Nouriel Roubini Gloats Over UK Push to Ban Crypto Derivatives

Bitcoin basher Nouriel Roubini hailed a proposal by the UK's Financial Conduct Authority to explore banning cryptocurrency derivatives. | Source: REUTERS/Shannon Stapleton

Economics professor and renowned crypto basher Nouriel ‘Dr. Doom’ Roubini is extending his rivalry with BitMEX CEO Arthur Hayes beyond the debate stage.

Hours after debating Hayes in Taipei during the 2019 Asia Blockchain Summit, Dr. Doom hailed the proposal by the UK’s Financial Conduct Authority to ban crypto derivatives in the region, saying the tide had turned from “buy, buy to bye-bye.” This was in a jab at BitMEX and Hayes.

Tangle in Taipei continued

According to Roubini, BitMEX’s business model is “shady” and relies on exploiting unsophisticated investors.

Dr. Doom also equated BitMEX’s business model to “drug pushing.” This is because it recklessly allowed “retail suckers” in the crypto space leverage of up to 100 times. Consequently, Roubini welcomed the FCA’s decision to “destroy BitMEX.”

While Dr. Doom may already be celebrating the FCA’s move, it may be too early to try to predict where the chips will fall. The FCA has merely issued a consultation paper that may or may not result in a ban on crypto derivatives in the UK.

Crypto “retail suckers” getting rekt

The New York University economics professor cited unsophisticated retail investors as the hapless victims when they trade crypto derivatives. Similarly, the FCA’s intentions also seem driven by these concerns. While announcing the proposed changes, the UK markets regulator noted that with regard to crypto derivatives, the deck is stacked against retail investors :

“We believe that retail consumers can’t reliably assess the value and risks of derivatives (contracts for difference, futures and options) and exchange traded notes (ETNs) that reference certain cryptoassets.”

The FCA believes that banning crypto derivatives in the UK will protect retail investors from financial losses totaling between £75 million ($94.33 million) and £234.3 million ($294.7 million). While a noble move, the FCA’s mission might have been better served by investing in educational initiatives for retail investors. This is because banning crypto derivatives is not likely to deter the most determined retail investors who will just turn to use virtual private networks (VPN).

Will crypto derivatives survive regulatory backlash?

The regulator, however, is spot on in stating that crypto derivatives have caused financial ruin to unsophisticated traders. Just last month, CCN.com reported that a Chinese trader who employed 100X leverage ended up taking his life after losing 2,000 bitcoins in the process.

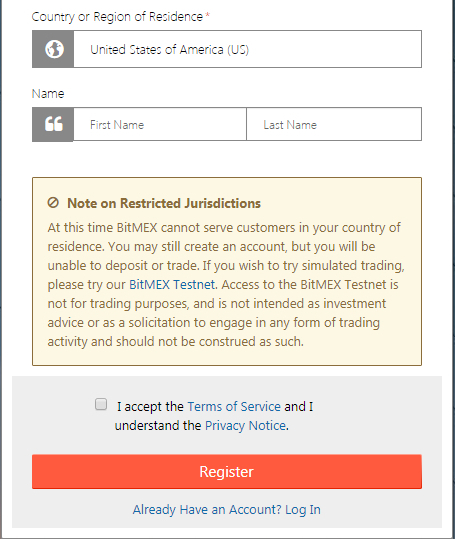

So what will happen to BitMEX if the FCA drops the hammer on crypto derivatives? Even if the FCA goes on to ban crypto derivatives in the UK, it is unlikely to take BitMEX out of business; it will continue to operate in other parts of the world. For instance, BitMEX, which is incorporated in the Republic of Seychelles, does not accept users from the U.S. due to regulatory restrictions.

And despite not operating in one of the most lucrative crypto markets in the world, the crypto derivatives exchange recently hit the $1 trillion mark in annual trading volume.