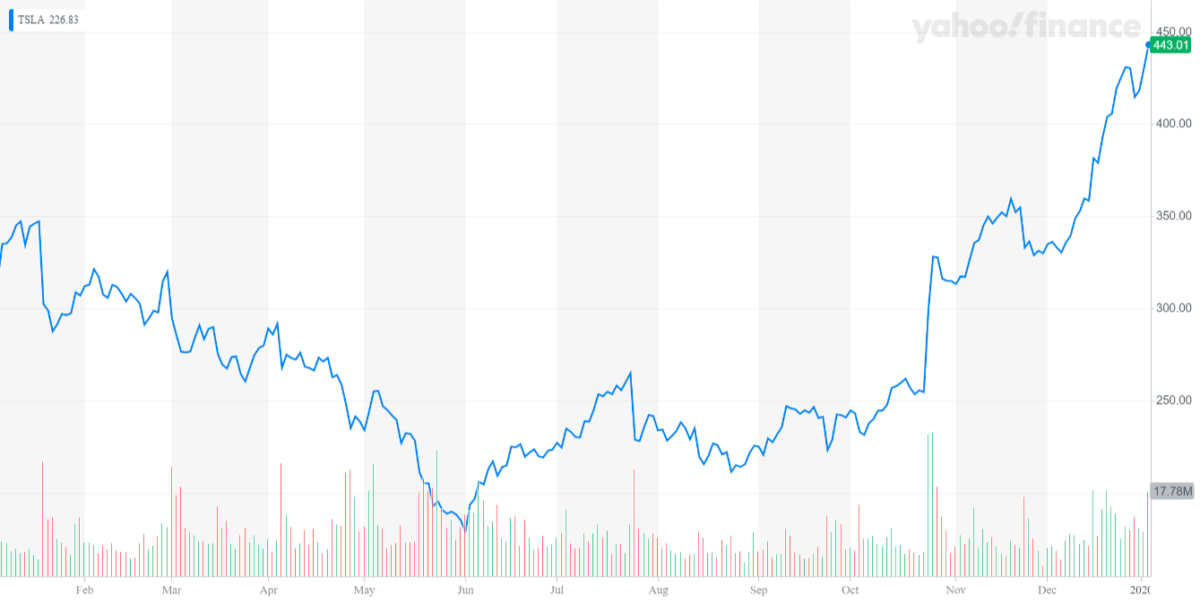

Supercharged Tesla Stock is Following Apple and Amazon’s Early Days

The affordable and successful Model 3 is helping Tesla on the road as the stock hits fresh all-time highs in 2020. | Source: Tesla

