Microsoft (MSFT) and Apple (AAPL) are Now Bigger than Germany’s Entire Stock Market

Germany's multi-trillion-dollar stock market has been overtaken by tech behemoths Apple and Microsoft. | Image: REUTERS/Ralph Orlowski. Edited by CCN.com.

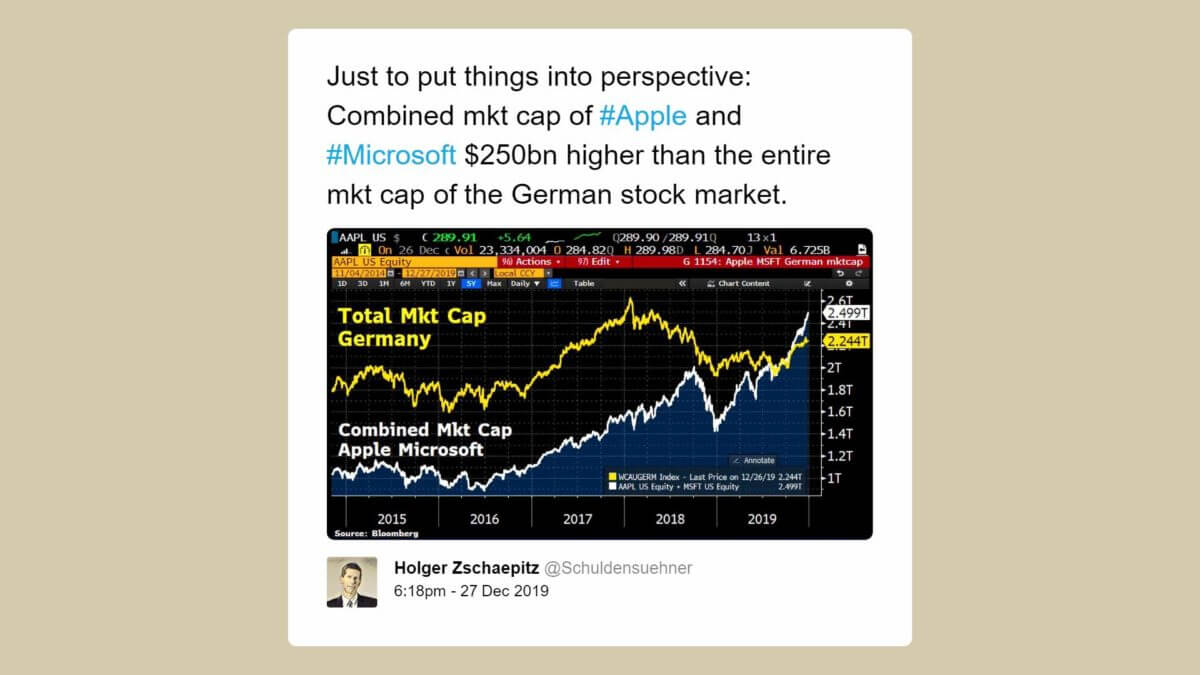

- With a combined valuation of $2.499 trillion, Apple and Microsoft have surpassed Germany’s stock market.

- Both conglomerates had an exceptionally strong 2019 with solid sales across many departments.

- These companies highlight the robustness of the U.S. economy.

Microsoft (NASDAQ: MSFT) and Apple (NASDAQ: AAPL) have surpassed Germany’s entire stock market in valuation amid the greatest bull run in U.S. history.

The combined valuation of Microsoft and Apple is $2.499 trillion. The total market cap of all companies listed on Germany’s stock market hovers at $2.244 trillion.

The statistic is all the more impressive considering that Germany is a part of the G7 and is the fourth largest economy in the world, according to Worldbank .

Part Apple and Microsoft, Part Trump

Apple and Microsoft have both surpassed the expectations of analysts in 2019.

With strong sales in the U.S. and China from the flagship iPhone 11 and Airpods, the Apple stock is en route to finishing the year with a staggering 83% gain.

