Tezos Price Surges 57% in Days as Coinbase Fuels Another Crypto Rally

The Tezos price exploded this week, and analysts pointed to Coinbase as the trigger for this major crypto rally. | Source: Shutterstock

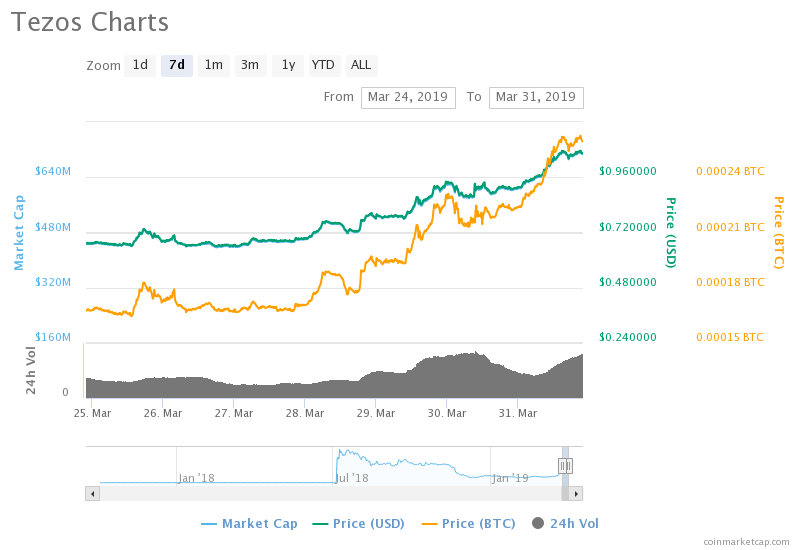

The week is ending on a hugely positive note for the Tezos cryptocurrency.

Tezos Races Ahead of Wider Crypto Market

The blockchain project’s native asset XTZ today established a new weekly high towards $1.08 – up more than 17 percent in the last 24 hours. The latest push also brought the coin’s weekly gains to 57 percent, bringing the price a few steps closer to its November 19 high at $1.09.

No other top-20 cryptocurrency came close to matching the breakneck Tezos rally.

Volume-wise, crypto exchanges listing XTZ-enabled pairs reported trading activity worth a little above $8.2 million. Among those were Gate.io, a China-based cryptocurrency exchange, that posted 27 percent of the total XTZ daily volume. Aside from that major slice, Tezos trading appeared well-distributed.

Interestingly, Tezos attracted considerable volume from fiat markets. On Kraken, a regulated US exchange with international markets, the euro contributed 9.23 percent of the coin’s total daily volume. At the same time – and on the same trading platform – USD accounted for $477,000, according to a 24-hour adjusted timeframe.

XTZ Rally: Fake or Genuine?

Genuine, no doubts about that.

On March 29, San Francisco-based Coinbase announced that it would allow its clients to stake their XTZ holdings and earn attractive annual returns. The new service – offered via Coinbase Custody – would enable investors to participate in the running of the Tezos blockchain by staking their holdings and validating blocks.

What reportedly made the Coinbase staking service attractive is fund security. The firm confirmed that it would keep all the staked XTZ tokens in fully-insured cold storage. Moreover, Coinbase will issue necessary bonds to Tezos validators out of its pocket. The move would ensure 100% security to clients’ funds.

That explains why speculators in the Tezos spot markets are preparing their upside positions. They expect big investors to purchase XTZ tokens to stake via Coinbase Custody, thereby fueling the coin’s demand against its limited supply.

That’s theoretically bullish, but time will test whether those speculations are correct.