Best Safest (Most Secure) Bitcoin and Crypto Exchanges in 2024

Best Most Secure Bitcoin and Crypto Exchanges in 2024

Below are the best secure Bitcoin and crypto exchanges you’re likely to find.

promotions

Get up to 100 USDT in trading fee rebate after full verification, first deposit, and first trade.Coins

promotions

Enjoy a 10% discount on BitMEX fees for six months when you register through a referral link.Coins

promotions

Receive $10 in Bitcoin when you register with a referral link and buy $100 worth of crypto on Okcoin.Coins

promotions

Get mystery boxes worth up to $10,000 when you register through a referral from a friend.Coins

Review of Our Top 10 Safest Bitcoin and Crypto Exchanges

Don’t register with any site until you read the short reviews of each of the safest Bitcoin and crypto exchanges listed on this page.

1. Binance

- 0.0000039 - 0.0005

- spot trading

- derivatives trading

-

futures trading

12

No result

- Bitcoin

- Ethereum

-

Binance Coin

291

No result

- Sepa

- GiroPay

-

Visa

305

No result

- English

- Indonesian

-

Spanish

22

No result

- France

- Italy

-

Lithuania

13

No result

- 2FA Google Authenticator

- 2FA SMS

- German

- Russian

-

Korean

15

No result

- Blog

- News

-

Announcements

1

No result

2. Blockchain.com

- spot trading

- margin trading

-

staking

3

No result

- Bitcoin

- Ethereum

-

Bitcoin Cash

28

No result

- Bank transfer

- Sepa

-

Faster Payments

49

No result

- English

- Spanish

-

Portuguese

2

No result

- Singapore

- Puerto Rico

- English

- Learn and Earn

- Podcasts

- Research and Analysis

3. LBank

- spot trading

- derivatives trading

-

futures trading

5

No result

- Ethereum

- Terra

-

Polygon

241

No result

- Visa

- MasterCard

-

Bank transfer

255

No result

- English

- Russian

-

Spanish

27

No result

- 2FA SMS

- 2FA Google Authenticator

- English

- Turkish

-

Polish

24

No result

- Academy

- Guides

- Videos

4. Binance TR

- spot trading

- wallet

- Holo

- Internet Computer

-

The Graph

80

No result

- Bank transfer

- Ziraat Bankasi

-

VakifBank

84

No result

- English

- Turkish

- 2FA Mobile App

- 2FA SMS

- 2FA Google Authenticator

- Turkish

- English

- Blog

- Announcements

5. BitMEX

- Maker/Taker: 0.0200% - 0.0750%

- spot trading

- derivatives trading

-

futures trading

3

No result

- BitMEX Token

- Bitcoin

-

TRON

8

No result

- Visa

- MasterCard

-

ApplePay

12

No result

- English

- Russian

-

Turkish

1

No result

- 2FA Google Authenticator

- 2FA Authy

- Chinese (Mandarin)

- Korean

- Russian

- Knowledge Base

- Videos

- Guides

6. MEXC

- Free

- spot trading

- derivatives trading

-

futures trading

9

No result

- SHIBA INU

- Wrapped Dogecoin

-

ADAX

191

No result

- Visa

- MasterCard

-

Bank transfer

110

No result

- English

- Russian

-

Turkish

14

No result

- Seychelles

- Estonia

-

Switzerland

2

No result

- 2FA Google Authenticator

- 2FA SMS

- English

- Turkish

-

Vietnamese

5

No result

- Videos

- Learn and Earn

-

Blog

2

No result

7. Okcoin

- 3.99%

- spot trading

- OTC trading

-

staking

1

No result

- Bitcoin

- Ethereum

-

Tether

101

No result

- Visa

- MasterCard

-

ApplePay

107

No result

- English

- United States

- Canada

-

United Kingdom

26

No result

- 2FA SMS

- 2FA Google Authenticator

- English

- Blog

- Developer Grant

-

Videos

1

No result

8. OKX

- Free

- spot trading

- derivatives trading

-

perpetual swaps trading

9

No result

- Tether

- Bitcoin

-

Litecoin

92

No result

- Bank transfer

- Visa

-

MasterCard

344

No result

- English

- Chinese (Mandarin)

