Best Ethereum Exchanges in 2024

Best Ethereum Exchanges in 2024

Here are the best Ethereum exchanges, according to our review team.

promotions

Get up to 100 USDT in trading fee rebate after full verification, first deposit, and first trade.Coins

promotions

Enjoy a 10% discount on BitMEX fees for six months when you register through a referral link.Coins

promotions

Receive $10 in Bitcoin when you register with a referral link and buy $100 worth of crypto on Okcoin.Coins

promotions

Get mystery boxes worth up to $10,000 when you register through a referral from a friend.Coins

Review of Our Top 10 Ethereum Exchanges

Before proceeding, I invite you to analyze the following quick reviews of the best Ethereum exchanges.

1. Binance

- 0.0000039 - 0.0005

- spot trading

- derivatives trading

-

futures trading

12

No result

- Bitcoin

- Ethereum

-

Binance Coin

291

No result

- Sepa

- GiroPay

-

Visa

305

No result

- English

- Indonesian

-

Spanish

22

No result

- France

- Italy

-

Lithuania

13

No result

- 2FA Google Authenticator

- 2FA SMS

- German

- Russian

-

Korean

15

No result

- Blog

- News

-

Announcements

1

No result

2. Blockchain.com

- spot trading

- margin trading

-

staking

3

No result

- Bitcoin

- Ethereum

-

Bitcoin Cash

28

No result

- Bank transfer

- Sepa

-

Faster Payments

49

No result

- English

- Spanish

-

Portuguese

2

No result

- Singapore

- Puerto Rico

- English

- Learn and Earn

- Podcasts

- Research and Analysis

3. LBank

- spot trading

- derivatives trading

-

futures trading

5

No result

- Ethereum

- Terra

-

Polygon

241

No result

- Visa

- MasterCard

-

Bank transfer

255

No result

- English

- Russian

-

Spanish

27

No result

- 2FA SMS

- 2FA Google Authenticator

- English

- Turkish

-

Polish

24

No result

- Academy

- Guides

- Videos

4. Binance TR

- spot trading

- wallet

- Holo

- Internet Computer

-

The Graph

80

No result

- Bank transfer

- Ziraat Bankasi

-

VakifBank

84

No result

- English

- Turkish

- 2FA Mobile App

- 2FA SMS

- 2FA Google Authenticator

- Turkish

- English

- Blog

- Announcements

5. BitMEX

- Maker/Taker: 0.0200% - 0.0750%

- spot trading

- derivatives trading

-

futures trading

3

No result

- BitMEX Token

- Bitcoin

-

TRON

8

No result

- Visa

- MasterCard

-

ApplePay

12

No result

- English

- Russian

-

Turkish

1

No result

- 2FA Google Authenticator

- 2FA Authy

- Chinese (Mandarin)

- Korean

- Russian

- Knowledge Base

- Videos

- Guides

6. MEXC

- Free

- spot trading

- derivatives trading

-

futures trading

9

No result

- SHIBA INU

- Wrapped Dogecoin

-

ADAX

191

No result

- Visa

- MasterCard

-

Bank transfer

110

No result

- English

- Russian

-

Turkish

14

No result

- Seychelles

- Estonia

-

Switzerland

2

No result

- 2FA Google Authenticator

- 2FA SMS

- English

- Turkish

-

Vietnamese

5

No result

- Videos

- Learn and Earn

-

Blog

2

No result

7. Okcoin

- 3.99%

- spot trading

- OTC trading

-

staking

1

No result

- Bitcoin

- Ethereum

-

Tether

101

No result

- Visa

- MasterCard

-

ApplePay

107

No result

- English

- United States

- Canada

-

United Kingdom

26

No result

- 2FA SMS

- 2FA Google Authenticator

- English

- Blog

- Developer Grant

-

Videos

1

No result

8. OKX

- Free

- spot trading

- derivatives trading

-

perpetual swaps trading

9

No result

- Tether

- Bitcoin

-

Litecoin

92

No result

- Bank transfer

- Visa

-

MasterCard

344

No result

- English

- Chinese (Mandarin)

