Best DeFi Exchanges in 2024

Best Decentralized Exchanges in 2024

Our team has reviewed several defi exchanges and compiled for you a list of the 10 best defi crypto exchanges.

promotions

Get up to 100 USDT in trading fee rebate after full verification, first deposit, and first trade.Coins

promotions

Enjoy a 10% discount on BitMEX fees for six months when you register through a referral link.Coins

promotions

Receive $10 in Bitcoin when you register with a referral link and buy $100 worth of crypto on Okcoin.Coins

promotions

Get mystery boxes worth up to $10,000 when you register through a referral from a friend.Coins

Review of Our Top 10 Defi Exchange Crypto Sites

You can have a look at some of the reviews of our 10 best DEX crypto exchanges.

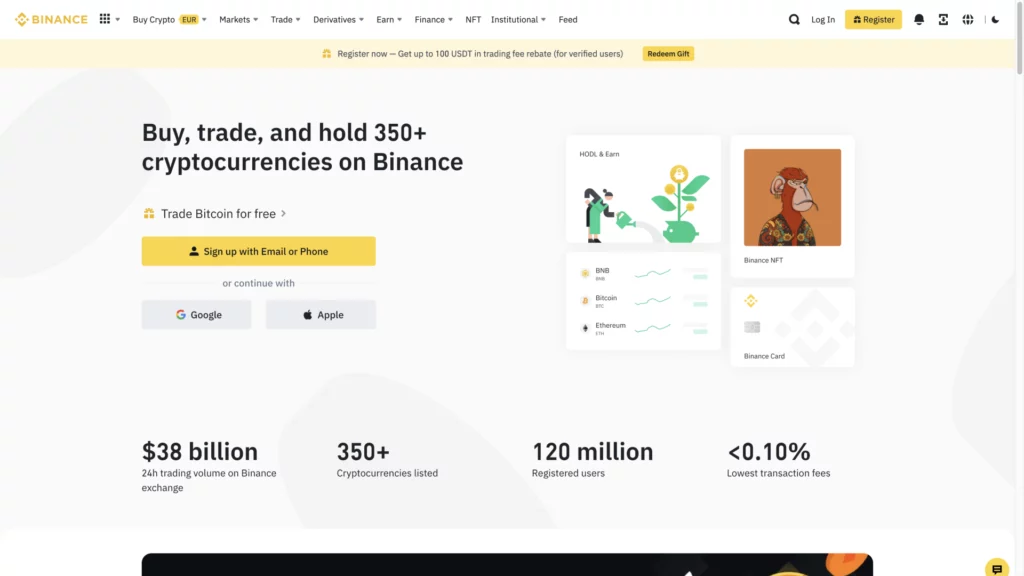

1. Binance

- 0.0000039 - 0.0005

- spot trading

- derivatives trading

-

futures trading

12

No result

- Bitcoin

- Ethereum

-

Binance Coin

291

No result

- Sepa

- GiroPay

-

Visa

305

No result

- English

- Indonesian

-

Spanish

22

No result

- France

- Italy

-

Lithuania

13

No result

- 2FA Google Authenticator

- 2FA SMS

- German

- Russian

-

Korean

15

No result

- Blog

- News

-

Announcements

1

No result

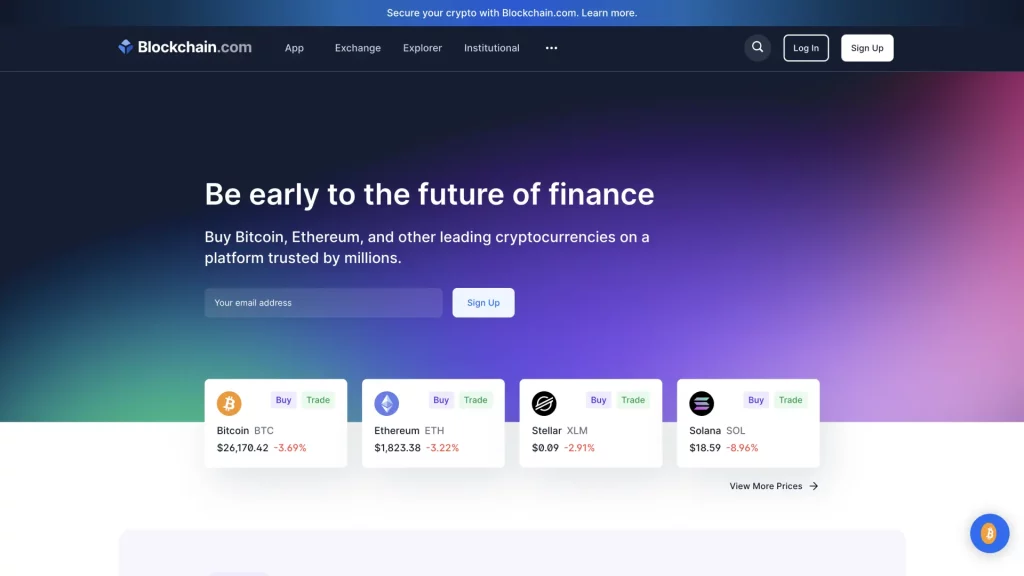

2. Blockchain.com

- spot trading

- margin trading

-

staking

3

No result

- Bitcoin

- Ethereum

-

Bitcoin Cash

28

No result

- Bank transfer

- Sepa

-

Faster Payments

49

No result

- English

- Spanish

-

