Treasury Secretary Won’t Let Crypto Become Next Swiss Bank Accounts

Here's what US Treasury Secretary Steven Mnuchin just said about bitcoin and Libra during his press conference on crypto regulation. | Source: Shutterstock

By CCN.com: U.S. Treasury Secretary Steven Mnuchin said that the G7’s Financial Action Task Force (FATF) organization will never let crypto assets “become the equivalent of secret numbered accounts.” Mnuchin was addressing a plenary session of the G7 initiative aimed at combating money laundering and terrorism financing.

The U.S. Treasury Secretary was referring to secretive bank accounts commonly offered in Switzerland as well as other offshore financial hubs where the identity of the account holder is kept secret and a client is only identified by a code word.

Mnuchin also disclosed that he had convened a working group comprised of various regulators including the Federal Reserve with the goal of ensuring that crypto is only used for legitimate purposes.

Crypto Businesses Treated as Banks

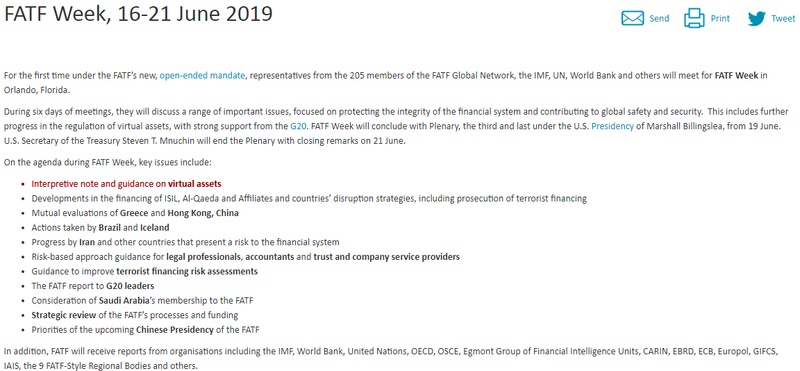

Mnuchin pointed out that an interpretive note that was adopted earlier this week by the FATF will require cryptocurrency exchanges, crypto-based remittance and payments firms, and other crypto-related businesses to implement bank-like anti-money laundering and Combating the Financing of Terrorism procedures. The FATF Global Network has been meeting in Orlando, Fla. since June 16.

In Mnuchin’s view, this will protect crypto firms from becoming enablers of illicit activities:

“By adopting the standards and guidelines agreed to this week, the FATF will make sure that virtual asset service providers do not operate in the dark shadows. This will enable the emerging FinTech sector to stay one-step ahead of rogue regimes and sympathizers of illicit causes searching for avenues to raise and transfer funds without detection.”

What Does It Mean for Crypto Businesses?

While regulators might welcome FATF’s guidance, the requirements could increase the operating costs of cryptocurrency-based businesses. For instance, regulated crypto businesses might need to add more employees responsible for executing AML/KYC processes. These added costs could be passed onto users in the form of higher fees and commissions.

https://youtube.com/watch?v=i7eIt-UoNrE

Regulated crypto exchanges could also delist privacy coins in order to comply with the requirements. The use of privacy coins in the affected jurisdictions could become needless when making payments or sending remittances. This is because crypto-based payments and remittance firms will likely have to obtain the sender’s and recipient’s identity, seemingly rendering the privacy and anonymity features of these coins moot.