Own Netflix Stock? We Guarantee This Chart Will Terrify You

All it takes is one chart to destroy the bull narrative for Netflix stock. | Source: Lionel BONAVENTURE / AFP

By CCN.com: Netflix has been a leader in the movie rental field since it was mailing out DVDs in red envelopes, and it remains outright dominant since placing a winning gamble on the streaming revolution. However, the company now finds its territory threatened on several fronts, and the fallout from some shocking data should devastate the bull case for Netflix stock.

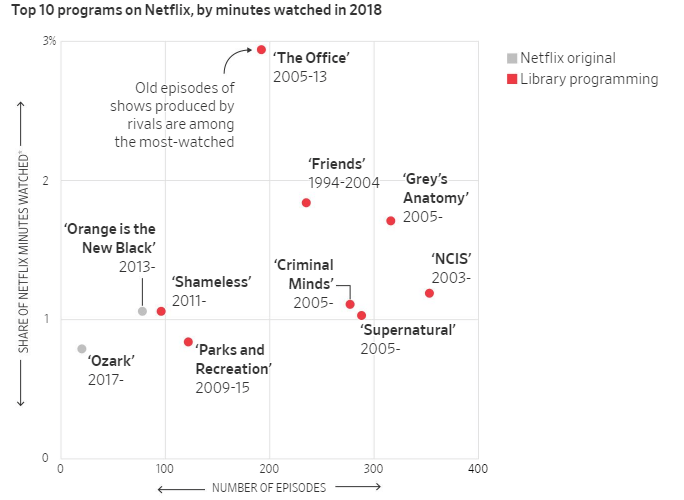

This Single Chart Kills the Bull Narrative for Netflix Stock

Despite plunging billions of dollars into original content, Netflix’s bread-and-butter remains reruns like “The Office.” In fact, the show – which has a soon-to-expire licensing agreement with NBCUniversal – accounted for nearly 3% of all viewing on the service in 2018.

That’s not an aberration, according to the Wall Street Journal . Only two of the streaming giant’s top 10 most-watched shows from 2018 were Netflix originals. Nielsen data indicates that users devote 72% of all viewing minutes to licensed content like “Friends” and “Grey’s Anatomy.”

That should terrify anyone who owns NFLX stock. NBCUniversal – which owns some of Netflix’s most popular shows – plans to launch its own streaming service. When it does, it wants its shows back.

In addition to NBCUniversal, Netflix risks losing programming from WarnerMedia and Walt Disney, both of which aim to compete in the streaming niche. Even if they don’t yank their shows completely, they could bleed the streaming giant dry with licensing fees, cognizant that the company can’t afford to lose audience hits like “The Office” and “Friends.”

Netflix tweeted a snarky retort to the article, which went viral on social media, noting that “The Office” would remain available until at least 2021.

NFLX shareholders should already hear the clock ticking.

Netflix Piles on Debt to Crank Out Original Content

The loss of content from the onslaught of its new competitors forced Netflix to beef up its spending on exclusive series and movies.

One hit movie is “Bird Box,” which stars Sandra Bullock. Netflix claimed that 45 million subscribers watched it during its first seven days on the service, the biggest first-week success of any movie launched on the 12-year-old streaming platform.

Netflix is borrowing at least $2 billion to help fund its original content pipeline, according to the AP . The news outlet reported that NFLX executives credit the spending for helping its video streaming service attract millions of new subscribers during the past five years.

It’s selling $2.2 billion in bonds in the U.S. and Europe this week.

As reported by Barron’s:

“The cash will be used to finance its cash-burning business producing original shows and movies. It ended up borrowing more than the $2 billion it had originally planned, after the offering was met with strong demand.”

Almost 15% of Netflix Subscribers Might Flee to Disney+

The success of its movies and series is impressive, but it hasn’t proven that original content will compensate for the loss of library content. Subscribers might disappear along with their favorite shows.

Since Disney announced it was entering the streaming fray, Netflix shares are up nearly 3%. Disney’s entry may not have spooked investors, but a survey released Wednesday by Streaming Observer should.

It found that 8.7 million subscribers may switch to Disney+.

“12.3% of current subscribers said they ‘might cancel Netflix and get Disney+’ while 2.2% said they will ‘definitely cancel Netflix.’ It’s also worth noting about 1 in 5 Netflix users plan on subscribing to both services, viewing the video services as complementary to one another.”

Now imagine what will happen when NBCUniversal and WarnerMedia leave Netflix users without access to “The Office” and “Friends.”