-

Simplified Chinese

14

No result

- 2FA SMS

- 2FA Google Authenticator

- English

- Learn and Earn

- Announcements

- Videos

9. Phemex

- 0.0001 BTC

- spot trading

- derivatives trading

-

perpetual contracts trading

8

No result

- Ethereum

- Cardano

-

Chainlink

233

No result

- SwiftCash

- Bank Transfer (ACH)

-

Sepa

310

No result

- English

- Russian

-

Japanese

6

No result

- 2FA Google Authenticator

- English

- Japanese

-

German

2

No result

- Blog

- Videos

-

Academy

4

No result

10. Poloniex

- 3.5% - 5%

- spot trading

- derivatives trading

-

futures trading

7

No result

- APENFT

- Bitcoin

-

Ethereum

365

No result

- Bank transfer

- Visa

-

MasterCard

368

No result

- English

- Chinese (Mandarin)

-

Simplified Chinese

9

No result

- Panama

- 2FA SMS

- 2FA Google Authenticator

- English

- Videos

- Guides

- Blog

Why It Pays to Trust CCN

There are close to 600 crypto trading platforms. How many of them are legitimate is anyone’s guess.

Then there’s the small matter of the countless fake BTC exchanges. It’s not always easy to tell a fraudulent site from the real thing.

This is where the CCN team comes in! Our reviewers don’t provide a surface-level overview, like so many other sites.

Instead, they register and trade to give you the lowdown on the crypto exchange. Every issue they face is reported to you, the reader.

We’re determined only to feature the safest crypto exchanges around. Our loyal visitors soon realize that it literally pays to trust us!

- Best Crypto & Bitcoin Exchanges

- Best Crypto & Bitcoin Exchanges in the USA

- Best Tether Exchanges

- Best USD Coin Exchanges

- Best Crypto & Bitcoin Exchanges Canada

- The Best Crypto Exchanges in the UK

- Best Binance Coin Exchanges

- Best XRP Exchanges

- Best Cardano Exchanges

- Best Litecoin Exchanges

- Best Tron Exchanges

- Best Polygon Exchanges

- Best Avalanche Exchanges

- Best Lowest Fee (Cheapest) Crypto & Bitcoin Exchanges

- Show More

Overview of the Best Safest (Most Secure) Bitcoin and Crypto Exchanges in 2024

| Casino | Welcome Bonus | Our Rating |

|---|---|---|

| Binance | Get up to 100 USDT in trading fee rebate after full verification, first deposit, and first trade. | 4.83 |

| Blockchain.com | N/A | 4.83 |

| LBank | Get 255 USDT Bonus when you sign up. | 4.83 |

| Binance TR | Get a 50 USD Bonus when you Register and complete authentication. | 4.67 |

| BitMEX | Enjoy a 10% discount on BitMEX fees for six months when you register through a referral link. | 4.67 |

| MEXC | Get 5 USDT bonus when you deposit 300 USDT. | 4.67 |

| Okcoin | Receive $10 in Bitcoin when you register with a referral link and buy $100 worth of crypto on Okcoin. | 4.67 |

| OKX | Get mystery boxes worth up to $10,000 when you register through a referral from a friend. | 4.67 |

| Phemex | Earn up to $6050 in crypto when you sign up | 4.67 |

| Poloniex | Get Up to $1000 Welcome bonus when you sign up and complete tasks. | 4.67 |

Disclaimer: Investing in cryptocurrencies carries significant risk. Values are highly volatile. Never invest more than you can afford to lose. This site does not provide financial advice. Act based on your own research and consult with a financial professional before making decisions. Don’t invest unless you’re prepared to lose all the money you invest.

