Despite its 70% Price Drop, Bitcoin Surpassed Gold in Settlement Volume

Gold has been a primary store of value for investors over decades. | Source: Shutterstock

Nic Carter, a well respected cryptocurrency researcher, has said that Bitcoin has surpassed the OTC gold market in settlement volumes, even amidst a 70 percent drop in its price.

Bitcoin as a Better Medium of Exchange

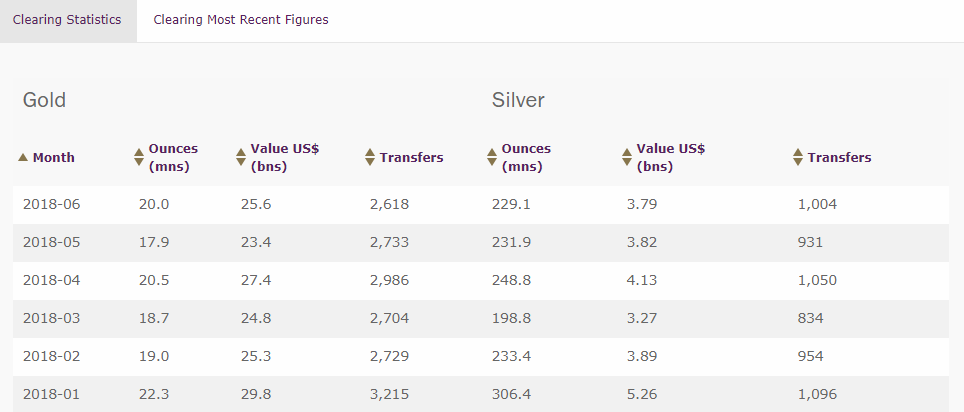

According to the clearing statistics of the London bullion market (LBMA), five major clearing members of the LPMCL including HSBC, ICBC Standard Bank, JP Morgan, Scotiabank and UBS, the global gold over-the-counter (OTC) market is on track to settle $446 billion in 2018, having settled less than $30 billion on a monthly basis since January.

In contrast, based on the data provided by Coin Metrics, a cryptocurrency market data provider cited by Carter, the Bitcoin market has already processed $848 billion this year and is on track to surpass $1.38 trillion by the year’s end.

Given that LBMA account for at least 70 percent of the global gold OTC volume, at $848 billion, Bitcoin has already settled more value in the past eight months than the predicted settlement volume of the entire gold market in 2018.

Carter explained :

“I’m conservatively estimating the London OTC market for gold, overseen by the LBMA, at 70% of global volumes. They publish clearing statistics. With these I can estimate the total net volume of regulated gold settlement at $446b for 2018 (based on 6 months of data). Conservatively, (adjusted estimates), Bitcoin has settled $848b this year, and is on track to settle $1.38T. Bitcoin, it appears, has quietly surpassed the OTC gold market in settlement volumes.”

The comparison offered by Carter did not include Ethereum, Ripple, Bitcoin Cash, Cardano, Litecoin, and other major cryptocurrencies in the global market. Ethereum for instance settles nearly two times more transactions on a daily basis than BTC.

Generally, transactions on the Ethereum network are smaller in value than Bitcoin as the majority of payments are initiated by decentralized applications to cover costs involved in processing information.

The huge discrepancy in the volume of the gold OTC market and the volume of Bitcoin has demonstrated that the mainstream has started to acknowledge and adopt Bitcoin as a premier store of value and a medium of exchange, due to its striking advantages over gold, such as fungibility, liquidity, and transportability.

So What is Holding Bitcoin Back?

Nikolaos Panigirtzoglou, a senior analyst at JPMorgan, said in December of 2017 that cryptocurrencies could evolve into a major asset class and compete against traditional assets like gold if more publicly tradable and strictly regulated financial instruments like futures and exchange-traded funds (ETFs) are introduced to US markets.

He explained :

“In all, the prospective introduction of bitcoin futures has the potential to elevate cryptocurrencies to an emerging asset class. The value of this new asset class is a function of the breadth of its acceptance as a store of wealth and as a means of payment and simply judging by other stores of wealth such as gold, cryptocurrencies have the potential to grow further from here.”

Hence, if the highly anticipated proposal of the CBOE Bitcoin ETF gets approved by the US Securities and Exchange Commission (SEC) by February 2019, the final deadline of the ETF, then it will open more investors to the cryptocurrency market.

Featured image from Shutterstock.