It’s Rough Times for Miners amid Bitcoin Price Crash

The relentless tornado that’s ravaging the crypto world is leaving no prisoners in its wake. The plummeting price of all major coins means that mining cryptocurrencies is currently no longer profitable for many miners–both individuals and companies.

Everyone’s been following the horror show of the past week or so as the bitcoin cash drama unfolded and the selloffs began, as OKEx forced early settlement of BCH futures contracts and cryptoville plunged into a tailspin.

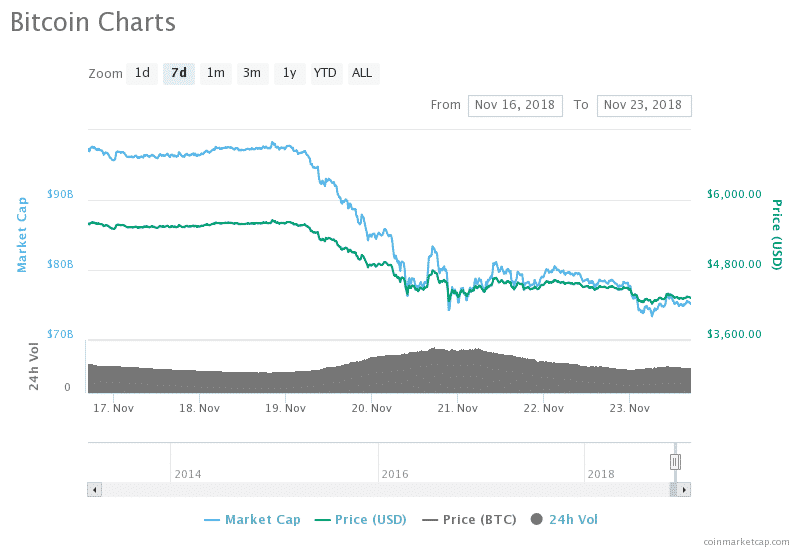

We’ve woken up day after day to bleeding markets and seen bitcoin hit its lowest point in 13 months at $4,134, with many analysts predicting the bottom is yet to come.

At the time of writing, the total crypto market cap hovers around $140 billion (one-fifth of its worth in January of this year) with bitcoin dropping some 30% in price in the last week alone.

This affects many stakeholders–investors, traders, blockchain companies, and employment in crypto-related services–not least of all mining.

According to the South China Morning Post , cryptocurrency miners are starting to make losses and beginning to dump their mining rigs, as the drop in price is leaving them vulnerable–and out of pocket.

Mining Cryptocurrencies at a Loss

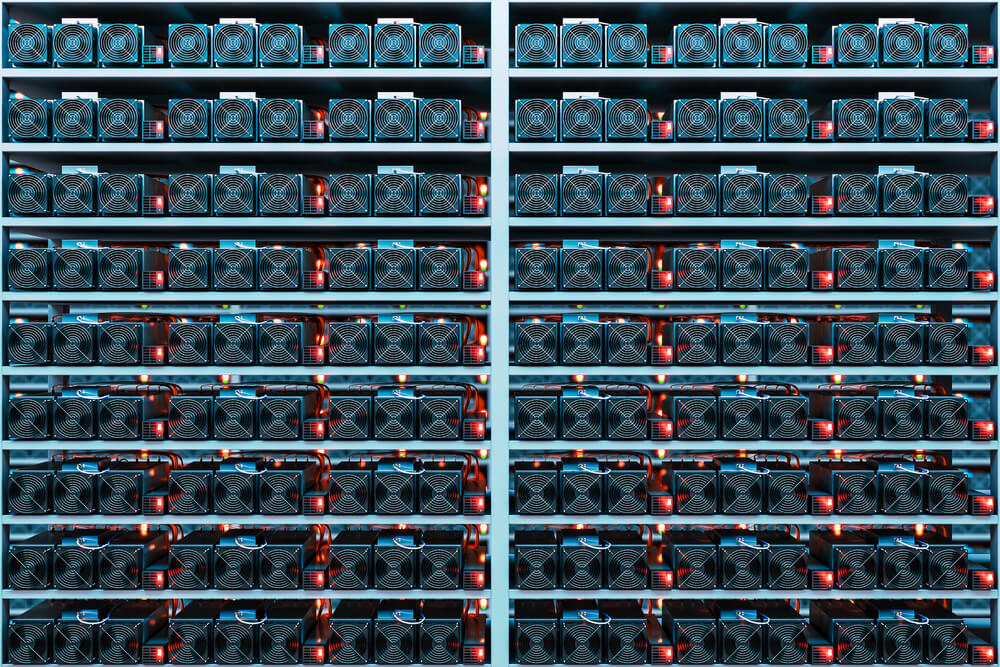

Cryptocurrency mining has long evolved from the individual computer nerd, mining bitcoin from his parent’s house by solving a complex mathematical equation. It’s now a mass-scale activity taking place in behemoth mining farms.

If you’ve ever seen what a mining farm looks like, you’ll have some notion of the costs that go into production. Companies like Bitmain and Canaan (with the largest cryptocurrency mining operations in the world) require so much power for mining cryptocurrencies that special rigs have to be set up.

With over 80% of the cryptocurrency mining centered in China, mining bitcoin according to many popular current practices is now no longer worthwhile there. Some mining farms are actually running at a loss when they take into account the high costs of power and machine management associated with mining.

At least four models of bitcoin mining machines consume too much power to make mining profitable at the moment. These include Bitmain’s Antminer S7 and Antminer S9, and Canaan’s AvalonMiner 741–and many are being removed from production.

Mining cryptocurrency, just like mining precious resources, is subject to supply and demand. If there ain’t no one buying gold, goldmines are shut down. The same is true with digital gold.

Bitmain and Canaan’s IPOs Hanging in the Balance

Bitmain and Canaan, along with Ebang (a smaller rival), have all announced plans to go public in Hong Kong this year. However, thanks to the latest drop, this is starting to look increasingly unlikely.

According to the Nikkei Asian Review , “controversial” companies like cryptocurrency mining were always going to have a hard time trying to convince regulators that their assets are no risk to investors. And with the market bleeding as it is, their valuations will almost certainly need to be recalculated.

Canaan just let its six-month application lapse and Bitmain and Ebang, well, they desperately need a market rebound.

Hong Kong-based mining platform Suanlitou has already suspended its contracts with Bitmain’s Antminer T9, which was, at its highest point, the most in-demand rig in the market.

The company explained that it couldn’t cover the costs of management and electricity of the rig for all mining carried out in a 10-day period from November 7.

China is responsible for the majority of all cryptocurrency mining thanks to its cheap energy and coal-fired power in the Inner Mongolia and Xinjiang Uygur regions. There are also plenty of hydropower stations that were intended to power smart cities that never came to fruition.

This surplus power has turned China into a paradise for miners–but market conditions are changing.

As no respite is in sight from the nuclear winter right now, Jack Liao from the Shenzhen Lightning Asic bitcoin mining firm cited in the South China Morning Post said, “many people won’t survive.”

Images from Shutterstock