-

Simplified Chinese

14

No result

- 2FA SMS

- 2FA Google Authenticator

- English

- Learn and Earn

- Announcements

- Videos

9. Phemex

- 0.0001 BTC

- spot trading

- derivatives trading

-

perpetual contracts trading

8

No result

- Ethereum

- Cardano

-

Chainlink

233

No result

- SwiftCash

- Bank Transfer (ACH)

-

Sepa

310

No result

- English

- Russian

-

Japanese

6

No result

- 2FA Google Authenticator

- English

- Japanese

-

German

2

No result

- Blog

- Videos

-

Academy

4

No result

10. Poloniex

- 3.5% - 5%

- spot trading

- derivatives trading

-

futures trading

7

No result

- APENFT

- Bitcoin

-

Ethereum

364

No result

- Bank transfer

- Visa

-

MasterCard

367

No result

- English

- Chinese (Mandarin)

-

Simplified Chinese

9

No result

- Panama

- 2FA SMS

- 2FA Google Authenticator

- English

- Videos

- Guides

- Blog

Why Should You Trust CCN?

It is sensible to approach any review site with skepticism. After all, many provide little more than half-hearted reviews that barely skim the surface.

Others allow their biases to shine through. Entities such as these provide little or no use to anyone genuinely looking for the best ETH exchange.

At CCN, we approach things very differently. Our team uses plenty of data points to produce all-encompassing reviews. These include but aren’t limited to security, product volume, and customer service standards.

By the time you finish reading our reviews, you’ll feel educated. Thus, you’re in a fantastic position to choose the best Ethereum trading platform for your needs.

Our reviews are neutral, with a focus on getting to the truth. Not every Ethereum exchange will like it. But, if our readers benefit, that’s what matters the most.

Overview of the Best Ethereum Exchanges in 2024

| Casino | Welcome Bonus | Our Rating |

|---|---|---|

| Binance | Get up to 100 USDT in trading fee rebate after full verification, first deposit, and first trade. | 4.83 |

| Blockchain.com | N/A | 4.83 |

| LBank | Get 255 USDT Bonus when you sign up. | 4.83 |

| Binance TR | Get a 50 USD Bonus when you Register and complete authentication. | 4.67 |

| BitMEX | Enjoy a 10% discount on BitMEX fees for six months when you register through a referral link. | 4.67 |

| MEXC | Get 5 USDT bonus when you deposit 300 USDT. | 4.67 |

| Okcoin | Receive $10 in Bitcoin when you register with a referral link and buy $100 worth of crypto on Okcoin. | 4.67 |

| OKX | Get mystery boxes worth up to $10,000 when you register through a referral from a friend. | 4.67 |

| Phemex | Earn up to $6050 in crypto when you sign up | 4.67 |

| Poloniex | Get Up to $1000 Welcome bonus when you sign up and complete tasks. | 4.67 |

Disclaimer: Investing in cryptocurrencies carries significant risk. Values are highly volatile. Never invest more than you can afford to lose. This site does not provide financial advice. Act based on your own research and consult with a financial professional before making decisions. Don’t invest unless you’re prepared to lose all the money you invest.