Choosing the Safest Crypto Exchange – Red Flags to Note

It's a wise move to do your research well about the safest, most secure crypto exchanges. Trust us; we have heard different horror stories about scam Bitcoin exchanges over the years. Unfortunately, the crypto boom resulted in people doing some unwise things.

These included emptying their savings accounts, bringing their balances to zero. Some even took out personal loans. They did this in the belief that cryptocurrency would make them millionaires.

Sadly, the poor regulation in the industry was manna from heaven for fraudsters. They ruthlessly took advantage, and many investors lost everything as scam exchanges formed.

Then, their creators disappeared. It was as if the company had never existed. Worse still, there was no hope of compensation.

Today, there are still plenty of bad actors in the cryptocurrency exchange industry. Here are some red flags to take note of when you’re considering a trading platform.

Low liquidity

Trading volume is hugely important in any BTC exchange. Without ample liquidity, the value of your coin is irrelevant. If no one wants to buy it, you can’t make a profit!

The best and safest BTC exchanges have high liquidity. This ensures that buy and sell orders are filled quickly. Moreover, you generally get the price you seek.

CoinMarketCap is a great resource for checking the 24-hour trading volume of a crypto exchange. Platforms like Coinbase, Kraken, and Binance traditionally show high trading volumes.

A crypto exchange with very low liquidity could be a sign of a fake platform.

Worthless licensing or none at all

Getting a bogus license is easy. After all, there are plenty of fake regulators around too.

Plenty of crypto exchanges don’t bother with the licensing process at all. A small business might claim it is too expensive.

Frankly, if a BTC trading platform doesn’t have a license of note, steer clear. Obtaining a worthwhile crypto license is a tough and expensive process. Thus, you should respect organizations that go through the time and expense.

Outrageous return on investment (ROI) claims

Traditional lenders such as banks have high-interest rates attached to their loans. But they typically offer a pitiful rate on your savings account.

Keeping this in mind, it isn’t surprising that people are trying different investment methods like crypto. Scammers usually say that users receive huge ROIs in a short period.

They know enough desperate individuals are willing to take the risk. This means that you should look at the ROI claims made by crypto trading platforms. If they don't point to the BTC exchange platform being the safest one you can find, then stay away.

If they’re unrealistic, the site is probably fake. In this situation, take your cash somewhere else.

The Best Crypto Exchanges See Security as Their #1 Concern

There is nothing more important to a highly-rated Bitcoin exchange than security. Here are some of their most important features that keep your money safe.

- Two-Factor Authentication (2FA): 2FA is an extra layer of security for your crypto assets. It asks for a second form of verification in addition to the password. For instance, you may receive a one-time code on your mobile device. This is a dependable way to keep your crypto safe.

- Cold Storage for Funds: A reputable crypto platform will put some of its funds in cold storage. This means that its money is offline and disconnected from the Internet. This protects the majority of user funds from online hacking attempts.

- Encryption: Robust encryption protocols secure sensitive user data, such as login credentials and personal information.

- Secure Socket Layer (SSL) Certificates: SSL encryption keeps communication between users' browsers and the exchange's servers private. It protects you and others from potential eavesdropping or data tampering.

- Audit and Transparency: A trustworthy crypto exchange conducts regular security audits by third-party firms. It also makes the results available to the public. Transparency instills trust among users.

- Know Your Customer (KYC) and Anti-Money Laundering (AML) Compliance: Following KYC and AML regulations is essential. It helps prevent illegal activities on the platform. These measures also ensure the identities of crypto platform users are verified.

- Withdrawal Whitelisting: This feature is found in the best crypto-staking platforms. It allows users to specify a list of wallet addresses to which funds can be withdrawn. It adds an extra layer of protection against unauthorized withdrawals.

