Next Bitcoin Bull Run Slays 2017’s ‘Hype-Driven’ $20,000 High: Researcher

Bitcoin's next bull rally will be 'bigger' than the previous spike that touched an all-time high of $20,000, a researcher has predicted. | Source: Shutterstock

By CCN.com: Tom Shaughnessy, a co-founder at Delphi Digital, an independent research boutique for institutional-grade analysis, believes the next bull run of bitcoin will be bigger than the previous rally.

“The last BTC bull run was driven by hype around magical internet money. The next one will be driven by an actual macro based understanding of the benefits of a non-sovereign, capped, digital SoV bolstered by lightning. The next bull run will be bigger,” he said .

As bitcoin and the rest of the cryptocurrency market matures, researchers like Shaughnessy foresee the demand for decentralized alternative cryptocurrencies and stores of value from the mainstream will increase, ultimately leading to an increase in the bitcoin price.

What Do Investors Expect in Bitcoin in the Near-Term?

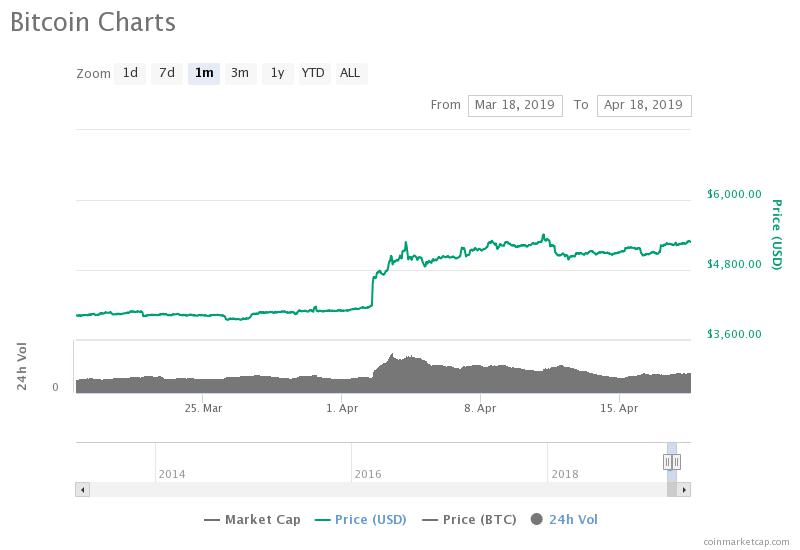

Throughout the past month, the bitcoin price has risen by 33 percent against the U.S. dollar from $3,901 to $5,268.

In a technical aspect, the abrupt surge in the bitcoin price has allowed the dominant cryptocurrency to break out of key resistance levels that prevented a further drop below the $3,000 region.

According to cryptocurrency trader Josh Rager, the stability of BTC at $5,200 could also strengthen the foundation of the asset that would support the next major rally.

“The longer BTC ranges between $5,000 to $5,200, the stronger support it becomes after the next push up Though this equally becomes a stronger resistance if a breakdown occurs in my opinion, Bitcoin likely stays in the price range of this chart ($5,000 region) for weeks to come,” Rager said .

Why Investors Remain Confident Amidst a Bear Market

Since January 2018, despite the recovery of BTC in April, the bitcoin price has dropped by 74 percent from its all-time high at $20,000.

Yet, many researchers and investors remain confident in both bitcoin and the cryptocurrency market in general possibly due to the progress the industry has made in recent months in areas including compliance, transparency, security, and institutionalization.

Fundamental factors such as the hash rate and the transaction volume of bitcoin have also been on the rise since early last year, suggesting that miners are still committed to securing the Bitcoin network, expecting the bitcoin price to increase over the long run.

There still exists a possibility that the mining infrastructure of bitcoin has improved in the past 12 months, contributing to the rise in the hash rate of the Bitcoin network. But. the breakeven cost of mining has still put significant pressure on miners.

Bottom is in

In January, Delphi Digital said in a report that the team expects the bottom of BTC to be reached in the first quarter of 2019 based on the UTXO output of the network.

“Using the timing of previous price bottoms relative to different bitcoin accumulation points, we are able to use current UTXO dynamics to strengthen our forecast of a rough date for a price bottom (sometime in Q1 2019),” the report read .

Traders generally consider the low point of bitcoin in March at $3,122 to be the bottom of the dominant cryptocurrency based on various factors and over the medium-term, researchers expect the sentiment around the cryptocurrency market to continue to improve.