Mother of All Bubbles Meltdown Will Be Bigger Than 2008: Ron Paul

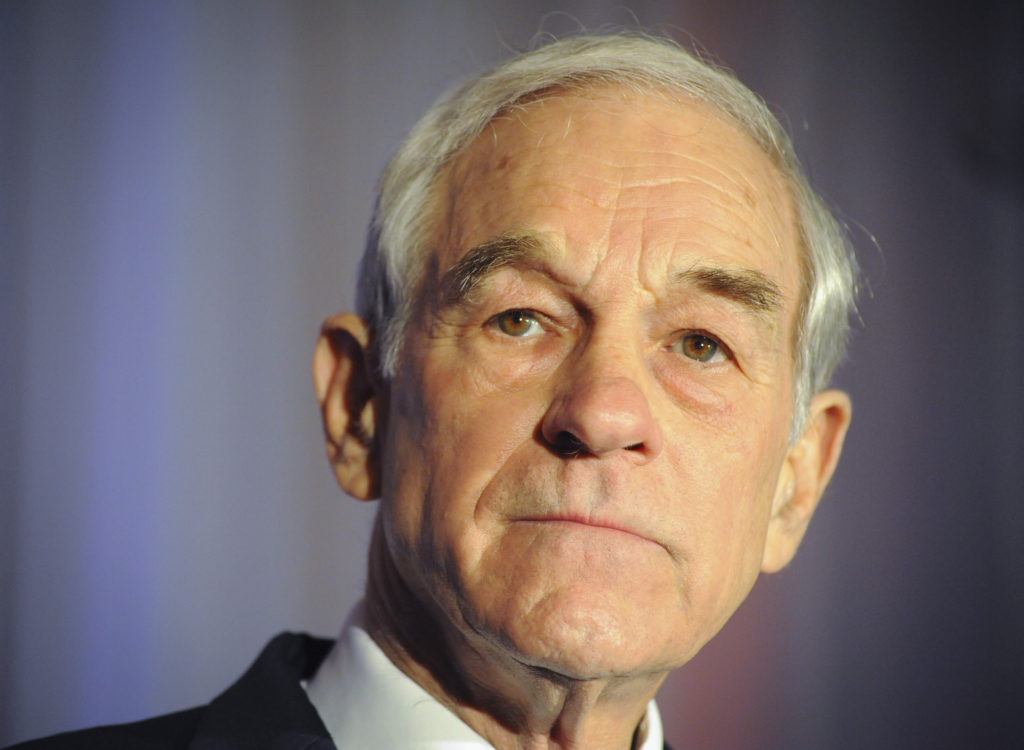

Ron Paul warns that the next financial meltdown will be far bigger than the one that preceded it. | Image: REUTERS/Dave Weaver

- Ron Paul believes the mother of all government debt bubbles will cause a meltdown bigger than the 2008 financial crisis.

- The New York Fed is pumping billions into the repo market, reflating its out-of-control balance sheet.

- Paul says returning to sound money is the only way to prevent authoritarian demagogues.

Retired politician and staunch crypto advocate Ron Paul believes the mother of all debt bubbles will inevitably burst. And when it does, the ensuing chaos will be orders of magnitude bigger than the 2008 financial crisis.

In this weeks feature column titled “Is The Mother of all Bubbles About to Pop?” Paul points out that the U.S. has backed itself into a financial corner. Quoting Blackstone strategist Joseph Zidle’s description of the “mother of all bubbles,” Paul explains:

When the sovereign debt bubble inevitably busts, it will cause a meltdown bigger than the 2008 crash.

NY Fed Resumes Ponzi Scheme Operations

Paul lays the blame squarely at the feet of the NY Federal Reserve, which began pumping billions into the repo market back in September.

That was supposed to last a few weeks yet two months later, the central bank hasn’t stepped off the gas. It added $62.54 billion to overnight bids only last Wednesday.

The repo market, which allows banks to make short-term loans to each other, is suffering a liquidity shortage. According to investment advisor Michael Pento, the only choice left is for the fed to resume its money printing “on steroids” operation.

Paul, who believes in the inevitable demise of the dollar, recently polled his Twitter followers. He asked them which asset they would prefer to own long term. Not surprisingly, bitcoin and gold came out on top while cash brought up the rear.

Ron Paul: Time to Dump the Fed and Embrace Sound Money

It’s no secret that Paul hates the Fed. The federal deficit has ballooned beyond $1 trillion this fiscal year and the president and congress have zero desire to cut back on spending.

To sum up the state of affairs he once again quotes Pento, who himself has authored how to survive the impending bond market collapse. Pento states:

It’s not just QE, it’s QE on steroids because everybody knows that this QE is permanent just like any banana republic would do, or has done in the past.

The likely result will be the eventual collapse of the dollar. That narrative should continue to support limited supply assets like cryptocurrency and gold. Paul, who now features regularly on the crypto-conference circuit, is a big believer in bitcoin.

In August when Fed Chair Jerome Powell announced a payment system that would rival bitcoin, Paul quickly came to its aid. According to Paul, however, that’s only one piece of the puzzle in preventing “authoritarian demagogues” from taking over:

The only way to avoid this is for those of us who know the truth to spread the message of, and grow the movement for, peace, free markets, limited government, and sound money.