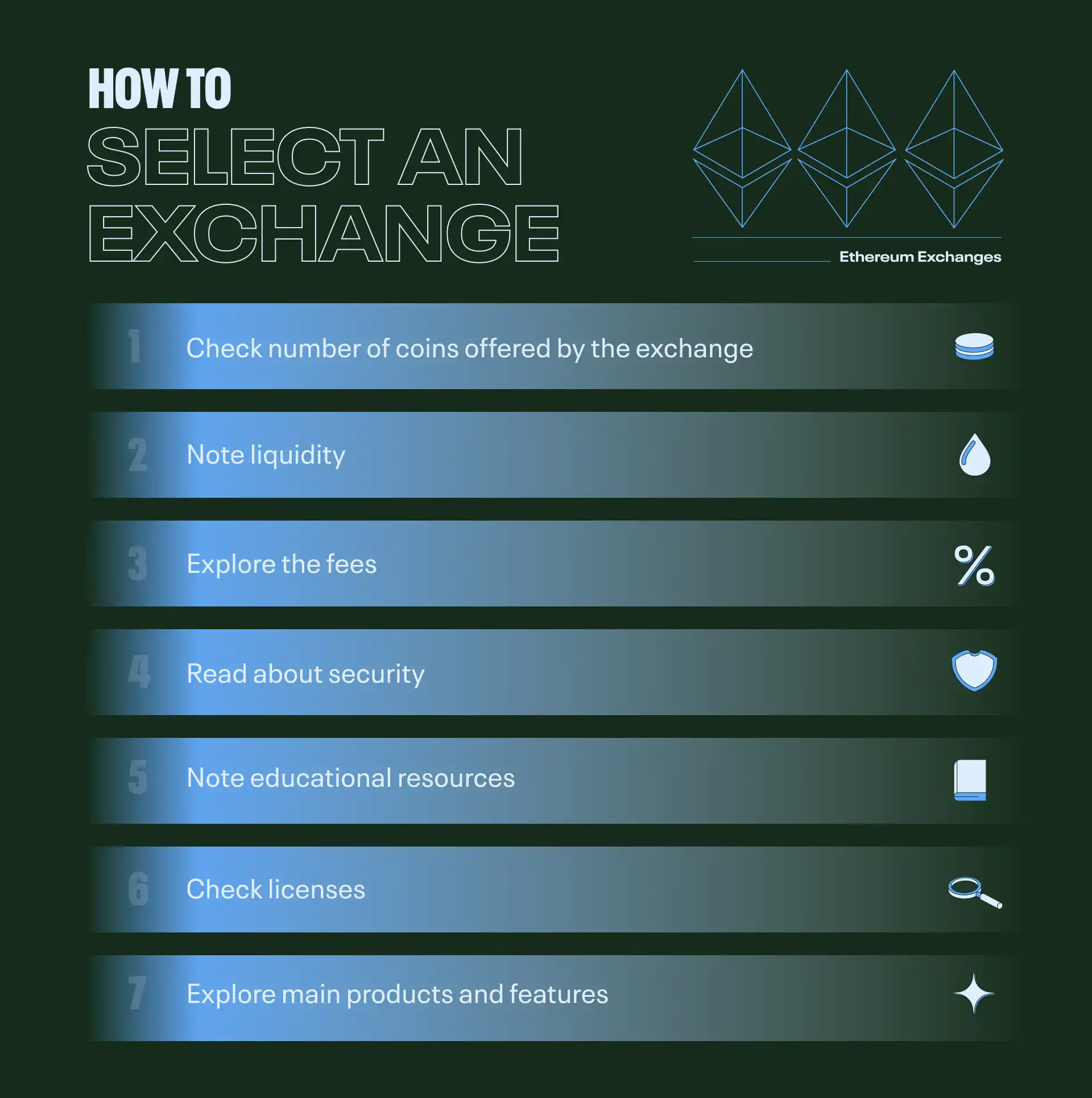

A Detailed Guide to Picking the Best ETH Exchange

By now, you are perhaps interested in choosing a crypto exchange. The sites on this page are some of the best Ethereum exchanges.

But picking the right option for you doesn’t necessarily mean picking the #1 provider on this list. Here are a few things to consider before making any decisions.

The importance of liquidity

Look for an exchange with good liquidity. There must be enough buyers and sellers on the platform.

In this scenario, buying or selling cryptocurrencies at fair prices becomes easier. Higher liquidity provides better trading opportunities.

Are your coins secure on the trading platform?

Look for exchanges that use robust security practices. These might include encryption, two-factor authentication (2FA), and cold storage for storing cryptocurrencies. Strong security helps protect your coins from hacks and theft.

Licensing and reputation

Check whether the ETH exchange is licensed and regulated. A licensed exchange adheres to certain rules and regulations, which can provide more trust and assurance.

Additionally, consider the exchange's reputation. Research user reviews and feedback to gauge its reliability and track record.

