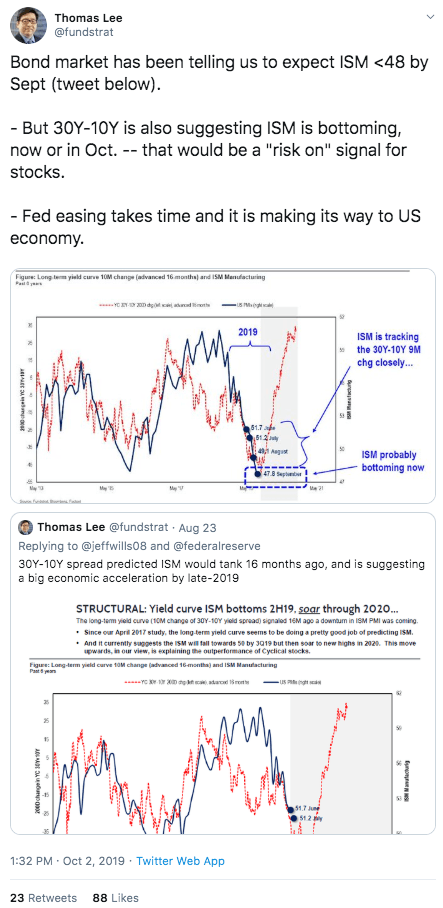

Thomas Lee: ISM Bottom Is a ‘Risk On’ Indicator for Stocks

CNBC reported that the ISM Manufacturing Index dropped to 47.8 in September, marking the worst month for American factories in a decade . The weak manufacturing output – coupled with less-than-encouraging data in the service sector – is a signal of sluggish economic activity and could present the stock market with a bearish forecast.

However, the Fundstrat executive believes that the worst is behind the manufacturing sector.

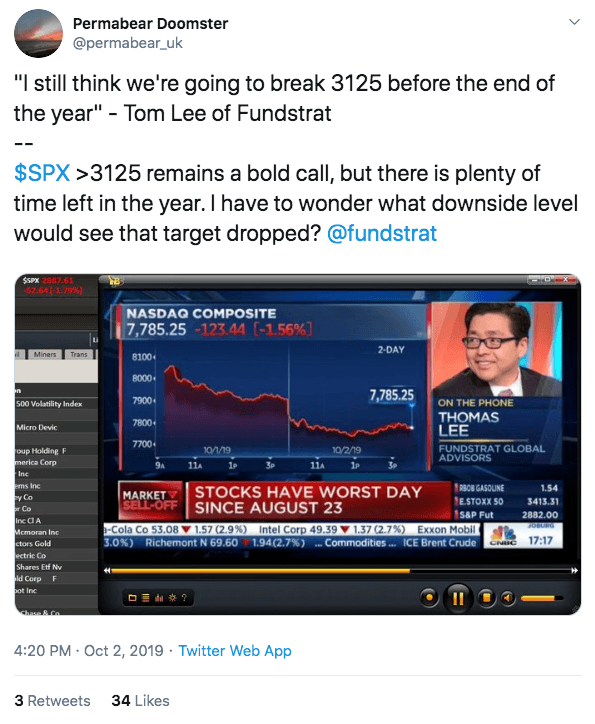

Predicting that US PMI has found a bottom, Lee said that the S&P 500 could surge to a new all-time high of 3,125 before the end of the year. That implies upside of nearly 7% from the index’s present level near 2,930.

This is a daring prediction considering that US PMI hasn’t ranged this low since the financial crisis.

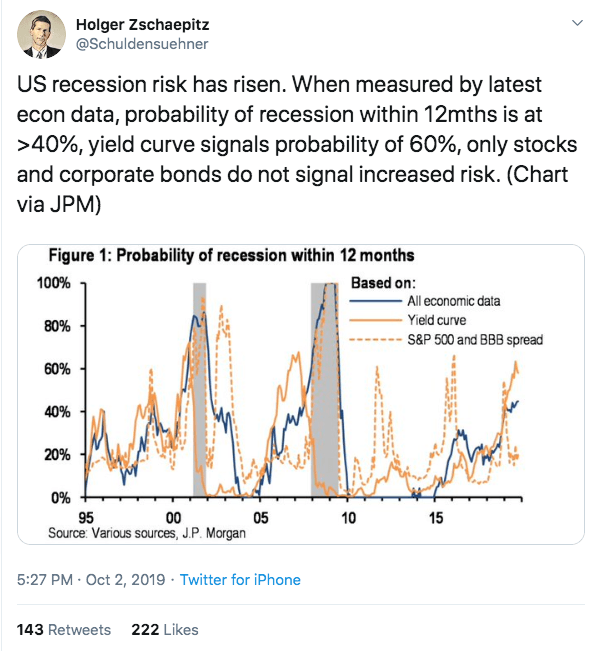

The weakness in the manufacturing sector is possibly one of the reasons why J.P. Morgan predicts a recession in the next 12 months.

J.P. Morgan: ‘US Recession Risk Has Risen’

While Tom Lee forecasts growth in the following months, J.P. Morgan begs to differ.

In a chart posted by the widely-followed Holger Zschaepitz , the financial institution projects that the US economy has a 40% chance of plunging into a recession within a year based on economic markers. If you look at the yield curve signals, the odds climb to 60%.

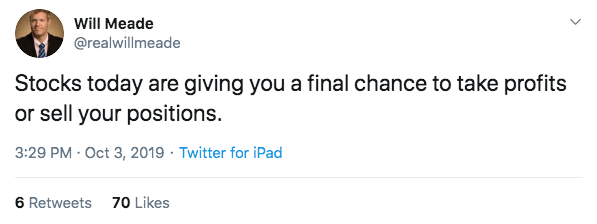

Hedge fund founder Will Meade supports the view of J.P. Morgan. In a tweet, the former Goldman Sachs analyst told his followers that yesterday’s rally was a chance to get out of the stock market.

We also spoke to Emma Muhleman , a global macro strategist who doesn’t share Tom Lee’s rosy outlook. She told CCN.com:

“Equity markets are likely to be volatile and we anticipate some turbulence and rising volatility as the quarter progresses toward year end.”

She added:

“Global economic activity should continue to weaken after we just saw the US ISM manufacturing gauge hit levels not seen since June 2009.”

However, for now, it appears that Wall Street’s bull case has been more persuasive to investors.