Portuguese

2

No result

- Singapore

- Puerto Rico

- English

- Learn and Earn

- Podcasts

- Research and Analysis

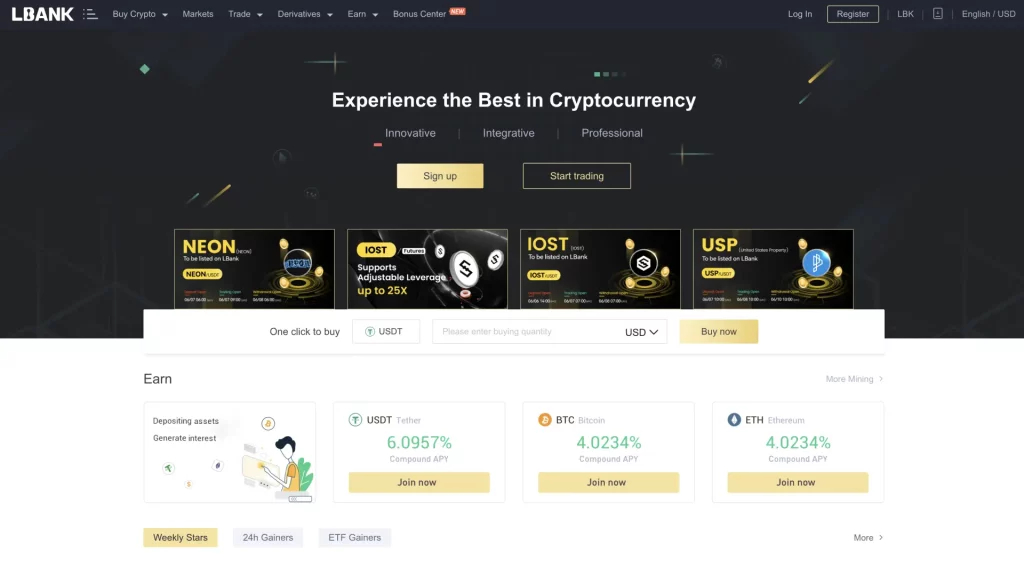

3. LBank

- spot trading

- derivatives trading

-

futures trading

5

No result

- Ethereum

- Terra

-

Polygon

241

No result

- Visa

- MasterCard

-

Bank transfer

255

No result

- English

- Russian

-

Spanish

27

No result

- 2FA SMS

- 2FA Google Authenticator

- English

- Turkish

-

Polish

24

No result

- Academy

- Guides

- Videos

4. Binance TR

- spot trading

- wallet

- Holo

- Internet Computer

-

The Graph

80

No result

- Bank transfer

- Ziraat Bankasi

-

VakifBank

84

No result

- English

- Turkish

- 2FA Mobile App

- 2FA SMS

- 2FA Google Authenticator

- Turkish

- English

- Blog

- Announcements

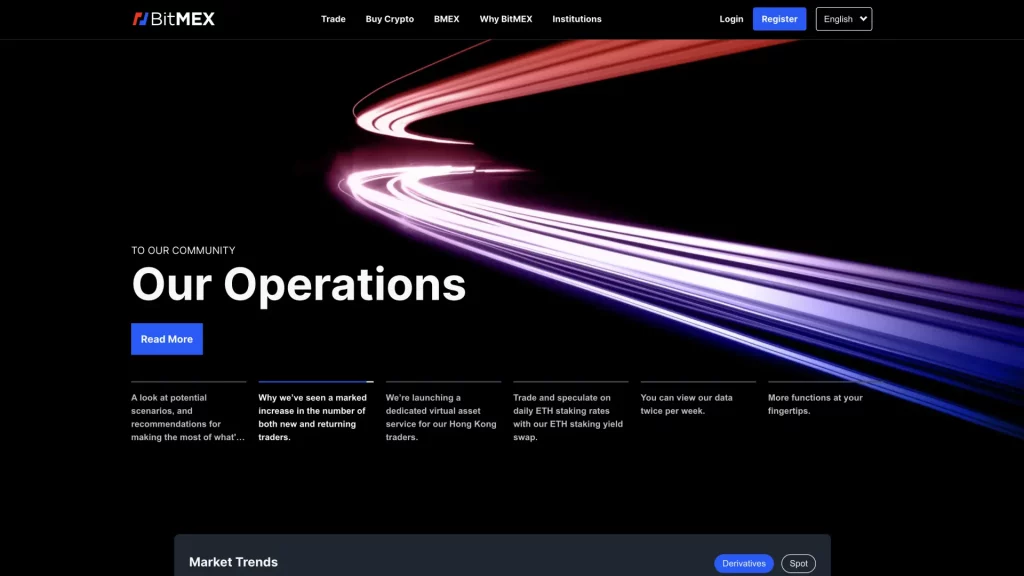

5. BitMEX

- Maker/Taker: 0.0200% - 0.0750%

- spot trading

- derivatives trading

-

futures trading

3

No result

- BitMEX Token

- Bitcoin

-

TRON

8

No result

- Visa

- MasterCard

-

ApplePay

12

No result

- English

- Russian

-

Turkish

1

No result

- 2FA Google Authenticator

- 2FA Authy

- Chinese (Mandarin)

- Korean

- Russian

- Knowledge Base

- Videos

- Guides

6. MEXC

- Free

- spot trading

- derivatives trading

-

futures trading

9

No result

- SHIBA INU

- Wrapped Dogecoin

-

ADAX

191

No result

- Visa

- MasterCard

-

Bank transfer

110

No result

- English

- Russian

-

Turkish

14

No result

- Seychelles

- Estonia

-