Does the exchange educate clients?

A good Ethereum exchange should provide educational resources. These tools can help users understand cryptocurrency trading and the platform's features.

Look for exchanges that offer tutorials, guides, or blogs. Such info can enhance your knowledge and confidence in navigating the crypto market.

Fees: The digital wallet killer

Pay attention to the fee structure of the exchange. Ethereum trading platforms will likely charge transaction, deposit, or withdrawal fees.

Compare the fees across different platforms. Consider how they match with your trading volume and frequency.

Crypto asset variety

Also, investigate the number and variety of cryptocurrencies available for trading. A diverse range of coins allows you to explore different investment opportunities. It also helps diversify your portfolio .

Look for Ethereum exchanges that offer a wide selection of popular cryptos.

Number of payment methods available

Check the variety of payment methods supported by the ETH exchange. Ensure that the site offers payment options that are convenient and accessible to you.

These might include popular fiat payments like credit cards or debit cards. It should also offer eWallets and crypto as options. With lots of choices, you can deposit and withdraw funds easily.

Does the platform have products that interest you?

The best Ethereum exchanges offer plenty of products and features to customers. Here are a few of the most common

Spot trading

Spot trading is quite basic. It involves buying and selling cryptocurrencies at the current market price.

You can exchange one cryptocurrency for another. You can also trade cryptocurrencies with fiat currencies such as USD or EUR.

Margin trading

Margin trading allows you to borrow funds from the exchange or other users to amplify your trading positions.

It enables you to trade with leverage, so you use more capital than you have. The potential profits and risks are much higher as a result.

Futures contracts

This form of trading involves agreements to buy or sell at a predetermined price on a specified date.

ETH exchanges let you speculate on the future price movements of cryptocurrencies without owning the actual assets.

Options trading

Options trading gives you the right to buy or sell cryptocurrencies at a specified price within a predetermined time frame. However, there is no obligation to do so.

It offers flexibility to hedge your positions or potentially profit from price movements.

Staking and lending

Some crypto exchanges offer staking and lending services. Staking allows you to earn rewards by holding and validating certain cryptocurrencies.

Lending lets you lend your coins to other users in exchange for interest earnings.

Initial coin offerings (ICOs) and token sales

ETH exchanges can enable initial coin offerings or token sales. New cryptocurrencies or tokens are launched at these events. You can participate in these sales and acquire newly issued coins or tokens.

Cryptocurrency savings accounts

Certain crypto trading platforms provide savings accounts. They allow you to earn interest on your deposited coins.

Like traditional bank accounts, clients can earn passive income on their holdings.

Crypto payment solutions

Some Ethereum exchanges offer crypto payment solutions for businesses. This enables them to accept digital assets as a form of customer payment.

It is a solution that helps bridge the gap between traditional finance and the cryptocurrency ecosystem.

It's important to note that not all exchanges offer all these products. The availability of specific products may vary from one site to the next.

I recommend researching and choosing an ETH exchange offering products and features that align with your trading goals and preferences.

Main Ethereum Exchange Types

There are two main forms of Ethereum exchanges. They are decentralized exchanges (DEX) and centralized exchanges (CEX), with hybrid exchanges being a mix of both.

Let’s look at the upsides and the downsides of each one.

Decentralized Exchanges (DEX)

DEXs are platforms allowing users to trade cryptocurrencies directly with each other without intermediaries. Here are some pros and cons of using DEXs.

Benefits of using DEXs

- Control: DEXs give users more control over their funds since, they usually operate through smart contracts. This eliminates the need to deposit funds onto the exchange.

- Privacy: DEXs often prioritize user privacy since they don't require users to provide extensive personal information.

- Security: DEXs operate on the blockchain. As a result, they are less vulnerable to hacking or centralized system failures.

- Access: DEXs are typically accessible to anyone with an internet connection. So, users from anywhere in the world can participate.

- Trustless: DEXs remove the need to trust a centralized authority. This is because you use smart contracts and blockchain technology to execute trades.