- Insurance Coverage: Some crypto exchanges offer insurance coverage for certain losses. This is a welcome way to protect user funds.

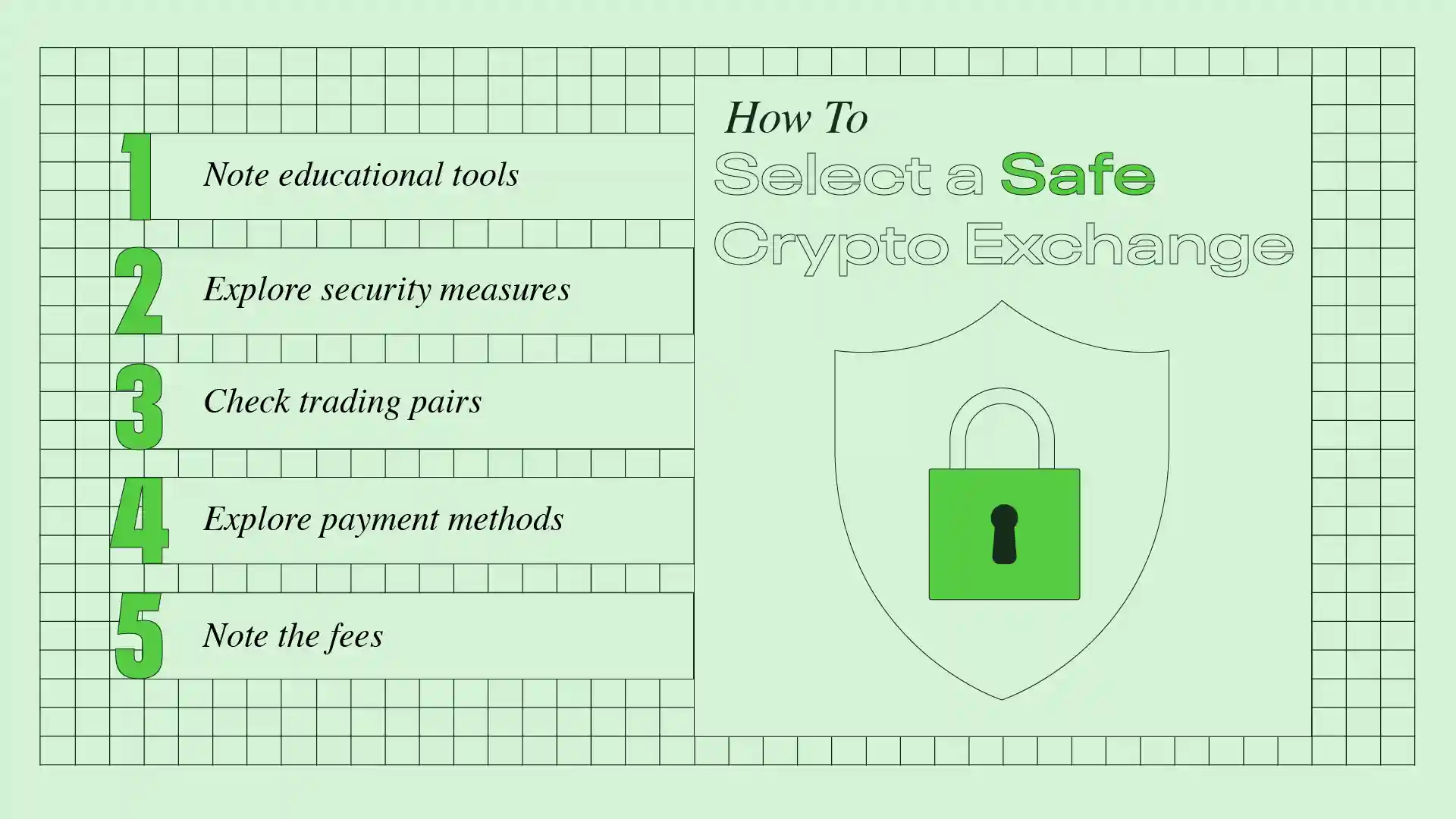

Other Things to Consider When Selecting a Secure Crypto Exchange

Genuine Bitcoin trading platforms show integrity by focusing on security. By now, you should already know how to tell an authentic site from a scam one.

