Indian Bitcoin Buying Reaches $985 as Exchanges Push for Adoption During Demonetization

As demand for bitcoin increases in India, Unocoin, a prominent Indian bitcoin exchange has developed and launched its mobile application wherein users will be able to buy, sell, send or receive and store bitcoin, via their smartphones.

Available on both iOS and Android, the launch of the mobile applications comes during a time when India is still crippled by the ongoing demonetization drive enforced by the government, a move which rendered nearly 90% of the country’s cash in circulation useless, overnight.

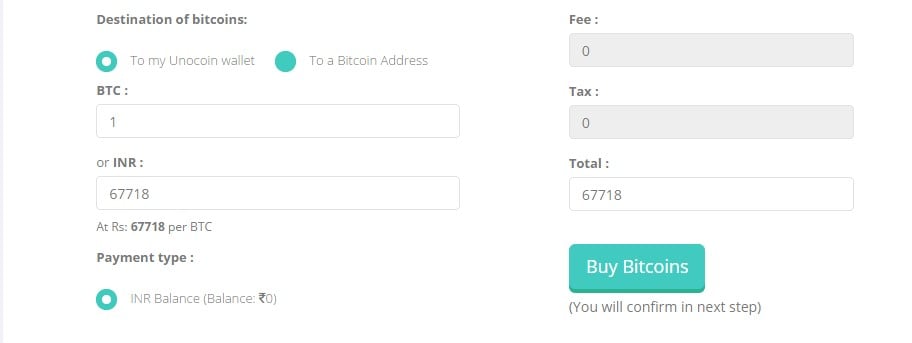

Interest in bitcoin as a store of value, away from the influence of an authority, has never been higher in India. Demand for bitcoin is driving buyers to obtain the cryptocurrency at soaring premiums. The cost of buying a bitcoin through Unocoin, at the time of publishing, is ₹67,718 INR (approx. $985.27 USD).

Pushing for adoption in a country that is home to a largely young population and soaring smartphone adoption is a no-brainer, according to Unocoin co-founder and CMO Abhinand Kaseti.

He stated:

As of now, there are more than 1 billion Indians who use mobile phones. More than 300 million use their phones regularly for accessing the internet. This trend is expected to go up by 56% per year.

The company runs with the motto “Bring Bitcoin to Billions”, as it claims, and has already developed a POS (Point of Sale) application enabling physical stores to accept bitcoin as a mode of payment earlier this year.

The new application’s dashboard also includes a 24-hour price graph, messaging capabilities, transaction progress and confirmation notifications, among other features, to sell itself as a fully-featured bitcoin application for the masses.

The bitcoin exchange launched its API earlier this month, soon after raising $1.5 million in funding from both domestic and foreign investors – a record round of investment for a bitcoin startup in the country. Zebpay, a competing bitcoin exchange in the country is reportedly in talks to raise $4 million in its own round of funding.

Image from Shutterstock.