Switzerland

2

No result

- 2FA Google Authenticator

- 2FA SMS

- English

- Turkish

-

Vietnamese

5

No result

- Videos

- Learn and Earn

-

Blog

2

No result

7. Okcoin

- 3.99%

- spot trading

- OTC trading

-

staking

1

No result

- Bitcoin

- Ethereum

-

Tether

101

No result

- Visa

- MasterCard

-

ApplePay

107

No result

- English

- United States

- Canada

-

United Kingdom

26

No result

- 2FA SMS

- 2FA Google Authenticator

- English

- Blog

- Developer Grant

-

Videos

1

No result

8. OKX

- Free

- spot trading

- derivatives trading

-

perpetual swaps trading

9

No result

- Tether

- Bitcoin

-

Litecoin

92

No result

- Bank transfer

- Visa

-

MasterCard

344

No result

- English

- Chinese (Mandarin)

-

Simplified Chinese

14

No result

- 2FA SMS

- 2FA Google Authenticator

- English

- Learn and Earn

- Announcements

- Videos

9. Phemex

- 0.0001 BTC

- spot trading

- derivatives trading

-

perpetual contracts trading

8

No result

- Ethereum

- Cardano

-

Chainlink

232

No result

- SwiftCash

- Bank Transfer (ACH)

-

Sepa

309

No result

- English

- Russian

-

Japanese

6

No result

- 2FA Google Authenticator

- English

- Japanese

-

German

2

No result

- Blog

- Videos

-

Academy

4

No result

10. Poloniex

- 3.5% - 5%

- spot trading

- derivatives trading

-

futures trading

7

No result

- APENFT

- Bitcoin

-

Ethereum

364

No result

- Bank transfer

- Visa

-

MasterCard

367

No result

- English

- Chinese (Mandarin)

