VanEck’s Quasi Bitcoin ETF Not a Game Changer: Economist

VanEck plans to launch a bitcoin fund designed for institutional investors that The Wall Street Journal falsely describes as a "limited version of a crypto ETF." | Source: Shutterstock

The bitcoin bulls have wrestled back control of the BTC price, with the leading cryptocurrency barreling for $11,000 once again. While the positive momentum emerged over the weekend, the optimism is no doubt also being fueled by today’s VanEck development. The New York-based investment management firm plans to launch a bitcoin fund, which is designed for “qualified institutional buyers,” that The Wall Street Journal describes as a “limited version of a crypto ETF.” The fund is called the VanEck SolidX Bitcoin Trust 144A Shares , and the comparison may be a little farfetched.

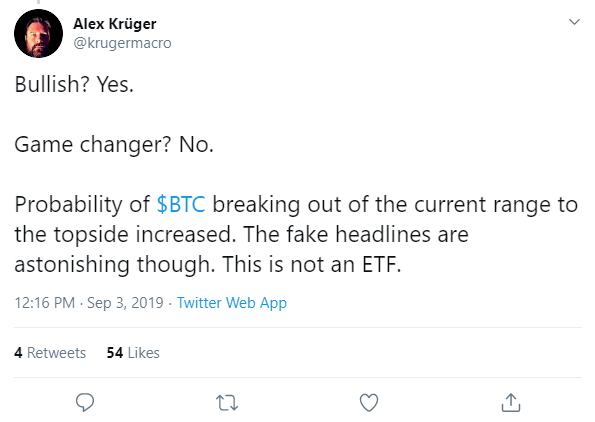

Widely cited economist and trader Alex Krüger wants to make one thing clear – the VanEck product is not a bitcoin ETF, tweeting:

“Van Eck, maybe tired of waiting for the SEC to approve a bitcoin ETF, are launching their version of Grayscale’s Bitcoin Investment Trust, which is a trust that holds bitcoin and trades in US OTC Markets under ticker $GBTC. Not an ETF. What people reads: limited bitcoin ETF!”

For one thing, if it were truly an ETF individual investors would be able to sock away their retirement savings in the fund – and they can’t. That’s because it’s reserved for big investors, including hedge funds, pension funds, and the like. VanEck is reportedly relying on a “workaround” to the SEC guidelines, which means in exchange for limiting the availability to institutions, the shares won’t have to be registered. It seems like a fair trade in the current market environment, where crypto interest is beginning to show signs of waning in countries such as Japan.

And crypto investors who have been burned by regulators time and again are taking what they can get, driving the price higher by 7%. Krüger suggests the VanEck bitcoin fund increases the chances of bitcoin breaking out of the brutal range it’s been stuck in, and for that all of the crypto community is thankful. But don’t call it an ETF. If anything, VanEck is launching the institutional-focused bitcoin fund much to the chagrin of the U.S. SEC.

As far as the SEC is concerned, they are not making it easy for mom and pop investors to gain exposure to a volatile asset like bitcoin, but in doing so they are not opening wide the door to the potential returns, either. Bitcoin has outperformed other asset classes including stocks, bonds, and gold year-to-date.

Krüger also describes the difference between VanEck’s new fund and Grayscale’s bitcoin trust:

“Key difference: Van Eck’s to allow for continuous, open-end creation/redemption of shares allowing price to track Net Asset Value (NAV) closely … GBTC does not and thus often trades at a premium.”

VanEck, meanwhile, is in good company, as Grayscale oversees approximately $2.7 billion in AUM at last check and the bitcoin trust has delivered returns of nearly 200% this year so far.