Non-Bitcoin Asset Blockchain Market Capitalizations Jump 1,600% in 3 Years

Bitcoin remains king of the hill in blockchain market capitalization, but alternative asset blockchains are nipping higher at bitcoin’s heels.

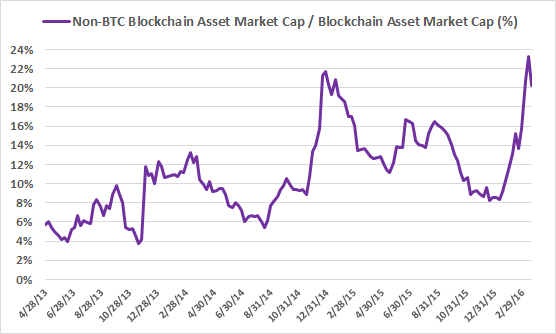

Non-bitcoin asset blockchains have expanded market value significantly in the last three years, jumping 1,600% while bitcoin’s market gap grew 300%, according to an analysis of coinmarketcap data by Venturebeat .

The article, written by Alex Sunnarborg, chief financial officer and co-founder at Lawnmower.io , a mobile app for investing in blockchain and bitcoin technologies, notes that the expansion of non-bitcoin assets offers investment opportunities for those looking to diversify portfolios.

Blockchain Assets Grow

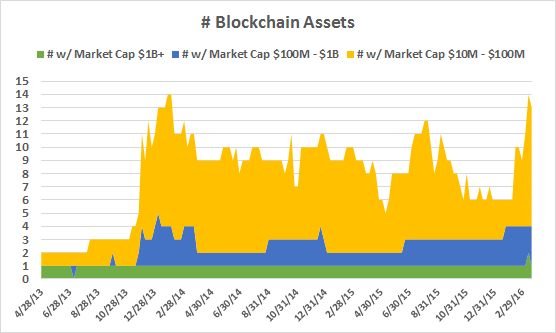

The market for non-bitcoin blockchain assets totaled $92 million on April 28, 2013, while bitcoin exceeded the $1 billion cap one month earlier. The non-bitcoin blockchain market exceeded $1.6 billion on March 21, 2016. (By then, bitcoin was at $6.318 billion.)

Bitcoin accounts for roughly 80% of the total blockchain asset market. Fifteen blockchain assets have surpassed the $50 million market cap.

Bitcoin’s Lead Frim

A list of the top 15 bitcoin assets based on the highest market cap reached indicates that bitcoin commands a clear leadership position at more than $13 billion, reached Dec. 1, 2013. The only other blockchain asset to exceed $1 billion is Ethereum, which hit $1.103 billion March 13, 2016. The third highest asset was Litecoin at $934,938,972 on Dec. 1, 2013, followed by Ripple at $756,028,823 on Dec. 21, 2014.

Bitcoin’s lead is even larger as of March 20, 2016, holding $6.317 billion, followed by Ethereum at $820,598,600, Ripple at $273,362,766, and Litecoin at $143,750,234.

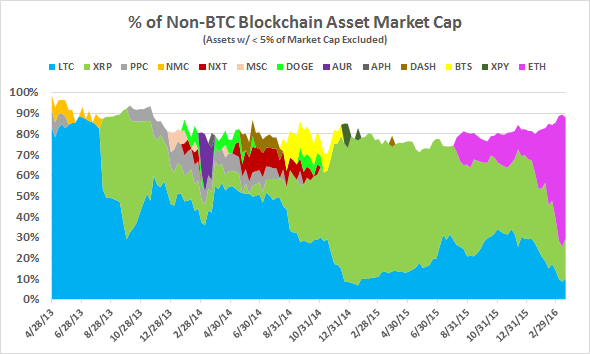

The Top Altcoins

Following is a review of the top non-bitcoin asset blockchains.

Ethereum is a decentralized platform that operates smart contracts on a custom-built blockchain. The applications run according to a program, with no chance for censorship, downtime, fraud or outside interference.

The initial sales of Ethereum’s Ether currency in September 2014 delivered more than $18 million, marking the fifth place highest funded crowdfunding project ever.

Also read: Ethereum’s growth draws support from more platforms

Litecoin, released in October 2011, features decreased block time compared to bitcoin; 2.5 minutes versus bitcoin’s 10 minutes. It also has a larger supply – 84 million, four times as many currency units as bitcoin. There is a different proof-of-work block-hashing algorithm than bitcoin – scrypt instead of SHA256.

Ripple, launched by Ripple Labs in 2012, is creating a global financial settlement network consisting of system integrators, financial institutions, international payment originators and others to provide an alternative to the current system for cross-border settlements. Ripple’s system of confirmation is called consensus and does not require mining, resulting in a different supply structure. One way it differs from bitcoin is that Ripple can automatically exchange and send any currency.

Dash, currently number five in current market capitalization with $37,326,845, is based on the bitcoin software. It claims to be a privacy-centric digital currency providing instant transactions.

Maidsafe, number six in current market capitalization with $37,169,240, developed the Secure Access For Everyone (SAFE) network from unused processing power, data connection and hard drive space from its users.

Featured image from Shutterstock.