-

Simplified Chinese

9

No result

- Panama

- 2FA SMS

- 2FA Google Authenticator

- English

- Videos

- Guides

- Blog

- Best Crypto & Bitcoin Casinos

- Best Crypto & Bitcoin Sports Betting Sites

- Best Crypto & Bitcoin Gambling Sites

- Best Crypto & Bitcoin Plinko Sites

- Best Crypto & Bitcoin Dice Sites

- Best Crash Gambling Sites

- Best New Crypto Casino Sites

- Best Crypto & Bitcoin Sports Betting Canada

- Best Crypto Sports Betting Australia

- Best Crypto Basketball Betting Sites

- Best Crypto Sports Betting Sites in the UK

- Best Crypto Soccer Betting Sites

- Best Tron Sports Betting Sites

- Best Ethereum Casinos

- Show More

Overview of the Best DeFi Exchanges in 2024

| Casino | Welcome Bonus | Our Rating |

|---|---|---|

| Binance | Get up to 100 USDT in trading fee rebate after full verification, first deposit, and first trade. | 4.83 |

| Blockchain.com | N/A | 4.83 |

| LBank | Get 255 USDT Bonus when you sign up. | 4.83 |

| Binance TR | Get a 50 USD Bonus when you Register and complete authentication. | 4.67 |

| BitMEX | Enjoy a 10% discount on BitMEX fees for six months when you register through a referral link. | 4.67 |

| MEXC | Get 5 USDT bonus when you deposit 300 USDT. | 4.67 |

| Okcoin | Receive $10 in Bitcoin when you register with a referral link and buy $100 worth of crypto on Okcoin. | 4.67 |

| OKX | Get mystery boxes worth up to $10,000 when you register through a referral from a friend. | 4.67 |

| Phemex | Earn up to $6050 in crypto when you sign up | 4.67 |

| Poloniex | Get Up to $1000 Welcome bonus when you sign up and complete tasks. | 4.67 |

Disclaimer: Investing in cryptocurrencies carries significant risk. Values are highly volatile. Never invest more than you can afford to lose. This site does not provide financial advice. Act based on your own research and consult with a financial professional before making decisions. Don’t invest unless you’re prepared to lose all the money you invest.

What are DeFi Exchanges?

Defi is short for Decentralized Finance exchanges. These exchanges have enhanced the way you trade cryptocurrencies. Imagine a platform where you can buy and sell digital assets directly with other users without relying on intermediaries.

That’s what Defi exchanges offer!

At the heart of Defi exchanges is blockchain technology, which is the very foundation of cryptos. With this technology, the transactions are verified and recorded on a public ledger. This brings transparency, security, and efficiency to the trading process.

Difference between Defi and CEX

How they operate

Usually, centralized exchanges(CEX) are controlled by single entities and are generally in control of your funds. On the other hand, Defi exchanges crypto sites operate in a more open and distributed manner.

Instead of relying on a central entity to facilitate trades, Defi exchanges rely on smart contracts. These are self-executing contracts with the terms of the agreement directly written into code. This means that the contracts automatically process trades, eliminating the need for intermediaries.

Who has control over funds

Another key difference between dexes crypto sites and centralized exchanges lies in who controls the funds. In a centralized exchange, users deposit their funds into the exchange’s wallets and trust the platform to manage their assets.

On the other hand, in Decentralized exchanges, you retain control over your private keys and funds at all times. This gives you greater ownership and security over your assets. It also reduces the risk of hacking or mismanagement.

In essence, Defi exchanges empower you by putting you in charge of your trades and funds.

Advantages and Disadvantages of Dex Exchanges

There are several advantages that set apart Defi exchanges from traditional CEXs. In this section, we’ll discuss the pros and cons of DeFi to help you evaluate if these exchanges meet your preference.

Pros of DeFi: embracing the power of decentralization

Let’s explore the benefits of using Dex crypto exchanges.

Decentralization: redefining transparency and trust

DeFi operates on a decentralized framework. This means that there is no central authority that governs transactions. As a result, you are guaranteed transparency and trust.

In traditional financial systems, you have to trust the central authority. Additionally, the transactions in a Defi crypto exchange occur on a public blockchain. This means that they can be audited and verified by anyone.

Direct peer-to-peer transactions

Unlike traditional financial systems where intermediaries facilitate transactions, DeFi supports peer-to-peer trading. This means that you can carry out transactions directly with other users. Consequently, your transactions will be seamless and save you time, as well as the cost of involving an intermediary.

Lower risk of hacking

One of the standout advantages of DeFi exchanges is that you have 100% control of your assets throughout the trading process. Crypto trading platforms such as these allow you to keep your assets in your personal wallet. This significantly reduces the risk of hackers accessing your wallet information.

