Stock Market Rally Proves Rate Cut Would Be a Mistake: Byron Wien

Byron Wien at the start of the year predicted the stock market would advance 15 percent in 2019. Now he says Fed should leave rates alone. | Source: REUTERS/Brendan McDermid

By CCN.com: Wall Street veteran Byron Wien has a reputation as a prognosticator in the stock market , and so when he makes predictions, you might want to listen up. Wien, who at the beginning of the year predicted the S&P 500 would advance 15 percent in 2019 , is reportedly so impressed by the stock market rally that he wants the Fed to lay off on the rate cuts. In fact, using his crystal ball, Wien preciously forecast that stocks would be doing so great this year that the gold price would sink to $1,000. There’s still time for that prediction to come true.

Blackstone’s vice chairman in the private wealth solutions group told CNBC :

“If you look at the market over the past week, stocks don’t need any help. They are roaring ahead, without the Fed doing anything.”

Wien, who for decades has been predicting the stock market’s performance as much as a year in advance, makes sense of all the market forces that are competing at the moment. The Dow Jones, for instance, has been in recovery mode since falling nearly 1,000 points last week. At the current pace, stocks are headed for gains this week for the first time in about a month, and that means something. Even if the stock market has already factored in a rate cut, any move by the Federal Reserve now would be overkill. Wien stated:

“But I think the stock market is fine.”

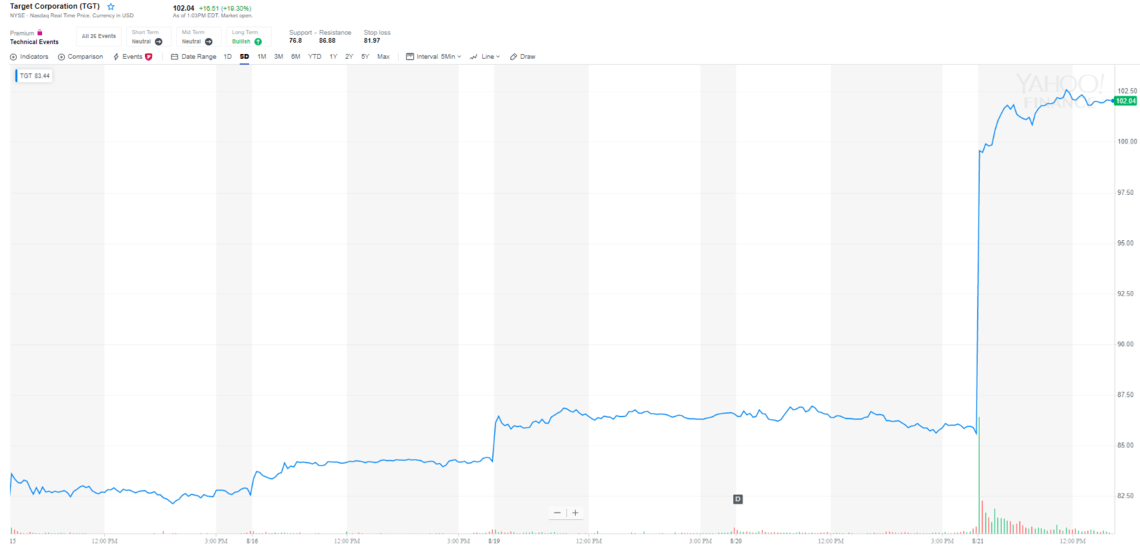

He’s right. While there may be pockets of weakness in the economy, the U.S. consumer is strong. Just look at the 20 percent pop in Target’s stock today, which is leading the entire stock market higher.

The stock is rallying on strong earnings results, and that is a function of a solid economy in which people are spending money. Target is trading above $100 for the first-time ever. Retail stocks don’t tend to set records during a recession. The company left analyst earnings estimates in the dust when it reported Q2 results and lifted its outlook for the rest of the year as more customers flock to the discount retailer. Target is even giving heavy-hitter Amazon a run for its money. Moody’s Charles O’Shea told CNBC :

“This is as good a quarter as Target possibly could have had.”

You can’t have your cake and eat it too. Either the economy is weak and desperately needs a rate cut to avoid recession or it’s expanding and therefore needs no accommodation by the Fed. Besides, President Trump likes a challenge. If he doesn’t get his rate cut, he’ll have more to brag about when the economy does great anyway.

So while the U.S. consumer may be holding up an economy that is only firing on a few cylinders, doesn’t that count for something? Byron Wien is right. The stock market is doing just fine on its own and doesn’t need the crutch of an interest rate cut. Investors are focusing on the good news and putting the trade war and interest rate scuffle in the rearview mirror – for now.

Disclaimer: This article is intended for informational purposes only and should not be taken as investment advice.