EOS, Litecoin Spike 13% in $5 Billion Crypto Market Gain; Can Bitcoin Surge?

Litecoin and EOS led the pack among major-cap cryptos to aid the market. Bitcoin could thrive off the momentum. | Source: Shutterstock

Following an abrupt short-term dip from $132 billion to $126 billion, the crypto market has almost fully recovered as Bitcoin bounced back to $3,800 and assets like EOS and Litecoin recorded 10 to 13 percent gains.

Peter Brandt, a prominent technical analyst, stated that crypto assets like Litecoin have led Bitcoin higher in the past 48 hours, allowing the dominant cryptocurrency to recover from $3,690 to $3,880.

If major crypto assets, small market cap cryptocurrencies, and tokens are able to sustain their momentum in the weeks to come, analysts expect Bitcoin to benefit from the bullish sentiment around the market.

Litecoin and EOS are Pushing Bitcoin Higher: Key to Crypto Momentum

Possibly due to the relatively high dominance index of Bitcoin at around 51.8 percent in comparison to the bull market in late 2017, the correlation between Bitcoin and the majority of cryptocurrencies has remained high.

As one analyst explained:

Correlation remains elevated with BTC’s average blended correlation to top 20 assets of 85.7% in Feb slightly down from January but still higher than Dec 2018.

For the most part, throughout the past two years, the correlation of crypto assets was led by Bitcoin and the performance of many cryptocurrencies have been dependent on the short-term price movement of the asset.

However, recent data shows that alternative cryptocurrencies have been fueling the short-term price movement of Bitcoin.

As a cryptocurrency trader with an online alias “Satoshi, MBA” explained in an interview with CCN.com, Bitcoin was at risk of falling back to the mid-$3,000 region that may have opened up a possibility of dropping to a 12-month low.

The strong performances of cryptocurrencies like Litecoin, EOS, Binance Coin, and many others lifted the overall sentiment of the cryptocurrency market and allowed BTC to recover in a short period of time.

“Most coins have very bullish set ups right now, virtually all of them sitting on annual support. When BTC moves sideways, liquidity will move into alts. Recently we’ve seen huge moves, 40%, 80%, even 150% overnight gains by some alternative cryptocurrencies,” the analyst told CCN.com.

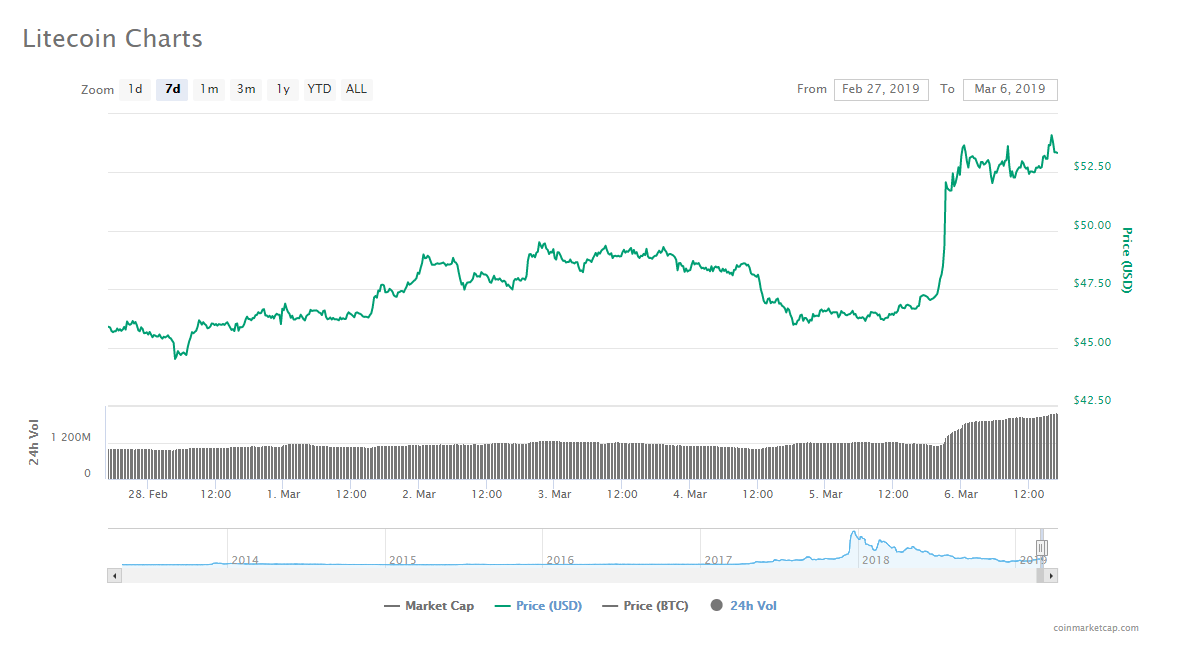

On March 5, Litecoin surged 17 percent against the U.S. dollar and established a new high for 2019.

Many tokens, which were down by around 95 to 99 percent against the USD in late 2018, have started to regain some of their value in recent weeks.

Bitcoin Still Not in All Clear

Alex Krüger, an economist and markets analyst, said that Bitcoin has been in a tight range from $3,150 to $4,200 for over three months.

If BTC breaks below $3,150 or breaks out of $4,200, it could either experience a drop to new lows in the $2,500 region or recover to the dreaded $5,000 to $6,000 range.

“Since December, BTC has been ranging in a $1050 range (4200-3150). At 3800, price is 38pp below the top of the range. The two key questions are: Is price more likely to break the top or the low? (i.e. a directional edge) and if either breaks, which side is likely to run more?,” Krüger said.

The sentiment around Bitcoin remains positive, partially due to the positive media coverage on the institutionalization of the asset class and the strong price movements of tokens.

As long as crypto assets continue to maintain their momentum throughout the next month or two, traders foresee Bitcoin initiating an accumulation phase after several months of consolidation, which would position the asset in an ideal position to recover over a long time frame.

Positive media coverage on the cryptocurrency sector including the recent move by the largest stock exchange in Switzerland to list an Ethereum exchange-traded-product (ETP) could contribute to the positive sentiment in the market.

Click here for a real-time EOS price chart and here for Litecoin’s current prices.

Bitcoin’s current trading charts can be found here.