How To Buy Cardano in 2024

Cardano is one of the most popular cryptocurrencies and has been rising in popularity for quite some time. You might want to buy these tokens and keep them in your eWallet, trade them, or use them for gambling. Regardless of why you need these, the first step is to buy Cardano coins.

This is a simple process, and most of the time can be completed within 30 minutes. But it can be challenging if you are a newbie. That’s why this guide can help you learn all the needed steps and buy Cardano today. All you have to do is follow the steps below.

Best Cardano Exchanges in 2024

Our team has reviewed several Cardano exchanges and compiled for you a list of the 5 best Cardano exchanges.

- Kraken – best for beginner and advanced traders, with a wide range of available crypto and good security processes

- Coinbase – best for beginners, with an intuitive, user-friendly interface and easy purchase process

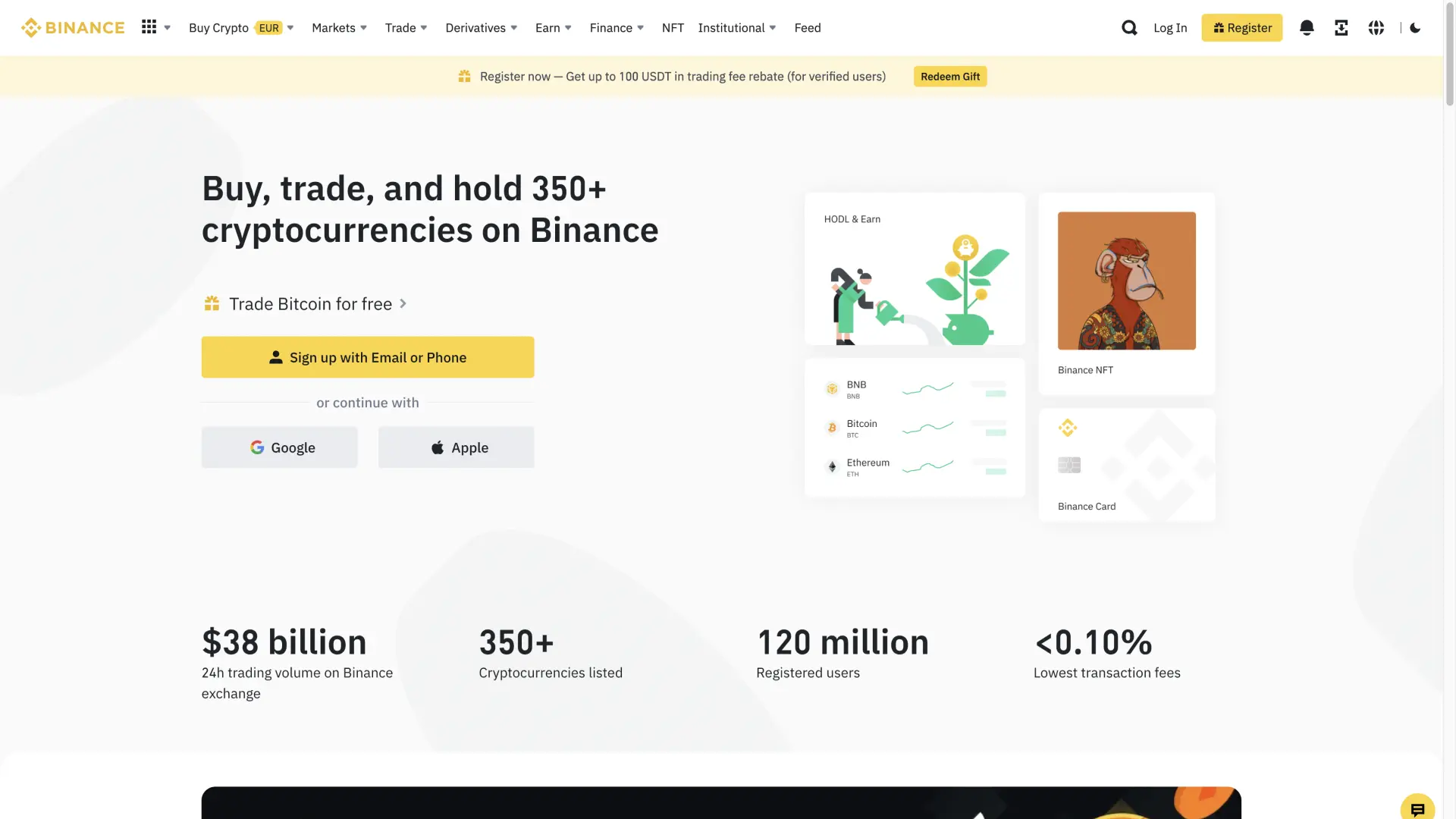

- Binance – one of the most popular exchanges, with a large selection of cryptocurrencies and low fees

- eToro – best for social trading, with a user-friendly platform that allows users to copy the trades of successful traders

- Bitstamp – best for low fees, with a simple fee structure and competitive rates

Reviews of the Top Cardano Exchange Sites

You can have a look at some of the reviews of our 5 best Cardano exchanges.