Fewer transaction fees

You will incur fewer charges at crypto dexes, since the exchanges eliminate the intermediaries that charge these fees. Whether it’s trading, lending, or borrowing, DeFi transactions involve fewer middlemen. This translates to lower fees for you. The reduced cost means that the services are accessible to many users.

Highly accessible

DeFi platforms operate on the internet and are accessible to users around the globe. As long as you have an internet connection, you can buy or sell crypto on a dex exchange. This global reach has revolutionized the way people from different backgrounds access and engage with financial services.

Innovation and flexibility

The DeFi landscape thrives on innovation. This sector is constantly evolving, spawning new financial products and services. This includes the development of decentralized applications (dApps). These apps also utilize blockchain technology to provide various financial features.

Challenges to consider in decentralized exchanges

Decentralized exchanges offer numerous advantages, but also come with their fair share of challenges. In this section, we’ll delve into some of the potential downsides that you should be aware of.

Less liquidity

Despite their revolutionary nature, Defi exchanges often face lower liquidity than their CEXs. This lower liquidity is because of the relatively smaller user traffic and trading volumes. Usually, centralized exchanges benefit from a broader user reach.

On the other hand, the decentralized landscape is still expanding its reach. As a result, it can be challenging when you want to place a larger trade on Defi platforms.

Navigating the uncharted waters of regulation

Crypto defi exchanges operate in a gray area which is not highly regulated. This poses some possible risk to your investments. The lack of regulation means that there might be less investor protection, and instances of fraud or scams can be harder to address.

The learning curve - embracing technicality

Defi exchanges can be more technically complex than centralized platforms. This is mainly because you need to be familiar with blockchain technology and crypto concepts. This learning curve can be quite discouraging, especially for a beginner.

Riding the waves of price volatility

Digital currencies, including those traded on Defi exchanges, are notorious for their price volatility. This volatility can lead to substantial price fluctuations over short periods. A fall in price could negatively impact your assets, leading to losses.

Security issues

The best defi crypto exchanges rely heavily on smart contracts. These are self-executing contracts with the terms of the agreement directly written into code. However, the security of these smart contracts isn’t always a given . A poorly developed smart contract could result in potential security issues. This is why it’s important to choose Defi platforms that have strict security measures and regular audits.

Counterparty risk

In general, most Defi exchanges are designed to operate without counterparty risk. This means that there’s no risk of credit default by the other party involved in a trade. However, it’s important to note that some Defi platforms might still carry counterparty risk.

This is why you should only use safe and reliable crypto dex. Fortunately, we have compiled for you a list of defi exchanges that have been verified by our team of experts.

Different Types of DeFi Exchanges

In the world of decentralized finance (Defi), there are several types of exchanges that you can choose depending on your trading preferences and strategies. In this section, I will discuss the main categories of decentralized exchanges. I will also list the pros and cons of each to help you make informed decisions.

Order book Defi exchanges

Order book defi exchanges work similarly to traditional stock exchanges. You can place buy and sell orders at specific prices, and these orders are matched based on price and time priority. Notable examples of order book defi exchanges include dYdX and Serum.

Pros

- Transparent in price due to the visible order book

- Suitable for experienced traders familiar with traditional markets

- Allows for more advanced trading strategies like limit and stop orders

Cons

- Can be overwhelming for beginners since order placement tends to be complex

- Limited liquidity in some cases compared to other exchange types

- Potential for slippage during high volatility periods

Automated market makers (AMMs)

AMMs do not use traditional order books. Instead, they rely on liquidity pools and algorithms to determine asset prices. Some of our top recommendable AMMs include Uniswap, SushiSwap, and PancakeSwap.

Pros

- Simple and user-friendly, hence suitable for beginners

- Continuous liquidity allows you to trade without relying on order-matching

- You can earn rewards when you provide liquidity to the pools

Cons

- Price slippage can occur, especially with larger trades

- Limited control over prices

- Initial liquidity requirements can be a barrier for entry

Hybrid DEXs

Hybrid exchanges combine the features of centralized exchanges (CEXs) and decentralized exchanges (DEXs). They aim to offer a balance between user control and liquidity from CEXs. Some of the best hybrid defi exchanges include 1inch and Curve Finance.

