Only an Idiot Would Use Facebook’s Shady Cryptocurrency

| Source: SAUL LOEB / AFP

By CCN.com: In its neverending conquest to take over the world, Facebook is building a network of online merchants and financial institutions to support its secretive new cryptocurrency. The Wall Street Journal reports that Mark Zuckerberg’s war machine is looking for $1 billion to fund the secretive stablecoin project, Project Libra, and is talking with heavyweights like Visa and Mastercard to get that cash.

Facebook Wants $1 Billion to Fund Project Libra

The company started Project Libra over a year ago as a simple way to transfer money between WhatsApp users. But in true Facebook fashion, it’s grown far beyond that original scope.

The project has expanded to include e-commerce payments on Facebook and other websites as well as rewards for viewing ads, shopping online, and interacting with content.

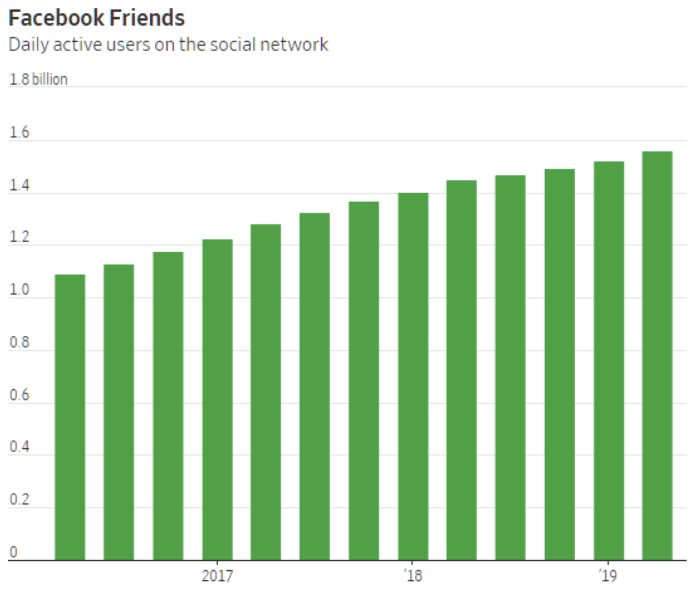

Facebook’s 2.38 billion monthly active users mean that, at launch, Project Libra would almost immediately compete with rivals Apple Pay (383M ) and PayPal (267M ). However, there are several reasons why you, and everyone else, should avoid Facebook’s upcoming cryptocurrency at all costs.

Who Trusts Facebook Anymore?

Let’s take a walk down memory lane to remember the times that Facebook proved it should be nowhere near your money.

Cambridge Analytica

There’s no better place to start than Facebook’s Cambridge Analytica scandal – the mac daddy of screw-ups. In 2014, the social media company sold the personal data of 87 million users to Cambridge Analytica without the users’ consent. Doing so was in direct violation of the company’s privacy policies.

Adding your financial data to the massive pile of personal information that Facebook already has on you is asking for trouble.

Plaintext Passwords

If Facebook’s data breaches weren’t enough to scare you, let’s examine how the company handles passwords. Hint: Not well.

In March, Facebook revealed that it had been storing hundreds of millions of account passwords in a readable, plaintext format since 2012 . Although there was no evidence that outside parties had access to the passwords, employees could grab them with ease.

Don’t forget about the company’s Amazon snafu that exposed data from 500 million accounts either.

By trusting any amount of money to a company that can’t even secure passwords, you’re effectively placing a sign on your back that says, “Please come and rob me!”

Facebook Censorship

The beauty of Bitcoin and other cryptocurrency assets is that they’re censorship-resistant. No single party can freeze your bitcoin wallet or block a transaction. Facebook can, and will, block your financial account whenever it pleases. The company’s already begun showing this overreach of power with its recent account bans.

This week, Facebook announced the bans of several individuals including Alex Jones, Louis Farrakhan, and Milo Yiannopoulos. Representatives from the company explained that those they banned violated the platform’s policy on hate speech and promoting violence.

While that reasoning may hold, it sets a dangerous precedent for future action. Where do you draw the line on censorship? The banning demonstrates that Facebook has the power to freeze your crypto assets if it doesn’t share your particular views and can block transactions to causes it may not support.

Facebook Crypto Should Be Dead on Arrival

Facebook’s cryptocurrency comes with all of the downsides of the company behind it and none of the benefits of an actual cryptocurrency. Anyone hyping it up as a step toward mass adoption simply doesn’t understand what makes crypto great.

If you’re looking for a currency with poor security and oppressive censorship, give your money to Facebook. If not, stay far, far away.