However, there are more things for customers to focus on when picking a suitable site. Here are some of the features of interest worth investigating before you pick a platform.

The existence of educational tools

Cryptocurrency exchanges often provide various educational tools and resources. The best companies want users to stay safe and make informed decisions.

These tools can improve your understanding of crypto trading. They should also help you learn about security best practices and potential risks.

Credible crypto exchanges might offer the following tools.

Knowledge bases and FAQs

Safe BTC exchanges usually have comprehensive knowledge bases and frequently asked questions (FAQ) sections. They cover various topics related to cryptos and trading processes .

Tutorials and guides

A high-quality trading platform might offer step-by-step tutorials and guides. These can help you navigate the platform and set up an account. The info might also explain how to make deposits, withdrawals, and execute trades.

Webinars and video content

The most reputable and secure crypto exchanges organize webinars or produce video content. In these videos, experts share insights, tips, and strategies related to trading and investing. They might also discuss how to stay safe in the crypto space.

Articles and blog posts

You can expect the availability of published articles and blog posts too. Important data points covered include market trends and updates on new features.

Demo trading accounts

A crypto trading platform will, indeed, have an account minimum. But you can practice trading without risking your balance using a demo account . It can help you gain confidence and experience in a risk-free environment.

Community forums

Some Bitcoin exchanges have community forums. These are places where people

interact, share knowledge and ask questions. They might also receive guidance from experienced traders and exchange staff.

Variety of Coins and Trading Pairs

A safe crypto exchange offers lots of digital assets for trading. A wide selection of coins allows you to diversify your investment portfolio.

Well-known digital assets like Bitcoin, Ethereum, and Litecoin are standard. The best BTC exchanges have hundreds of other altcoins.

However, quantity should not compromise the quality of listed cryptocurrencies. The exchange should carefully vet and list reputable and well-established coins.

Doing this helps avoid potential scams or low-quality projects. It is a necessary measure to protect crypto beginners in particular.

Number of Products Available

Spot trading is standard in any exchange business. Yet a reliable exchange offers other exciting products.

They might include futures contracts, options, and margin trading. These products cater to different trading preferences and strategies. This points to the fact that investors have the chance to make smart moves and potentially profit.

Payment Methods

A safe exchange supports multiple payment methods. These include fiat options like credit cards and bank transfers. You might also get to use eWallets like PayPal.

The more options you have, the easier it is to fund your account. Of course, these offerings must meet relevant regulations.

Are the Fees Excessive or Fair?

Fees play a crucial role in the overall trading experience. Crypto exchanges charge trading fees for executing orders. They also charge withdrawal fees to transfer funds.

Low and transparent transaction fees are generally more favorable to traders. That’s because high fees can eat into their profits.

Thus, you need to check the exchange’s fee structure. You must also find out what it charges for each payment method. For instance, you’ll discover that crypto transactions are cheaper than using a credit card.

Decentralized or Centralized? Which Is More Secure?

There is no clear-cut answer to this question. Decentralized exchanges (DEXs) have pros and cons. It’s the same story for centralized exchanges (CEXs).

So, you must be honest and decide which features matter the most. Below, I look at the strengths and weaknesses of both exchanges from a security standpoint.

DEX security strengths

- No single point of failure: DEXs operate on a distributed network of nodes. So the risk of a single point of failure is much lower. Users control their private keys and funds. This means they are at less risk of hacking or exit scams than CEX users.

- Censorship resistance: DEXs allow you to trade without intermediaries. As a result, you benefit from censorship resistance. There is then less chance of funds being frozen or seized by authorities.

