Goldman Sachs’ Boeing Recommendation Is a Portfolio Disaster

In this photo people hold up pictures of the victims of Boeing 737 MAX disasters. Congressional investigators blamed two deadly Boeing 737 MAX crashes on "repeated and serious failures" by Boeing and air safety regulators, according to a report released on September 16, 2020. Despite what Goldman Sachs says, intelligent investors know to steer clear of Boeing right now. | Image: JIM WATSON / AFP

- Goldman Sachs added Boeing to its conviction buy list.

- The airline manufacturer was already in trouble before the pandemic.

- Order cancellations and changing travel patterns suggest it’s way too early to buy.

Goldman Sachs just added Raytheon and Boeing to its conviction buy list because they have a large number of defense contracts— typically a steady business. While that’s true for Raytheon, Boeing still looks like a disaster for investors who follow Goldman’s advice and buy now.

Goldman’s Case for Boeing

Goldman’s analysis for Boeing comes down to one thing and one thing only: An optimistic view that the pandemic will end and things will return to normal (instead of the “new normal”).

As Goldman analyst Noah Poponak wrote:

[Boeing] would likely benefit from an acceleration in the alleviation of impact and concerns from the coronavirus… There is still broad skepticism in the market around the timing of return, and this risk keeps many from owning the stock.

There’s one major problem with this analysis. It’s shallow. It’s based on the view that air travel will quickly return to prior levels, airlines will need to replace planes in their fleet, and they’ll go to Boeing.

It overlooks the fact that Boeing was in serious trouble before the pandemic hit. The company had zero sales in January 2020 , two months before the United States started its “15 days to flatten the curve ” and air travel ground to a halt, reducing the need to replace or upgrade commercial airlines.

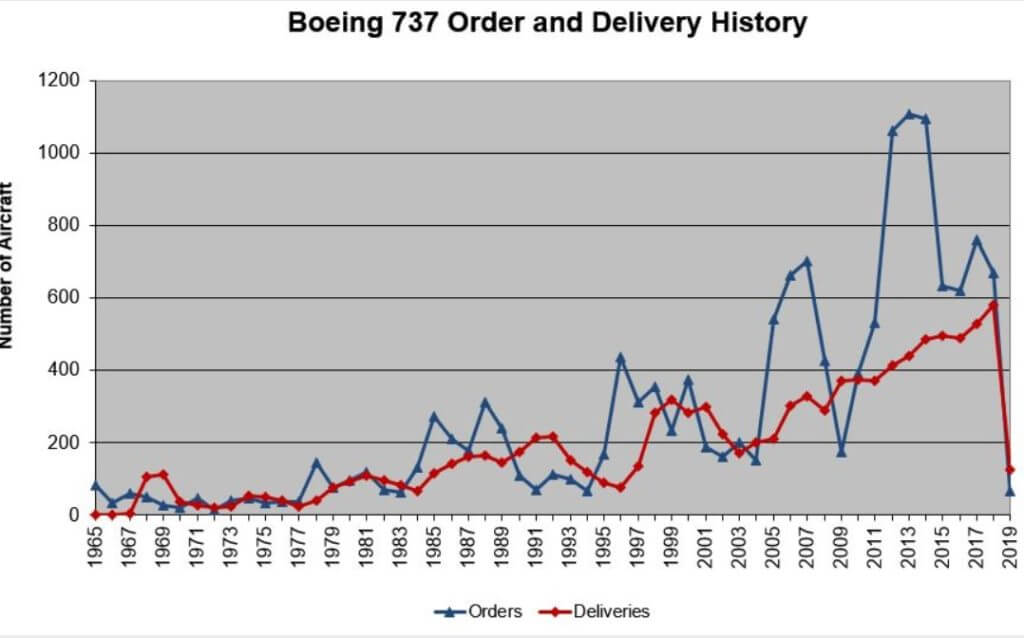

The company’s 737 Max models, which suffered multiple high-profile crashes last year, still don’t appear ready to fly . The company’s best-selling model 737 saw a total collapse in sales and deliveries in 2019 alone.

Most of 2020 has seen the company’s core business run backward, as order cancellations have exceeded new sales . If anything, the Goldman analysis should have taken a closer look at the company’s government contracts, one of the few bright spots for the firm.

The Case for Patience

Can Boeing recover from the fiasco of its self-inflicted 737 Max disaster and an unexpected pandemic? Yes, in time. And while that’s a dire picture, the company’s defense contracts for aerospace products have helped a bit, leading to a modest 25% drop in revenue compared to 2019 (admittedly a bad year for the company as well).

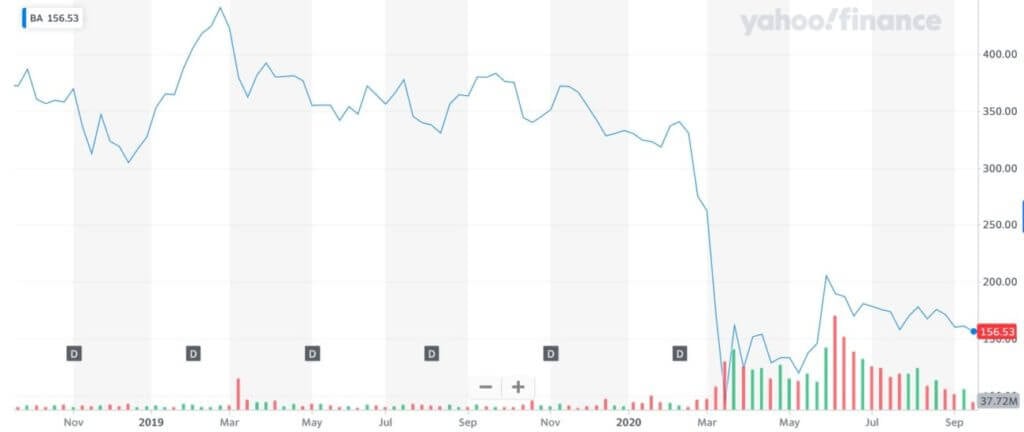

It’s still way too early for investors to buy into shares. Yes, they’re up nearly 50% from the March panic low but are still down almost 60 % over the past year. As long as air travel demand remains low, a trend that could last for years, shares will likely limp along.

Worst case, the company will need a government bailout mainly to protect its defense contracts. That may keep the doors open at the company, but it won’t do much for investors today.

The real conviction buy won’t come when Goldman Sachs tells people to buy after a 50% rally from the bottom. The real buy will come when shares have just tanked, and Goldman is screaming to sell.

Disclaimer: The opinions expressed in this article do not necessarily reflect the views of CCN.com and should not be considered investment or trading advice from CCN.com. The author holds no investment position in any of the above-mentioned securities.