Stock Market Investors Might Want to Be Greedy & Pile into Square

The stock market just suffered its most brutal week of the year so far, and Square was not immune to the pressure. Did investors overreact? | Source: Shutterstock

The two biggest emotions that fuel the stock market are fear and greed. One will send stocks swooning, while the other can create bubbles. But as Warren Buffett famously says , “Be fearful when others are greedy and greedy when others are fearful.” If he’s right, then now’s the perfect time to pile into payments company Square (SQ).

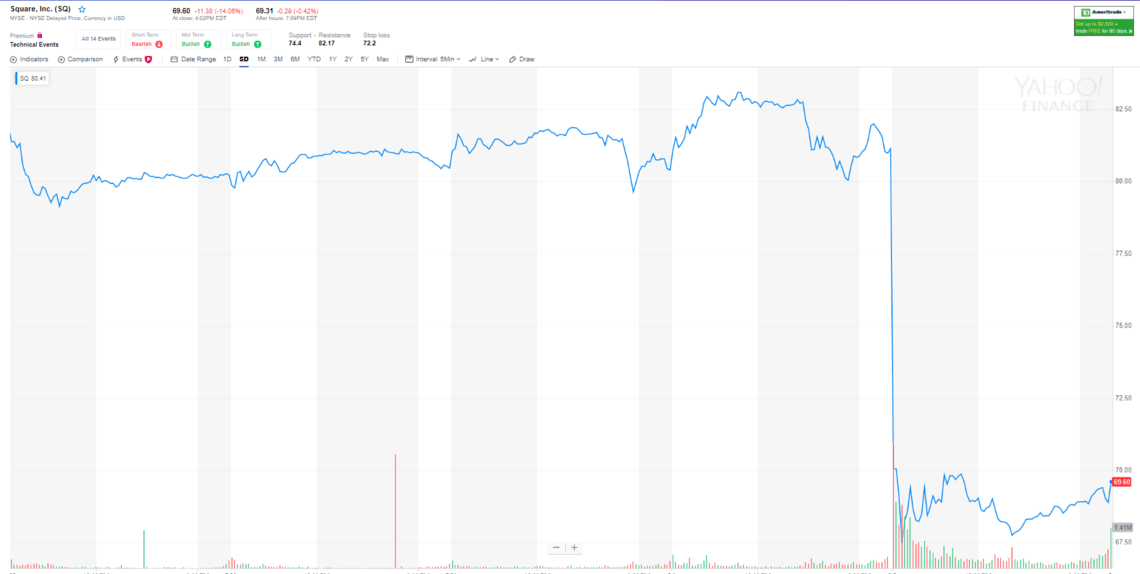

In case you didn’t notice, the broader stock market just suffered its most brutal week of the year so far. The silver lining in all of the selling is that it gives investors the opportunity to buy the dip in stocks that are fundamentally solid. Square, the payments startup run by Jack Dorsey, is one such opportunity, having shed 14 percent on Friday alone. Investors got scared and fled the stock after the company issued lackluster guidance for the third quarter. Analyst firm Evercore knocked the stock down to an underperform, slashing the price target to $64. While the outlook wasn’t what Wall Street was hoping for, could they be missing the forest for the trees?

Stock Market Investors: Feeling Greedy?

Payments companies are all the rage. Everybody wants to be a bank these days. Fintech companies like Square have the best of both worlds because they are innovative enough to capitalize on the latest technology trends without having to worry about legacy systems that weigh down the banks. Square never would have been able to expand to support bitcoin payments if it were a bank, nor would it probably have wanted to. And its bitcoin revenue has been ballooning over the past year. The point is, Square is a solid long-term play in the stock market that just met a rough patch. Here’s where the greed comes into play.

Paul Meeks, lead portfolio manager at the Wireless Fund, observed some of the technical signals that he shared on CNBC . According to Meeks, stock market selling pressure sent Square’s stock below both the 50-day and 200-day moving averages. As a result, there could be more pain ahead, and the stock could fall further to revisit June levels of $60 but only before reversing course. He owns the stock and would be a buyer at the current level because he believes that over the long-term, the stock is headed higher.

“Over the long term… I do like it. And I like to buy stocks ala Warren Buffett, be greedy when others are fearful. I do believe that over time, their growth will – if it doesn’t necessarily reaccelerate – it will stabilize and it will deserve a nice valuation.”

Despite Friday’s bludgeoning, the stock has increased by more than 20 percent year-to-date.

Lean, Mean Payments Machine

Square is streamlining its business and selling non-core assets like its food-delivery business Caviar. The company is evolving into a lean, mean payments machine that could recapture its former glory in the stock market. For investors inclined to be greedy when others are clearly fearful, Square could be just the right candidate.

Disclaimer: This article is intended for informational purposes only and should not be taken as investment advice.