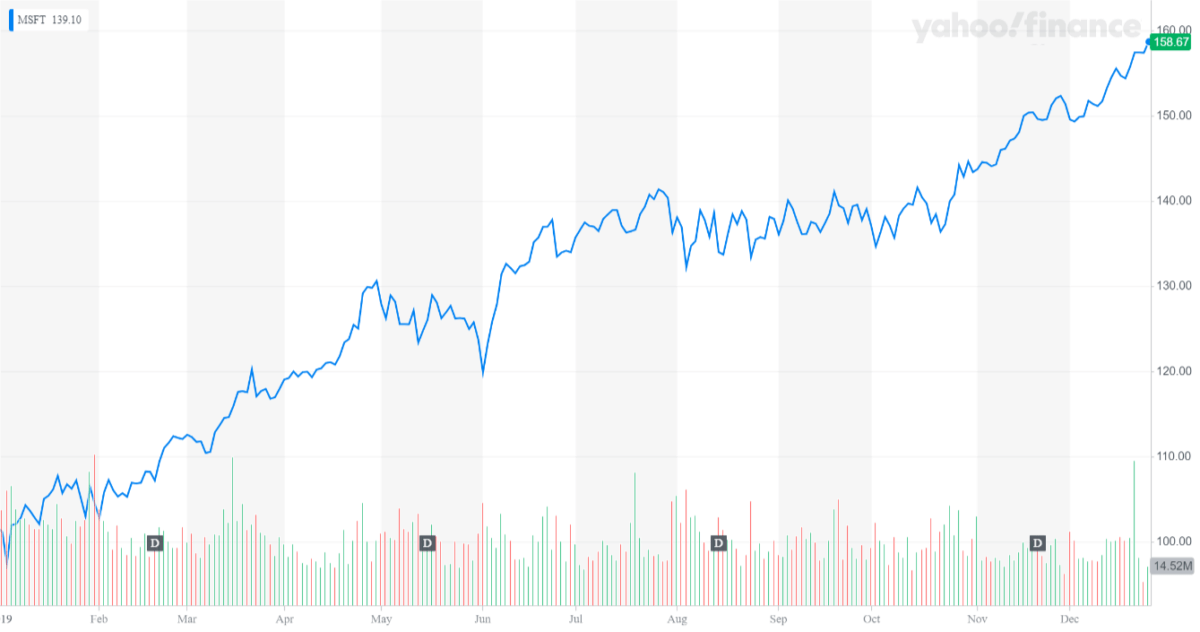

Microsoft, uplifted by its successful transition to cloud computing and rising demand for the Microsoft Surface product line, is on track to end the year with a 56% increase in its stock since January.

Both conglomerates have shown significant improvements in diversifying their operations to reduce the dependence on their respective core products, which eventually led the confidence of investors to surge.

But, the strength of the U.S. stock market, buoyed by loose financial conditions created by the Fed and trade deals secured by the U.S. government, played a paramount role in further raising the sentiment around American conglomerates.

Surpassing Germany’s stock market is not an easy feat

Germany is home to many high profile corporations that exceed $50 billion in market cap in the likes of Mercedes Benz parent company Daimler, Volkswagen, Allianz, BMW AG, Siemens AG, and Bosch Group.

Similar to the Dow Jones Industrial Average (DJIA) of the U.S., the DAX PERFORMANCE-INDEX had a strong rally in 2019 with a year-to-date gain of 26%. Both the Dow Jones and the DAX are coming off of an extensive rally.

Apple and Microsoft surpassing the valuation of all German stocks is not merely because of the slowing growth of Germany’s economy. Rather, it’s the performance of Apple and Microsoft that went far beyond what analysts had anticipated at the start of the year put together with the expanding economy of the U.S.

Heading into 2020, both companies are set to have another solid year.

Apple has already increased the production of the iPhone 11 by 10% and Airpods by 200%. It also crucially avoided the imposition of tariffs by China that was scheduled for Dec. 15, leaving the iPhone 11 in an affordable price range for Chinese customers.

Microsoft is on track for 10% growth in 2020 supplemented with growing demand for Azure and LinkedIn. Microsoft’s Intelligent Cloud department, which houses Azure, has seen a substantial increase in revenues to $10.5 billion thanks to big long-term contracts .