1. Kraken Exchange Review

Overview: Kraken is a well-established cryptocurrency exchange that has been operating since 2011. It is headquartered in San Francisco, California, and offers a wide range of trading options for both beginner and advanced traders.

Tradable coins: Kraken supports more than 200 cryptocurrencies, including Cardano (ADA).

Fees: Kraken’s fee structure is competitive, with fees ranging from 0% to 0.26% depending on the trading volume. The fees are lower than many other exchanges, making it a good choice for traders who want to keep costs low.

Pros:

- Low fees

- Good security processes

- Wide range of available cryptocurrencies

Cons:

- Can be overwhelming for beginners

- Customer support can be slow at times

2. Coinbase Exchange Review

Overview: Coinbase is a user-friendly cryptocurrency exchange that was founded in 2012. It is headquartered in San Francisco, California, and is a good choice for beginners who want to start trading cryptocurrencies.

Tradable coins: Coinbase supports a limited number of cryptocurrencies, including Cardano (ADA).

Fees: Coinbase’s fee structure is relatively high, with fees ranging from 1.49% to 3.99% depending on the payment method. However, the user-friendly interface and easy purchase process make it a popular choice for beginners.

Pros:

- User-friendly interface

- Easy purchase process

- Good security processes

Cons:

- Relatively high fees

- Limited selection of cryptocurrencies

3. Binance Exchange Review

Overview: Binance is one of the most popular cryptocurrency exchanges in the world, founded in 2017. It is headquartered in Malta and offers a wide range of trading options for both beginner and advanced traders.

Tradable coins: Binance supports a large number of cryptocurrencies, including Cardano (ADA).

Fees: Binance’s fee structure is relatively low, with fees ranging from 0.1% to 0.02% depending on the trading volume. The fees are lower than many other exchanges, making it a good choice for traders who want to keep costs low.

Pros:

- Large selection of cryptocurrencies

- Low fees

- Good security processes

Cons:

- Can be overwhelming for beginners

- Customer support can be slow at times

4. eToro Exchange Review

Overview: eToro is a social trading platform that was founded in 2007. It is headquartered in Israel and offers a user-friendly platform that allows users to copy the trades of successful traders.

Tradable coins: eToro supports a limited number of cryptocurrencies, including Cardano (ADA).

Fees: eToro’s fee structure is relatively high, with fees ranging from 0.75% to 5% depending on the payment method. However, the social trading feature and user-friendly platform make it a popular choice for beginners.

Pros:

- User-friendly platform

- Social trading feature

- Good security processes

Cons:

- Relatively high fees

- Limited selection of cryptocurrencies

5. Bitstamp Exchange Review

Overview: Bitstamp is a well-established cryptocurrency exchange that was founded in 2011. It is headquartered in Luxembourg and offers a simple fee structure and competitive rates.

Tradable coins: Bitstamp supports a limited number of cryptocurrencies, including Cardano (ADA).

Fees: Bitstamp’s fee structure is relatively low, with fees ranging from 0.05% to 0.5% depending on the trading volume. The fees are lower than many other exchanges, making it a good choice for traders who want to keep costs low.

Pros:

- Low fees

- Simple fee structure

- Good security processes

Cons:

- Limited selection of cryptocurrencies

- Can be overwhelming for beginners

Disclaimer: Investing in cryptocurrencies carries significant risk. Values are highly volatile. Never invest more than you can afford to lose. This site does not provide financial advice. Act based on your own research and consult with a financial professional before making decisions. Don’t invest unless you’re prepared to lose all the money you invest.

Choose The Exchange Platform

The first step you need to take is to choose a crypto exchange where you can buy Cardano. There are countless options. For instance, you can use Binance, Kraken, Coinbase, and many more.

All of these are just a few examples. Crypto exchanges are basically platforms or websites where you can buy, sell, or trade cryptocurrencies. All of them support multiple cryptocurrencies. Some support over 350 coins. Others support a much smaller number.

A good thing about Cardano is that almost all crypto exchanges support this coin. For the purpose of this guide, I chose Binance. This exchange has the lowest fees, and offers fast transactions.

However, you can use the same steps to buy Cardano or other cryptocurrencies at other cryptocurrency exchanges. The phases are almost identical.

