Tech Stocks Had a Miserable Start to 2019 But One Industry is Keeping Dow Jones Alive

A major Russian bank has reportedly frozen the bank accounts of a Venezuelan state oil firm to avoid blowback of US sanctions.. | Source: Shutterstock

While most major tech stocks in the likes of Intel and Nvidia had a bad start to 2019, one industry has performed exceptionally well, sustaining the momentum of the Dow Jones and the U.S. stock market.

In the fourth quarter of 2018, the oil industry had one of its best years to date. Exxon Mobil Corp and Chevron Corp reported strong earnings in the latter half of last year, generating record profits.

The expectations toward oil giants dropped as oil prices declined by 38 percent approaching the end of 2018.

Despite falling oil prices, the oil industry demonstrated resilience to a wide range of geopolitical risks that heavily affected the electronics and technology sector.

BP and Total Set to Record $84 Billion Annual Profit, Dow Jones to React Positively

Following the positive earnings reports of Exxon and Chevron, more large oil conglomerates including BP and Total are set to release their earnings in the upcoming days.

Early estimates put the yearly profits of the two companies at $84 billion, up $10 billion than four years ago, as reported by The Wall Street Journal.

Exxon and Chevron generated profit in the range of $3 to $6 billion in the last quarter of 2018, recording a 10 to 19 percent increase in profits from the previous year.

Edward Jones analyst Brian Youngberg said :

These companies have figured out how to operate in this new environment, and they have adjusted well. The key going forward will be maintaining discipline. This is now a low-growth industry, so you’ve got to invest well.

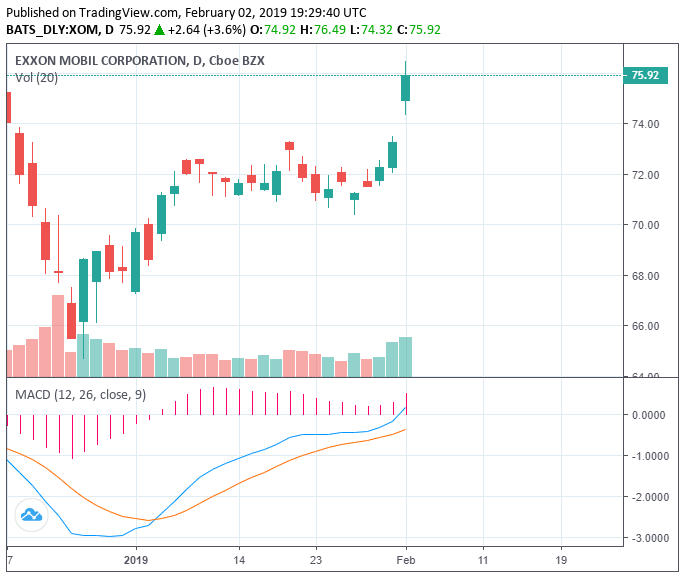

The solid rebound of Exxon in the last several months of 2018 was crucial for the oil industry as the company experienced a plunge in its share price by 24.27 percent from its yearly peak in October.

Since late December, Exxon has recorded a 15 percent increase in valuation as the oil sector recovered as a whole.

With the oil sector fueling the positive sentiment around the U.S. economy, the Federal Reserve vowing to be patient with regard to increasing its rates, and U.S. job growth increasing steadily, the pressure on the Dow Jones and U.S. stock market is dropping gradually.

But, as it is for virtually every major industry in the U.S., the ongoing trade talks with China remains an interest for oil companies.

In an unlikely event that a comprehensive trade deal is not achieved by the U.S. and China by March 1, Dr. Philip K. Verleger, Jr. explained in a column that it could drive crude prices down and hurt the oil industry.

“Those in the oil market also worry about China. The country’s economic growth has been a key driver of global crude oil consumption,” Verleger, Jr. wrote, adding that there exists a possibility it may negatively affect the growth of international markets.

Verleger, Jr. noted :

The danger occurs because lower oil demand growth in China comes just when independent refining capacity there is rising. The capacity growth has been financed primarily by debt, most likely supplied by China’s alternative lenders. As demand slows, these refiners will turn to international markets, dumping products in Singapore, the Americas, or Europe to earn hard cash.

General Optimism in U.S. Markets

U.S. President Donald Trump has reassured investors that the trade talks with China are seeing progress and that both countries do not want to increase tariffs from current levels.

With major industries in the U.S. outperforming the expectations of Wall Street and various factors fueling the recovery of the Dow, the short-term outlook on the U.S. stock market remains positive.

If the trade talks with China move smoothly over the next four weeks, the oil, technology, and car manufacturing industries are all projected to rebound and retain momentum.