- Non-custodial trading: DEXs allow peer-to-peer trading directly from users' wallets. This is possible without the need to deposit currencies into an exchange. The risk of a large-scale security breach where users' funds could be compromised is lowered.

- Transparent transactions: Transactions on DEXs are usually recorded on the blockchain. So you benefit from transparent and auditable trade histories.

DEX vulnerabilities

- User error: You have complete control over your funds and private keys. As such, you are solely responsible for safeguarding your crypto wallet. Any mistakes in managing private keys could lead to irreversible loss of funds.

- Liquidity concerns: DEXs may face liquidity challenges. Consequently, it may prove tough to execute large trades at favorable prices.

- Scams and fake tokens: Some DEXs might host a scam token or two or unvetted projects. Newcomers to the crypto money market could lose funds due to their inexperience.

CEX security benefits

- Strong security infrastructure: CEXs often have dedicated teams and resources. They build robust security measures, including firewalls, encryption, and intrusion detection systems.

- Risk mitigation: With centralized control, crypto exchanges can implement risk management tools. This helps the site detect and prevent suspicious activities.

- Customer support and account recovery: Suppose you lose your password or have account access issues. CEXs can provide customer support and facilitate account recovery processes.

- Regulatory compliance: CEXs usually comply with regulatory standards. They may operate under licensing requirements. This means an extra layer of accountability and oversight.

CEX security vulnerabilities

- Single point of failure: CEXS are vulnerable to large-scale hacks or insider attacks. These issues could result in significant financial losses for users.

- Custodial risks: The funds held on centralized exchanges are custodial. This means you must trust the exchange to secure its assets properly.

- Data breaches: CEXs store sensitive user information. In this sense, they are potential targets for data breaches and identity theft.

Both CEXs and DEXs have security pros and cons. The choice depends on individual preferences and risk tolerance.

CEXs may offer more user-friendly features and stronger regulatory compliance. DEXs provide enhanced security through user-controlled funds and censorship resistance.

A Simple Guide to Buying Bitcoin Securely

Here's a short and easy-to-understand guide to buying crypto securely on an exchange.

Choose a reputable exchange

Research and select a reputable Bitcoin trading platform. It must have a proven track record of security. Look for user reviews and make sure the company follows regulatory requirements.

Create an account

Sign up for an account on the exchange's website or mobile app. Use a strong and unique password. Also, enable two-factor authentication (2FA) for extra security.

Complete verification (if required)

Crypto exchanges in many countries request identity verification (KYC). They do this to comply with regulations.

Follow the instructions and submit the necessary documents. Ensure your computer or mobile device has updated antivirus software and a secure operating system. Also, avoid using public Wi-Fi for transactions.

Add a payment method

Link your bank account, debit, or credit card to the crypto exchange to fund your account. Ensure that the payment method you use is safe and reputable.

Before making any purchases, research the coins you’re interested in. Understand their purpose, potential risks, and historical performance. Avoid making impulsive decisions based on hype.

Set up a wallet (optional)

Certain BTC trading platforms offer custodial wallets. Yet using a non-custodial wallet to store your digital assets is more secure. Consider setting up a hardware wallet or a software one with strong encryption.

Place your order

Go to the exchange's trading platform and select the cryptocurrency that meets your needs. Next, decide on the amount and type of order (market or limit).

A market order buys at the current market price, while a limit order allows you to set your desired price.

Double-check all transaction details before confirming the purchase. These include the amount and the coin you're buying.

Storage and monitoring

Not planning to trade actively? If so, transfer your crypto asset to your personal crypto wallet for added security.

Regularly check your account and transaction history to detect any unauthorized activities.

Be cautious of phishing emails, fake websites, or unsolicited messages promising easy profits. Verify all communication directly through the official exchange website or app.

Never share your account credentials, private keys, or personal information with anyone.