Register An Account

Once you have chosen Binance you need to register. Simply provide basic information, such as an email address, create a username and password, and confirm all of them. Now you are one step closer to buying or investing in Cardano.

You can also verify the email and use 2 Factor Authentication to secure the account. The latter makes this particular cryptocurrency exchange special and more appealing than you may think.

Keep in mind that you can also download an app for Android or iOS devices and use it to buy Cardano. The steps are the same, but you can complete all of them on your phone.

Set Up a Payment Method

Now that you have an account, simply click on ‘’buy crypto.’’ The button is located on the left side. There, you can choose the cryptocurrency you like. Among others, you can find Ethereum, Bitcoin, Litecoin, Dogecoin, and obviously Cardano.

Choose Cardano , and you can enter how much you want to buy. You can see the latest prices, and you can also see any fees applicable.

Keep in mind that all the available options at the time are linked to the country where you live. As such, some users have more options, while others are more limited. Once you have completed this step, move on to the next one.

Deposit Funds

You have to deposit funds in order to buy Cardano. In a few words, you are exchanging fiat currency for cryptocurrency. Here you can use credit cards, debit cards, PayPal, and bank transfers to deposit funds. Only the options that are available in your country are presented to you here.

Choose the method you want to use and enter the amount you wish to deposit. It could be as low as a couple of USD or very high. Just keep in mind that different payment methods have different limitations and fees.

Each crypto exchange charges fees when you buy coins or trade them. In addition, there are withdrawal fees as well. However, all of these are very low for all payment methods.

Beginners typically opt for a Visa or Mastercard. These are the most popular payment methods in the world. One advantage of using these is that you already have them in your wallets and know how to use them.

Most investors opt for bank account transfers when they buy massive amounts of Cardano. You may want to do the same. This is done because the security is at the highest level possible when you use your bank account, and there is no middleman.

Buy Cardano

Immediately after you confirm the amount, it is converted into an ADA coin. This means that now you have Cardano at the exchange.

It will be in your wallet, and you can see the price changing accordingly. Cardano is a volatile cryptocurrency, meaning the price of the tokens changes multiple times per hour. If the price goes up, your balance has a higher value.

There are multiple options for how you can buy Cardano. The one you saw earlier is through the exchange, and it is the most common. But you can also use peer-to-peer transactions.

The latter means that you can buy Cardano directly from other users. They can post ads on the exchange, and you can choose the one you like and purchase it. However, here you don’t get the freedom you get when using the exchange method.

The last method you can use is via gift cards. For lack of a better word, people can buy or receive gift cards that contain a specific value of Cardano. All you have to do is exchange the gift card for the coins and keep them in your crypto wallets.

Move Coins To Your eWallet

Now that you have Cardano coins on your account at the exchange, you can leave them there or withdraw them to your eWallet. I recommend this option, and most users should do it. In fact, this is one of the best tips you can use.

For instance, when your coins are secure on your personal non-custodial wallet, they are safer and excluded from any risks related to the company. This is how you can keep your money secure.

To withdraw Caradno, open the account at one of the eWallets and go to the exchange account you have. Click on “withdraw” and enter the needed details. Confirm and the coins will be in your account within seconds.

Over To You

Purchasing Cardano (ADA) involves a step-by-step process that includes choosing a reliable exchange platform, registering an account, selecting suitable payment methods, depositing funds, buying ADA, and considering the option to move the coins to a personal wallet for better security.

While this guide primarily references Binance, numerous platforms offer similar procedures. Users are encouraged to explore different exchange platforms and safeguard their crypto assets in personal wallets for long-term security and control.

Frequently Asked Questions

How can I ensure the security of my Cardano purchase in 2024?

It starts with using a reputable cryptocurrency exchange. Be sure to use a unique, complex password. Enable two-factor authentication as well.

Are there any restrictions or regulations for buying Cardano in 2024?

It depends on what country you reside in. At this time, the USA does not have any formal restrictions on Cardano trading. However, the Securities and Exchange Commission (SEC) has declared that Cardano (ADA) is an unregistered security.

What are the fees associated with buying Cardano in 2024?

Fees vary depending on the exchange used to buy Cardano, but they tend to be low. Binance’s fees range from 0.1% to 0.02%. See other examples above.

Is it better to use a centralized or decentralized exchange to buy Cardano in 2024?

For less technical users, a centralized exchange will be easier. More advanced users may prefer decentralized exchanges (DEXs). Users can be more anonymous on DEXs and may be able to access markets without geographical restrictions.

Can I buy fractional amounts of Cardano in 2024?

You can usually purchase a fractional amount of most crypto, including Cardano. However, Cardano’s price is often not that high, so you will likely purchase a whole coin.