Issues with DEXs

- Liquidity: DEXs can have lower liquidity than centralized exchanges. This means there might be fewer buyers or sellers for certain assets.

- User experience: Some DEXs might have a steeper learning curve or a less user-friendly interface than CEXs.

- Limited offerings: DEXs may not support all cryptocurrencies or trading pairs. This limits the range of options available.

- Speed: Trading on DEXs is sometimes slow due to the reliance on blockchain confirmations for each transaction.

- Price impact: With lower liquidity, larger trades on DEXs can lead to price slippage, impacting the execution price of trades.

Centralized Exchanges (CEX)

CEXs are “traditional” crypto exchanges. They permit buyers and sellers to trade through a centralized platform managed by a company or organization. Here are some pros and cons of using them.

Benefits of using CEXs

- Liquidity: CEXs generally have higher liquidity, making buying and selling coins easier.

- User-friendly: Many CEXs offer intuitive user interfaces and features designed to simplify trading for beginners.

- Wide range of assets: CEXs often support a wide range of cryptocurrencies and trading pairs, providing more options for users.

- Customer support: CEXs typically provide customer support services, allowing users to seek assistance.

- Advanced trading features: Some CEXs offer advanced trading tools, such as margin trading and stop-loss orders, for more experienced traders.

Issues with CEXs

- Centralization: CEXs require users to trust the exchange with their funds. This is because you can find them on the exchange's platform.

- Privacy Concerns: CEXs often require users to go through identity verification processes, which can compromise privacy.

- Security Risks: CEXs are attractive targets for hackers or are subject to internal security breaches.

- Dependency: Trading on CEXs relies on the uninterrupted operation of the exchange. This can be affected by technical issues or maintenance.

- Regulatory Risks: CEXs are usually subject to regulatory requirements and restrictions. This points to the fact that the services included might not be available in certain locations.

It's important to consider these factors and your personal preferences when you choose between DEXs and CEXs. Each option has its advantages and disadvantages.

Buying ETH, the Quick and Easy Way

As you're about to discover, buying Ethereum on an exchange is extremely easy.

Choose a well-known exchange platform

Research and choose a well-known and reputable cryptocurrency exchange platform. Some popular options include Coinbase, Binance, or Kraken. Ensure the platform supports Ethereum trading.

Alternatively, select one of this page's top ETH trading platforms.

Create an account

Sign up and create an account on the chosen exchange platform. This typically involves providing personal information. You must also set up security measures like two-factor authentication (2FA) to protect your account.

Select your payment method

Choose your preferred payment method to deposit funds into your Ethereum exchange account.

Common options include bank transfers, credit/debit cards, or digital payment platforms like PayPal. Check the available payment methods supported by the exchange.

Deposit funds

Once your account is set up, navigate to the deposit section of the exchange platform.

Follow the instructions to transfer funds from your bank account. Alternatively, use your preferred payment method to deposit money into your exchange account. Make sure to double-check the details to ensure accuracy.

Find the ETH market

Once your funds are deposited and confirmed, locate the Ethereum market on the exchange platform. This is usually listed under the trading section.

Look for the ETH trading pair (e.g., ETH/USD or ETH/BTC) that suits your needs.

Place a buy order

Decide the amount of Ethereum you want to buy and enter the details in the order form. Specify the price you want to buy or choose the market price for an instant purchase. Review the details and confirm the order.

Store your ETH

After your order is executed, the purchased Ethereum is credited to your exchange account.

Moving your ETH to a personal wallet is generally recommended for enhanced security.

You can create a wallet on your computer or use a hardware wallet for added protection. Follow the wallet provider's instructions to receive and store your Ethereum securely.

Remember, a CEX is not the only place to acquire cryptocurrency. You can also consider peer-to-peer (P2P) platforms, cryptocurrency ATMs, or DEXs.

Each method has its advantages and considerations. So, it's important to thoroughly research and choose the option that aligns with your preferences and needs.

How do ETH trading platforms work?

An Ethereum exchange is a platform where people can buy and sell cryptocurrencies. It is like how stock trading platforms allow you to buy and sell stocks.

