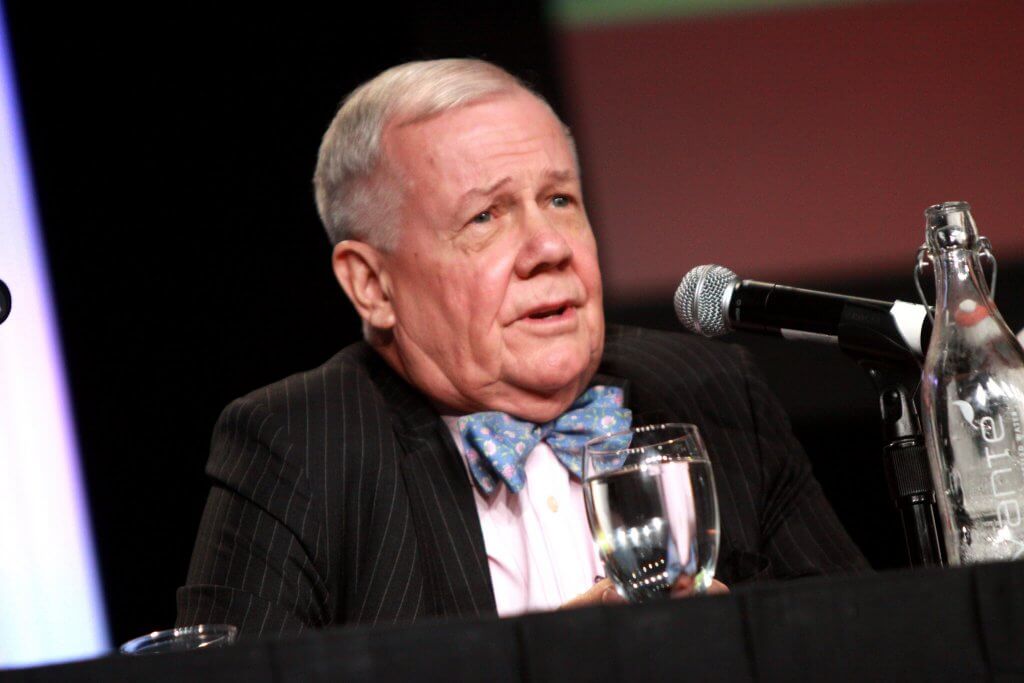

Legendary Investor Jim Rogers Believes FinTech Will Replace Banks and Cash

Veteran investor Jim Rogers believes that banks must invest in the financial technology (fintech) space or they face being replaced.

Chairman of Rogers Holdings and Beeland Interests, Inc. and co-founder of the Quantum Fund, the American businessman said that traditional banks need to improve their situation in the face of the growing fintech space.

Speaking to China Daily , he said:

My children will never walk into a bank when they become adults as by then all the banks along the streets will be replaced by computers and certainly mobile phones.

Rogers appears to be a supporter of the fintech sector. According to the report, he has invested in Hong Kong-based ITF Corporation, the world’s first financial technology bank founded by Hui Jie Lim. It’s hoped that operations will start next year. Rogers has also invested in Tiger Broker, a Chinese online brokerage.

Even though his investments in these projects have yet to present any profits, he is confident of where the industry is heading.

He also believes that digital currencies could change how we see money in the next 10 to 20 years. Even though he hasn’t invested in the crypto market Rogers is of the opinion that governments could issue their own cryptocurrencies in the future.

His comments come at a time after predicting that a market crash will occur in the next few years.

Speaking with the Business Insider in June, Rogers said that ‘some stocks in America are turning into a bubble’ and that with the bubble will come a collapse. When questioned what will trigger it Rogers said that it could be an American pension that goes broke or a country that’s not being looked at. He cites Iceland and Ireland’s financial crisis as examples. When asked how big the crash would he, he said:

It’s going to be the worst in your lifetime.

Featured image from Flickr/Gage Skidmore .