The Road Ahead For FinTech Acceptance of Blockchain

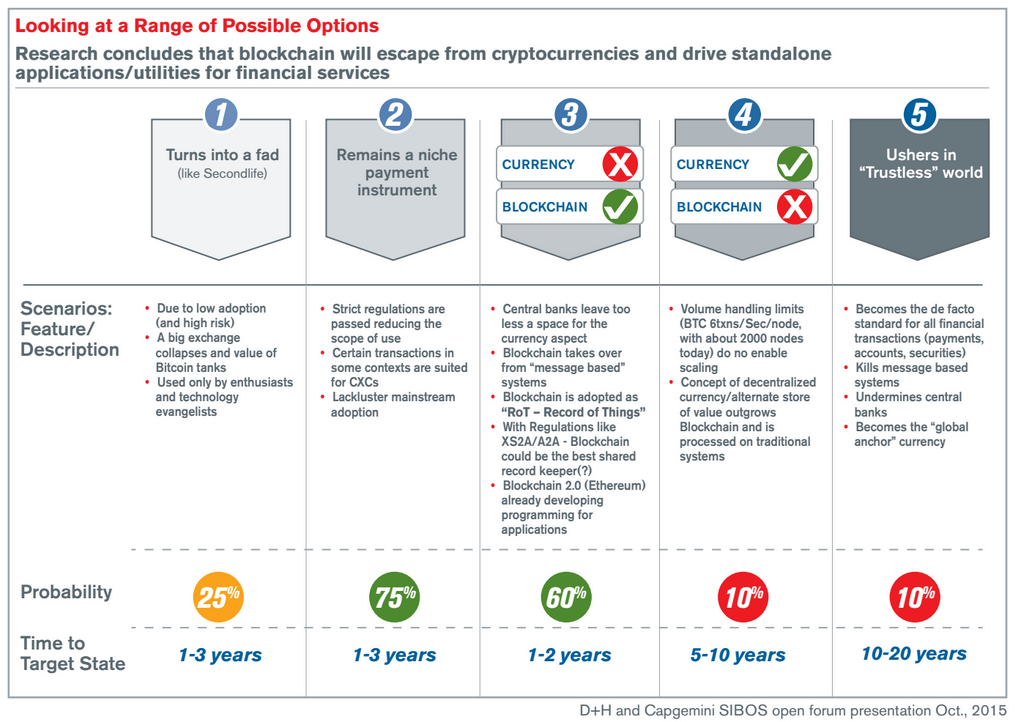

Financial technology solutions company D+H has provided a whitepaper on what they consider to be the top milestones that blockchain technology must hit before it will be an accepted addition to the world of fintech. At large, international scale conferences, executives and those heavily involved in the financial and banking sector have painted with broad strokes on their opinions about blockchain.

Many executives see the technology as ultimately useful if it can be leveraged properly. However, the radical nature of blockchain technology and its inherent association with an uncomfortably disruptive technology in Bitcoin has caused some entrenched finance pro’s to turn up their noses. This whitepaper by D+H gives an honest assessment of what blockchain technology will need to bring to the table in order to be palatable and widely applicable in a notoriously guarded, regulated, conservative and risk-averse industry.

A New Era of Financial Services

The introduction makes it clear that many financial services professionals, including the writers of this paper, will concede that finance as we understand it traditionally is at a crossroads. Markets are changing, but more importantly, technology is changing even faster. There seemed to initially be a collective hesitance to not be the first-mover with a large rush of investment into blockchain technology from banks, but now that atmosphere has changed.

“If 2014-2015 was the era of blockchain experimentation and innovation, then 2016-2017 is the time when this rapidly evolving technology should start to emerge from banks’ back forms and begin to be applied to solve real business problems.”

But Is There A Problem With The Market?

The papers point to the Payment Services Directive in the EU, the Dodd-Frank Act in the USA and the Basel III Capital and Liquidity Framework as major changes to the financial services within the last 3-5 years. They’ve increased competition and pressure in the industry by introducing challenger banks and third party payment processors. The effects of this on banks has made their operations as a whole more complex and prone to friction and high costs.

There certainly seems to be no real opportunity to place blame on the state of blockchain technology, but rather on the state of the finance industry as being hamstrung by legacy technology, traditions and also external regulation from governments both domestic and abroad. Even though the blockchain technology in theory should work beautifully instead of what banks are using now to move money and more, it’s unclear to banks how they’ll actually be able to change their ways of operation fast enough and effective enough to make a switch viable.

Payments Are Probably Where Blockchain Is Most Promising

There can be endless talk on the potential and theoretical aspects of blockchain from a digital currency, smart contracts and market standpoint, but D+H believes that payments will be where blockchain technology will be used in the best way.

“Blockchain offers an unrivaled ability to tackle these issues – opening the way to the creation of a global payments environment characterized by less friction, higher speed, great efficiency, and enhanced transparency and security.”

According to D+H the five obstacles that blockchain must tackle to be used in Fintech are:

- Find the right problem to fix. Blockchain probably can’t be used in every single aspect of operation from a bank’s perspective, so leaders are going to have to think really hard about the best possible use-causes to tackle up-front.

- There has to be a dominant use or application to convince banks to move highly sensitive data or processes over to blockchain technology. Without a rock-solid few use cases that banks are compelled to use, the cascading effect of a full blockchain integration will be slow to follow.

- The value and disruptive potential of the blockchain technology must not lose its luster once it’s been saddled with “regulatory and industry” baggage.

- The technology needs to scale on all levels to handle every aspect of what an international banking system can and will need from it.

- The blockchain’s success in banking is dependent on the technology being able to fully align with the timescales and perspectives of banks and institutions. That includes long-term (as in decades) plans and the continued reliability of very old and established companies.

What’s interesting about this paper is that in the title “5 Things The Blockchain Must Get Right” it seems to be addressed to some central mind share that controls “the blockchain.” As if it’s like a bunch of bankers talking to Bitcoin core developers giving them a list of ransom demands if their technology is to be accepted someday. But in reality, the banks needs to face inward when addressing whether or not they can actually change fast enough and be agile enough to use blockchain technology.

“In our view, the conditions for tackling each of these challenges can be found within the banks themselves… This creates a strong case for banks to use blockchain for internal utilities – in turn enabling them to gain the experience and insight needed to roll out blockchain capabilities across the ecosystem.”

It’s almost certain that there will be some very brave and hopefully very successful first movers in the banking industry to move on integrating blockchain technology into their Fintech in a significant way. Hopefully, that risk loaded leap of faith in this new technology will reap those first movers many benefits and prove to the others that they shouldn’t have waited on the sidelines for so long.

Featured image from Shutterstock.