Lyft Stock Plunges as Insiders Race to Dump Shares on Clueless Investors

Source: Shutterstock

Lyft is getting crushed on the first trading day following its much-hyped IPO, and unsophisticated investors are learning the hard way that it’s not a good idea to plow into companies as soon as they go public.

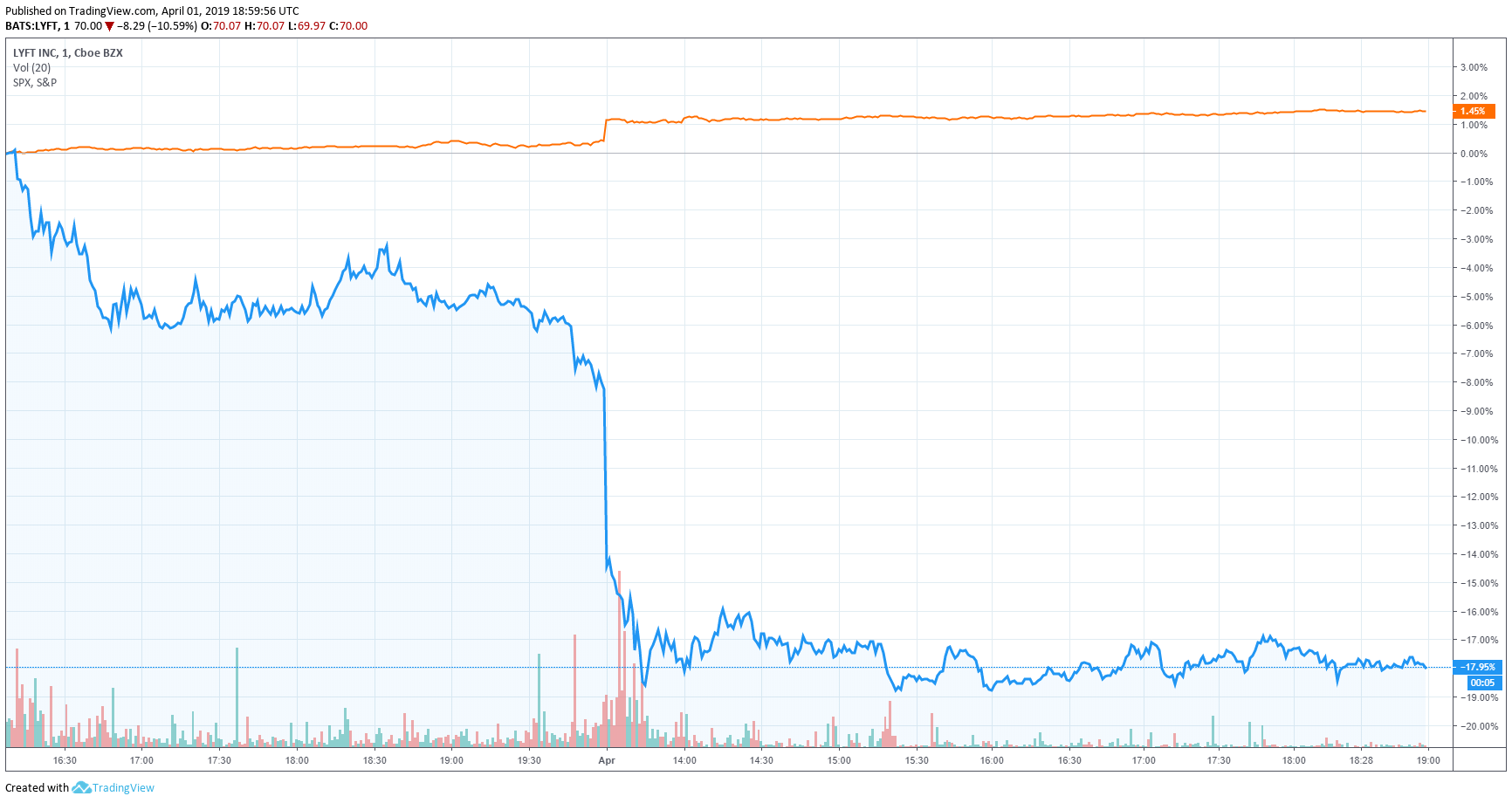

Lyft Stock Dives Below IPO Price While Dow, S&P 500 Surge

Lyft went public Friday at $72 a share. Almost immediately, the price rose 20% as retail buyers raced to gobble up shares, only to close well off its session high as insiders dumped their stakes.

When it opened for trading Monday, the price sank even further to $69.12 a share, which was more than 20% below its Friday intraday high of $88.60.

Even as the Dow climbed back above 26,000 Monday, Lyft was literally, not lifted higher. As of 3:11 pm ET, shares stood at $70.11 for a single-day plunge of 10.42%.

What’s Going on With the Industry Darling?

Although Lyft started trading near $90 on Friday, those gains were wiped out over the course of the day as savvy investors took profits. Most believed that the ride-hailing company’s shares would retreat, but now many are saying good grief!

The downward spiral of Lyft is partly the result of buyers’ remorse. The regrets are leading to selling. Not knowing what you’re getting into is leading to the demise of many unsuspecting investors.

For one, Lyft has a $25 billion valuation, which is questionable given its cost structure and losses. There’s also the fact that its current U.S. ride-hailing market share is still less than half that of its rival Uber.

Insiders Race to Dump Shares on Clueless Investors

Retail investors are constantly warned to steer clear of IPOs, especially tech IPOs. Eager beavers ignored logic and jumped in head first in the company that hasn’t turned a profit.

That worked out to be just fine for insiders. This is especially true for Lyft’s investment bankers who are rewarded for riling up the unsophisticated investor. For Lyft, the bankers went all out pumping the IPO. Remember, they get paid tons of money for hyping IPOs. They must attract buyers.

Ken Fisher, the founder and executive chairman of Fisher Investments, told USA Today:

“So [investment bankers] whip up a mindless frenzy. The excitement and lure of magic returns suck in otherwise rational folks.”

When the strong swoop in on the vulnerable, stocks often get clobbered. That’s what we’re seeing with Lyft.

Next Best Since Facebook? Yeah, Right!

Several red flags had been raised as warnings that this IPO wouldn’t be all that it was being cracked up to be.

First, Lyft was the first ride-hailing company to go public, beating rival Uber to the punch. No one really knew how it would be received. Knowing this, sophisticated investors waited on the sidelines, while their clueless counterparts saw this as a buying opportunity.

Not-so-savvy investors also shrugged off the IPO price being boosted two days before the offering. Shares were initially set to price between $62 and $68. They were pumped to $70 to $72 Wednesday evening.

As pointed out by The Motley Fool:

“[That boost] gave way to higher pricing once it became clear that the institutional participants saw high demand for Lyft shares and were willing to pay up to get them.”

CCN.com reported on how trading bots know there will be an offering of fragile retail positions buying, while some early investors cash out. Crowded longs leave a potentially explosive bearish situation if things start sliding.

Mom & Pop Investors Have to Learn the Hard Way

The novelty of a company going public often means they are difficult to analyze. They’ve amassed little, to no, historical information. Newbies and uniformed shrugged this off, too.

Lesson learned, and hopefully many won’t repeat it.