Remember, secure trading involves taking the time to research. Doing this will help you use reputable services. Also, protect your account and funds diligently.

As with any investment, only invest what you can afford to lose. Finally, avoid making emotional decisions based on market fluctuations.

Enhance Safety by Registering with Several Bitcoin Exchanges

Using several crypto exchanges instead of relying on just one or two is wise. It can provide added safety and security for several reasons. I highlight a few below.

Diversification of assets

By using multiple exchanges, you spread your holdings across different platforms. This diversification reduces the risk of a significant loss because of a big event. Possible issues include a security breach, operational issues or insolvency.

Reduced single-point-of-failure

Relying solely on one or two exchanges creates a single point of failure. Suppose a crypto trading platform experiences downtime, hacking, or other issues.

You may lose access to your funds temporarily or permanently. On the other hand, using multiple exchanges reduces this risk. This action gives you alternative options to manage your crypto wealth.

Access to different cryptocurrencies

Not all exchanges list the same coins. Using different platforms allows you to access a broader range of digital assets.

You can also invest in various projects, increasing the chances of your portfolio growing. Also, you can open extra crypto wallets for added security.

Liquidity and trading opportunities

Crypto exchanges have varying levels of liquidity and trading volumes. Using different options helps you to find better prices. You can also seize trading opportunities on platforms with higher liquidity.

Regulatory compliance and stability

Regulatory environments can differ between exchanges and jurisdictions. Using various Bitcoin exchanges that comply with relevant regulations is a good idea.

It enhances overall stability. Through this process, everything is held by reputable entities.

Avoid pressing a single website

Overloading a single BTC exchange with a large volume of trades might raise red flags. For example, a possible result is limitations on your account. Spreading your trading activities can help you avoid such restrictions.

There is one essential thing to remember. You are exposed to the risks of every platform you use.

Thus, you must conduct due diligence. Choose reputable exchanges with proof of a strong security track record and positive user reviews.

Also, always prioritize the security of your assets. Finally, stay informed about the latest security practices in the cryptocurrency space.

How Do Secure Cryptocurrency Exchanges Operate?

Safe Bitcoin exchanges operate similarly to stock market trading sites. They act as marketplaces where buyers and sellers can trade digital assets. Here's a brief outline of how they function securely.

User registration and KYC

Secure crypto exchanges require users to register and complete the KYC process . This is necessary to ensure compliance with regulations and prevent illegal activities.

During registration, you need to provide identification documents. You can’t trade without first verifying your identity.

Order placement

You can place orders to buy or sell cryptos on the exchange. Like stock markets, you can choose between market and limit orders.

Matching engine

The crypto exchange's matching engine matches buy and sell orders from different users. A trade occurs when a buy order's price matches a sell order's price.

Order book

The exchange maintains an order book. It displays all the current buy and sell orders, along with their respective prices and quantities. This allows traders to see the market's supply and demand.

Custodial and non-custodial accounts

Some Bitcoin exchanges offer custodial accounts. This is where they hold users' funds on their behalf, simplifying the trading process.

Other crypto trading platforms offer non-custodial accounts. Users maintain control of their private keys and funds, providing enhanced security.

Market surveillance

BTC exchanges monitor trading activities to detect and prevent market manipulation and fraud. This is similar to how stock exchanges have market surveillance mechanisms.

What Are My Options Once I Buy Crypto?

When you buy crypto, here are a few steps you can take.

Diversify your portfolio

Diversify your crypto holdings by investing in different coins. This action can help spread risk and potentially improve overall returns.

Stay informed

Keep yourself updated with the latest news and developments in the crypto space. Being informed about market trends and regulatory changes can help you make sensible decisions.

Avoid emotional trading

Don't let emotions dictate your trading decisions. Avoid impulsive buying or selling based on market fluctuations. Stick to your investment strategy and stay focused on long-term goals.

Use reputable exchanges

Trade on reputable and secure cryptocurrency exchanges. The best platforms have a track record of reliability and customer satisfaction. Do your research before choosing an exchange.