Here is a quick overview of how they work.

Getting set up

To use an Ethereum trading platform, you typically need to create an account. This involves providing personal information and setting up a wallet. Think of it as a digital bank account for holding cryptocurrencies.

After registration, you can deposit money into the ETH exchange. Use these funds to buy crypto. Like depositing money into a bank account, you transfer funds from your traditional bank accounts to the exchange.

Placing orders

On the exchange, you can browse different coins available for trading. You can place orders to buy or sell a specific cryptocurrency at a certain price. These orders are similar to placing buy or sell orders for stocks on a standard trading platform.

Order matching

When you place an order, the exchange matches it with someone who wants to sell or buy at the same price. If there is a match, the trade goes through. Next, the ownership of the crypto assets is transferred between the buyers and sellers.

Crypto prices are volatile, meaning they can change rapidly. The Ethereum exchange displays the current market prices for different cryptocurrencies. This means that you can see the value of your holdings and make informed decisions.

Making a withdrawal

Start a withdrawal to transfer crypto from the exchange to your wallet. This process is similar to transferring money from a bank account to your pocket.

Cryptocurrency exchanges resemble stock trading platforms in some ways. For instance, they provide a digital marketplace for buying and selling assets.

Like stock trading platforms facilitate the trading of stocks, crypto exchanges allow you to trade digital coins. Both platforms allow users to place orders and match buyers and sellers. They also provide real-time market information to help users make decisions.

However, it's important to note that cryptocurrencies and stocks are different asset classes. They have unique traits. Also, the underlying technology and regulations governing them can vary.

Yes, there are similarities in how the stock market and crypto exchanges function. But it's essential to understand the specific nature of cryptocurrencies when engaging in this form of trading.

Learn the Value of Using Two or More Trading Platforms

Using multiple Ethereum exchanges is a sensible practice for a few reasons. Let’s explore just three of them below.

Asset protection

Having accounts with several platforms helps to protect your investments in case of a catastrophic event. For instance, if an Ethereum exchange collapses, you have some refuge.

But, if you have all your coins stored in a single exchange that shuts down, you could lose everything.

Diversification

It is a good idea to diversify your investments , even in the world of cryptocurrencies. Like traditional investments, spreading your holdings across different platforms minimizes risk.

Each exchange may have its strengths, features, and security measures. So, by using more than one site, you can take advantage of the benefits offered by each.

Familiarity

Lastly, using different exchanges lets you become familiar with how different platforms work. Each cryptocurrency exchange has its own user interface, tools, and features.

Using multiple sites, you can gain experience and understand how these platforms operate.

This knowledge is valuable in helping you explore the cryptocurrency landscape. You make informed decisions and adapt to changes in the market as a result.

Using multiple Ethereum exchanges is a sensible practice. It helps protect your investments, diversifies your holdings, and allows you to become familiar with different platforms.

It's a way of counteracting risks and taking advantage of various features. It also lets you enhance your understanding of the cryptocurrency ecosystem.

All About Ethereum

A well-known figure in the cryptocurrency world, Vitalik Buterin created Ethereum in 2015. Buterin was just a teenager when he came up with the idea.

He wanted to build a platform that would go beyond Bitcoin's capabilities and allow the creation of a number of decentralized applications. With the help of a team of developers, Buterin turned his idea into a reality.

Since then, it has become one of the world's most influential and widely used blockchain platforms.

What can ETH do?

Ethereum is a digital platform that allows you to create and use applications without relying on a central authority like a bank or a government. It's like a global computer that anyone can access using the Internet.

What sets Ethereum apart from traditional systems is its use of "smart contracts." These digital agreements automatically carry out transactions. The contracts are enforced automatically once certain conditions are met.

This means that transactions and interactions on Ethereum can happen without intermediaries. With no lawyers or banks, things move much faster. These transactions are also potentially more secure than traditional fiat ones.

Ether (ETH) is Ethereum’s cryptocurrency. You can think of Ether as a digital currency used within the Ethereum network.

It's similar to using physical money to buy goods or services. Yet, in this case, it's all happening digitally.