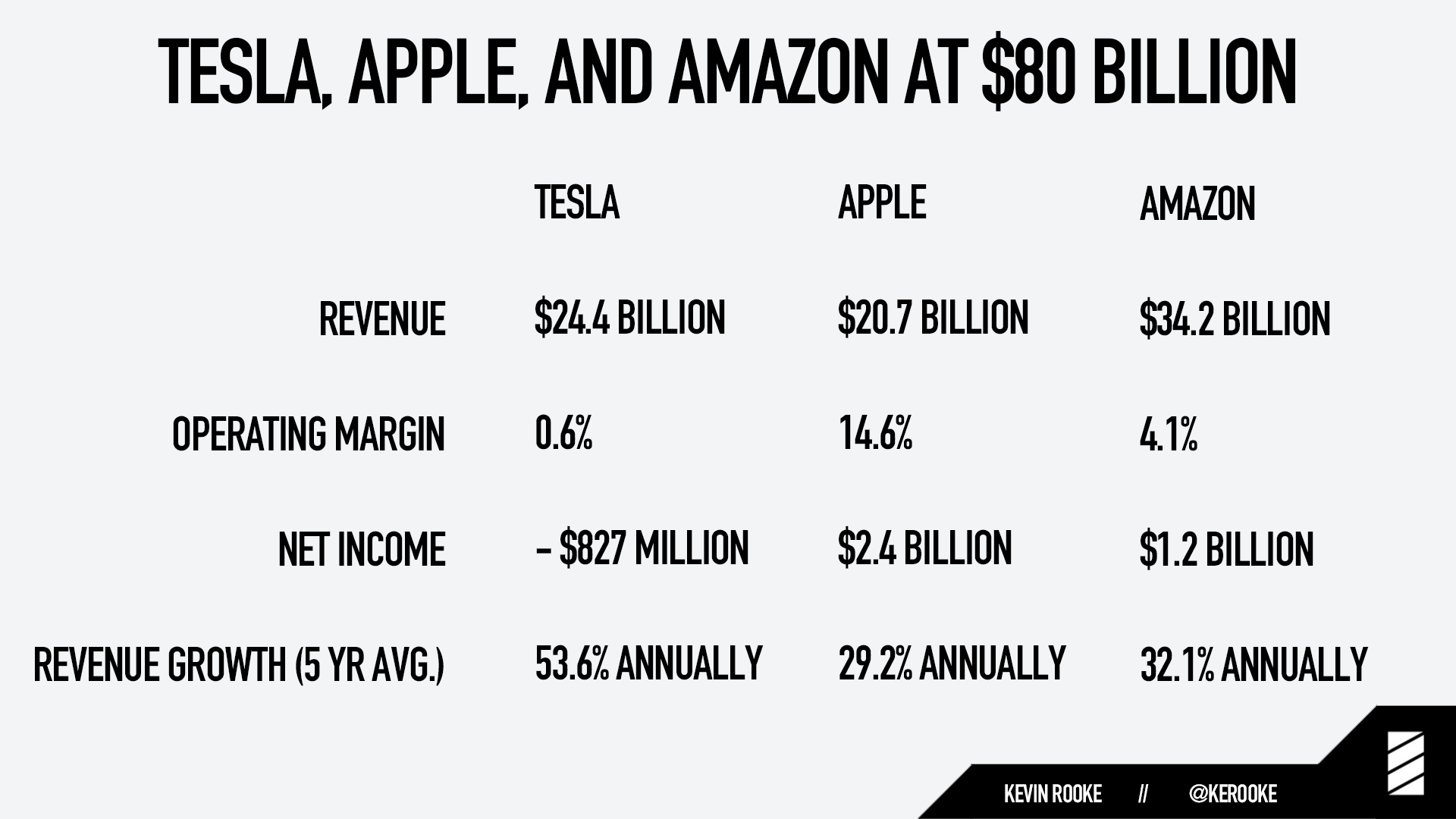

- Tesla is now valued at $80 billion and it shares similarities with Apple and Amazon when they had the same valuation.

- The firm is not overvalued because of its rate of growth and dominance over its industry.

- It has been able to target the Chinese market early on in its business.

After a strong year for the Tesla stock (NASDAQ:TSLA), the carmaker is now valued at $80 billion. According to technology researcher Kevin Rooke, the company shares many similarities with Apple and Amazon when they had the same valuation.

Tesla, whose stock is the most shorted amongst all major carmakers, is often described to be overvalued by strategists.

Not overvalued, similar numbers as Apple and Amazon in their early days

When Apple and Amazon were valued at $80 billion, the two companies generated $20.7 billion and $34.2 billion in revenue respectively, with 29.2% and 32.1% annual growth.

Currently, Tesla is recording revenue of around $24.4 billion, with a 53.6% annual growth rate.

While the car maker’s operating margin and net income are significantly lower than that of Apple and Amazon , Rooke emphasized that their rate of growth and expansion make up for it.

“Though Tesla’s operating margin and profit figures are slightly lower than both companies, Tesla is also growing much faster than both Amazon and Apple. This compensates for the lack of profit… for now. And this leads us to the ultimate question Tesla investors need to ask themselves,” said Rooke.

Like Apple, Rooke noted that Tesla also has big growth potential if it leverages the Tesla Network. Often, investors describe Tesla as a software company rather than a conventional carmaker in that it prioritizes building software along with manufacturing.

That will allow Tesla to obtain a high-margin hybrid business explained Rooke, which further justifies the $80 billion valuation of the company.

Tesla has a big market in China supporting the firm

Tesla succeeding in China has become a win-win scenario for both the company and the government.

It would indicate that foreign companies can grow in China, which benefits the government, and China has been supportive of Tesla following the creation of a national initiative to grow the local electric car market.

Tesla, after creating a Gigafactory in Shanghai, had subsidies and tax cuts approved by the Chinese government. It built a completely new factor from ground up and started production in it within a single year, an unprecedented pace of expansion when compared with other multi-billion dollar manufacturing corporations.

China became a big market for Apple years after the iPhone took off in the U.S. and in the Asian market. But for Tesla, the lucrative Chinese market can become a catalyst for the firm’s medium to long-term success relatively early on.

Dominance in U.S. and European market

Neither Apple or Amazon had dominance over their respective industries as much as Tesla does over the electric car market.

Q4 2019 data shows that it accounted for 77% of all-electric car sales in 2019 in November , dwarfing sales of companies like BMW, Nissan, Daimler, and Volkswagen.

Recent reports have also revealed that the company sold more vehicles in 2019 than 2017 and 2018 combined , showing fast scalability and ability to improve cash flow.

Issues that were presented as major roadblocks for the company like the trade war between the U.S. and China have subsided, creating a more practical environment for Tesla to expand in 2020.