Keep track of transactions

Maintain a record of all your crypto transactions for tax and accounting purposes. You can use portfolio tracking tools to monitor your investments effectively.

Practice good security hygiene

Regularly update your software and use strong passwords. Also, be cautious of phishing attempts, and avoid sharing sensitive information online.

Be mindful of taxes

Understand the tax implications of buying and selling digital assets in your country. Cryptocurrency transactions may be subject to capital gains taxes.

How to Store Your Cryptocurrency Securely

Secure storage protects your assets from theft and unauthorized access. There are various ways to store your crypto safely.

Hardware wallets

Hardware wallets are physical devices designed specifically for storing cryptocurrencies offline. They are considered one of the safest options because private keys never leave the device.

Some popular hardware wallet brands include Trezor, KeepKey, and Ledger. These wallets offer robust security features. Examples of these features include PIN protection and passphrase support.

Software wallets

Software wallets are crypto apps or programs you install on your computer or smartphone. There are two types of software wallets: desktop wallets and mobile wallets.

Desktop wallets are more secure if used on an offline computer or not connected to the Internet. Popular software wallets include Exodus, Electrum, and Atomic Wallet.

Web wallets

Crypto exchanges or third-party services provide web wallets. While convenient, they are generally considered less secure than hardware or software wallets.

They store your private keys on a server controlled by the service provider. If you use this option, though, only use reputable and well-established web wallets. Also, consider using them only for small amounts of cryptocurrency.

Paper wallets

A paper wallet generates public and private keys offline and prints them on paper. Since it's not connected to the Internet, it provides a secure cold storage option.

However, creating and handling paper wallets require caution to avoid physical loss or unauthorized access.

Backup and recovery

Always create secure backups of your private keys or wallet recovery phrases. Keep these backups in a separate physical location.

For instance, put them in a safe or secure storage place. Doing so helps protect against data loss or hardware failure.

Keep software up-to-date

Ensure you keep your wallet software and operating system updated with the latest security patches and fixes. Regular updates reduce the risk of vulnerabilities that attackers could exploit.

Beware of phishing

Be cautious of phishing attempts and fake wallet apps. Always download wallets from official sources and double-check URLs and email addresses before entering your sensitive information.

Keep private keys private

Never share your private keys or recovery phrases with anyone. Treat them as highly sensitive information, and avoid entering them on dubious websites or platforms.

Choosing the right storage method depends on various factors. These include your risk tolerance, tech savviness, and the amount of crypto you own.

Hardware wallets and cold storage solutions offer maximum security for larger amounts or long-term holdings. For day-to-day transactions or small amounts, software wallets are more convenient. They also offer a decent level of security.

Final Word

Selecting a secure cryptocurrency exchange can help safeguard your investments. Scams and fraudulent platforms exist, so it’s important to conduct research before choosing a trading platform.

Look out for red flags like low liquidity, lack of licensing, and unrealistic ROI claims. Opt for exchanges with robust security features like 2FA, cold storage, encryption, SSL certificates, and compliance with KYC/AML regulations. Understanding secure exchange operations, post-purchase options, and safe storage methods like hardware wallets, software wallets, web wallets, and paper wallets is crucial for investing.

Frequently Asked Questions

What services do the safest crypto and Bitcoin exchanges offer?

Crypto trading platforms act as a marketplace where you can buy and sell digital coins. They enable you to engage in spot and margin trading. The best BTC exchanges have advanced trading features, such as futures. Moreover, they offer a crypto wallet to store your coins in. Eventually, you may wish to put them in a more secure location.

How much money do I need to use a Bitcoin exchange?

A few bucks is all you need to get started with any crypto exchange. Even the best crypto trading platforms let you begin with between $2 and $10. I also recommend choosing sites with demo accounts. They let you get used to the trading process with no financial risk.