On Ethereum, people can build and run "decentralized applications" or "dApps" for short. These dApps can offer various services. These include decentralized finance (DeFi) platforms, games, and social networks.

Since Ethereum is an open platform, anyone can create and deploy their dApp.

Another important aspect of Ethereum is its community. There are many developers and enthusiasts around the world who contribute to the network's growth and improvement. They work together to make Ethereum more secure, efficient, and useful.

What can I do with my crypto?

Once you buy Ethereum, there are several things you can do with it. Let’s explore a few options below.

Hold as an investment

You can hold onto Ethereum, hoping its value will increase over time. Like buying stocks or other assets, you can buy and hold ETH as a long-term investment, anticipating its price appreciation.

Trade on exchanges

You can also use your coins to trade for other cryptocurrencies or tokens on various exchanges. These platforms offer a wide range of trading pairs.

In this case, you can explore different investment opportunities and potentially profit through trading.

Participate in decentralized finance (DeFi)

Ethereum has fueled the growth of decentralized finance (DeFi) applications. DeFi platforms allow you to lend, borrow, earn interest, or participate in liquidity provision using your Ethereum.

These entities offer financial services without intermediaries like banks. This means they provide new ways to manage and grow your assets.

Invest in NFTs

Ethereum is widely used in the world of non-fungible tokens (NFTs). NFTs represent unique digital assets like artwork, collectables, or virtual real estate.

With ETH, you can buy, sell, or invest in these digital assets, participating in the growing NFT market.

Support blockchain projects

Ethereum is a platform for developers to build decentralized applications (dApps) and launch their tokens.

You can support these projects by participating in token sales. It is also possible to get involved in decentralized platforms and communities.

Why it is important to buy several coins

Buying multiple coins, not just Ethereum, is important for diversification. Different cryptocurrencies have different characteristics, use cases, and price movements.

By investing in a variety of cryptocurrencies, you spread your risk. If the value of one cryptocurrency goes down, your other holdings may still retain value or even increase.

Diversification helps to balance potential losses and maximize potential gains.

How to store your coins

You can use cryptocurrency wallets to store your Ethereum and other cryptocurrencies securely. There are two main types.

Software wallets

These wallets are applications you install on your computer or smartphone. They generate a unique address for your Ethereum.

You can send, receive, and store your coins securely. Examples include MetaMask, MyEtherWallet, and Trust Wallet.

Hardware wallets

These are physical devices. You use them to store your coins offline. You benefit from extra security with a hardware wallet, as they store your private keys.

You need these keys to access your coins offline. Popular hardware wallets include Ledger and Trezor.

It's important to choose a reputable wallet and follow best practices for security. For instance, use strong passwords and enable 2FA. You should also keep backups of your wallet information.

Storing your coins in a personal wallet gives you more control and security than an exchange. Even on the best ETH trading platform, there’s a higher risk of hacking.

Become a Crypto Trading Expert on a Top Ethereum Exchange

Choosing the right Ethereum exchange demands careful consideration of various factors. Factors such as liquidity, security measures, licensing, educational resources, fees, asset variety, payment methods, and available products should guide your decision-making process.

Decentralized and centralized exchanges each offer their own advantages and drawbacks, and diversifying across platforms can safeguard investments and broaden understanding within the crypto landscape. It's important to understand Ethereum's potential, functionalities, and diversified utility, and to store assets securely in personal wallets. Ultimately, becoming well-informed and cautious is key when entering cryptocurrency trading, ensuring that you invest only what you can afford to lose.

Frequently Asked Questions

What services do Ethereum exchanges offer?

An ETH exchange lets you buy, sell, and trade in hundreds of digital currencies. It provides a range of trading options, such as spot trading, margins, options, and futures. Such platforms can also serve as a storage depot of sorts. However, finding a more permanent place to store your coins is best.

How much money do I need to use an Ethereum trading platform?

Much less than you think! I know of at least one well-known exchange that lets you trade with a $2 deposit. In general, $10 is all you need to get started with most companies.