Bitcoin ‘a Return to the Gold Standard’—What Brian Armstrong Means

Bitcoin to Solve the US Debt Crisis? Image: Eduardo Munoz Alvarez/VIEWpress/Getty Images

Key Takeaways

- Coinbase CEO Brian Armstrong suggests Bitcoin could be a modern return to the gold standard.

- The US national debt has reached staggering levels, with rapid increases becoming a bipartisan issue.

- Gold standard practice curbed excessive spending, can BTC mirror that?

Brian Armstrong, CEO of Coinbase, has reignited discussions about financial stability and discipline in the context of the United States’ escalating national debt. Armstrong notes that the adoption of Bitcoin could represent a contemporary return to the gold standard by injecting a much-needed sense of financial restraint.

With upcoming presidential elections in the US, fiscal deficit has become a bipartisan issue.

Gold Standard in Bitcoin Adoption

Armstrong draws a comparison on the historical precedent of the gold standard. The US abandoned the standard, where the value of currency was backed by a specific amount of gold, in 1971. Its supporters claimed the standard provided a check on rampant government spending and printing of money.

According to the Coinbase CEO, Bitcoin offers a modern parallel to the concept with its fixed supply and decentralized nature. According to Armstrong, embracing Bitcoin could serve as an “important check and balance on excessive deficit spending,” essential for maintaining the strength of the US economy.

US National Debt Crisis

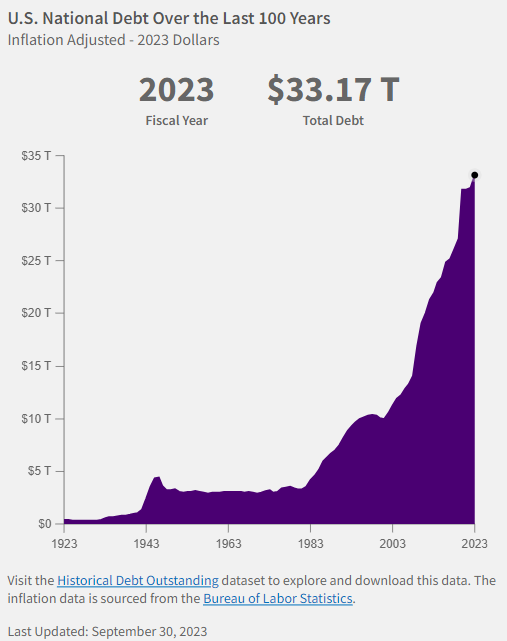

The national debt represents the total amount of money the government owes, accumulated over decades of spending. Investor Robert Sterling’s analysis paints a vivid picture of the debt’s exponential growth. He claimed the problem was not down to a single party but was a result of actions taken by multiple administrations. Also, he said that debt had grown more rapidly in recent years. According to the Bank of America, the US is adding approximately $1 trillion to its total every 100 days, signaling an unsustainable fiscal trajectory.

Sterling claimed national debt was “not slowing down”. He added: “Biden has another 300 or so days in office this term. When either he or Trump enters their second respective term in office in 2025, the debt will likely be above $37 trillion.”

At the time of writing, the total US national debt is standing at $34.5 trillion. It represents the cumulative borrowing by the Federal Government of the United States throughout its history.

The surge in national debt is attributed to a variety of factors, including military expenditures and efforts to stimulate the economy during crises such as the Great Recession and the COVID-19 pandemic.

Elections and the Future of US Debt

With the upcoming elections, there’s increased scrutiny on how both Joe Biden and Donald Trump plan to address the national debt.

Bloomberg quoted Kenneth Rogoff, an economics professor at Harvard University, who warned that both candidates are pushing US debt to risky levels.

Rogoff told Bloomberg TV: “Washington has a very relaxed attitude towards debt that I think they’re going to be sorry about.” Furthermore, government spending, particularly on the military and overseas aid, has reached 9.3% of GDP in the last four years. Meanwhile, BoA data indicates higher expenditures than ever before.

Can Bitcoin Take Over?

Brian Armstrong’s comments spark a crucial conversation on how the US might tackle its growing debt crisis.By drawing parallels to the gold standard, Armstrong suggests a pathway to restraint through Bitcoin. Regardless, anything that counters the current trajectory of unchecked fiscal expansion in the US could help matters.

But as the national debt continues to rise, the concept of a digital gold standard in the form of Bitcoin presents an argument.