Hong Kong Activates ‘Faster Payment System’ with 450,000 Public Registrations

Hong Kong has become the latest nation to introduce a 24×7, instant payments system as a fintech upgrade for retail payments in the country.

Aptly dubbed the Faster Payment System (FPS), the initiative was first announced by the Hong Kong Monetary Authority (HKMA) – the country’s defacto central bank – two weeks ago.

The new platform operates in real-time, all-the-time, to connect banks and stored-valued facility (SVF) operators, the HKMA said at the time. At launch, 21 banks including the majority of retail banks and 10 SVFs were participating in the system to provide the service to customers immediately.

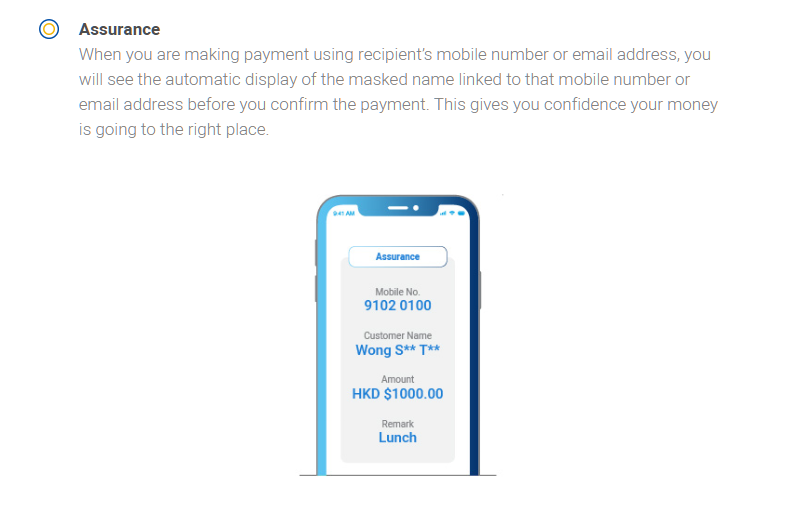

Quite simply, the platform enables Hong Kong residents to transfer funds in real-time across banks and SFVs participating in the system by using the mobile number or email address of the recipient, rather than a bank account number, with added support for QR codes.

The FPS notably supports both the Hong Kong Dollar (HKD) and China’s fiat currency Renminbi (RMB) for settlements in the mainland. The HKMA will operate the book of settlement for HKD payments while the Bank of China (Hong Kong) limited performs the same role for RMB payments. The Hong Kong Interbank Clearing Limited will take up the mantle as the entire system’s operator.

To propel adoption, the HKMA also announced the Common QR Code Standard for retail payments with a free mobile app named Hong Kong Common QR Code (HKQR). The app converts multiple QR codes from various payment providers to a single, combined QR code to better facilitate payments among merchants, small and medium enterprises (SMEs) and the public to accept payments in a single code.

Since its announcement, the FPS has seen over 450,000 registrations from the public as payees, the central bank revealed on Sunday while announcing the full launch of the service.

“After the full launch of the FPS on 30 September, Hong Kong will enter a new era of electronic payment as the FPS is a unique retail payment system in the world,” HKMA chief executive Norman Chan said during the ‘Activation Ceremony ’ of the service.

The central bank executive also revealed the service would be free for small-value transfers, adding:

“We can enjoy an instant payment service which is round-the-clock, simple and convenient to use, robust and secure, with full connectivity while supporting both the Hong Kong dollar and the renminbi. It is also free of charge for small-value fund transfer.”

A complete list of participants including settlement entities (licensed banks) and clearing entities (SVFs), as of September 28, can be found here .

The launch of the FinTech service comes at a time when the Hong Kong government is actively attracting blockchain professionals with friendlier immigration policies to boost the country’s economic development by investing in crucial jobs.

Hong Kong dollar image from Shutterstock.