Pros

- Combines the liquidity and speed of CEXs with the security and user control of DEXs

- Provides access to a wide range of assets

- May offer advanced trading features while maintaining a user-friendly interface

Cons

- Not as decentralized as conventional DEXs, which could lead to potential risks

- Regulatory concerns due to centralized features

- You’ll need to trust the centralized aspects of the platform

Comparing pros and cons

Each type of Defi exchange has its strengths and weaknesses. If you are a beginner, we highly recommend you start with AMMs. Hybrid exchanges are also great alternatives, but often face regulatory issues due to their centralized aspects. For advanced traders, order book exchanges and hybrid exchanges are excellent options.

How to Select Your Decentralized Exchange

From what we’ve discussed so far, you now know the pros and cons of defi crypto exchanges and the various types of dex exchanges. In this section, I will take you through the key factors to consider when you want to choose a decentralized exchange.

Truly understand how they work

DeFi exchanges do not operate under a central authority. Instead, they use smart contracts to process transactions directly from users’ wallets. This setup offers complete control over your funds and makes you responsible for your security. It’s like having your digital wallet that you manage entirely.

Research the different types of defi exchanges

To make an informed choice, go through the pros and cons of each type of dex exchange we’ve discussed above. This will help you find the one that aligns with your trading preferences. If you are new to the crypto trading world, we recommend AMMs or hybrid defi exchanges. On the other hand, if you want more advanced trading tools, you can opt for order book exchanges.

Ensure the DeFi exchange has sufficient liquidity

Liquidity is vital to any exchange, and DeFi platforms are no exception. Liquidity ensures that you can easily buy or sell your assets without huge price fluctuations. A higher trading volume generally means better liquidity. Choose a DeFi exchange with a high user base and a wide range of trading pairs to ensure seamless trading.

Compare the fees

Let’s face it –you can’t avoid fees. What you do is choose reliable exchanges with no hidden fees. Some of the fees that you can expect from top dexes include deposit, trading, and withdrawal charges. Also, check whether your preferred decentralized exchange charges gas fees. This is usually associated with transactions on the blockchain. When you know the fees to expect, you are in a better position to manage your trading costs effectively.

Review security measures

Security is a key factor to consider when trading digital currencies. Since DeFi exchanges are not immune to online hacks, we recommend that you only use reputable platforms. To save you the headache, we have compiled for you a list of reliable defi exchange crypto sites with a positive track record.

Evaluate user experiences

A user-friendly platform can significantly enhance your trading experience. Look for DeFi exchanges with seamless interfaces, easy-to-use features, and responsive customer support. Your trading experience should be smooth and enjoyable, even as a beginner.

Read reviews and expert opinions

Reviews from reputable sources can provide insights into the reputation of various exchanges. Additionally, look out for expert opinions which can help you understand the strengths and weaknesses of each platform.

Licenses and geo-restrictions

We recommend that you only trade at licensed platforms. Licensed exchanges offer you a layer of protection and safety. The best defi exchanges are regulated by renowned authorities such as FINRA and FinCEN.

Also, keep in mind that different countries have varying laws related to crypto trading. Therefore, confirm that your preferred defi exchange crypto site accepts players from your region.

What products are available on the DeFi Exchange?

DeFi exchanges offer a range of products beyond basic trading. These include:

Cryptocurrency trading platforms and tools

DeFi platforms enable peer-to-peer trading directly from your wallet through smart contracts. They also offer stablecoin trading pairs for reduced volatility.

Yield farming

Earn rewards when you contribute to the liquidity pools on DeFi exchanges.

Staking

Hold and lock up your cryptocurrencies on exchanges for staking to earn rewards. You’ll receive a portion of the transaction fees.

Lending and borrowing

Some platforms allow you to lend or borrow cryptos and earn interest.

Cross-chain swaps

You have the option to exchange your coins across different blockchain networks seamlessly.

Insurance

Certain DeFi platforms offer insurance to reduce risks associated with smart contract failures and other potential issues.

What payment methods are accepted?

DeFi exchanges often support a wide range of banking methods. From e-wallets to debit/credit cards, you can choose your most convenient payment option.

- E-Wallets: These are the top preferred payment methods that support fast and safe transactions. Paypal, Skrill, and Neteller are among the best e-Wallets to choose from

- Credit/debit card: Visa and Mastercard are widely accepted. These cards allow you to transfer funds directly from your bank account into your defi exchanges. With these banking cards, you get to enjoy added security through features like Verified by Visa

- Bank Transfer: If credit cards are not supported in your country, you use bank transfers. Although this method is known for slow processing time, it is a safe option

How to Buy Crypto on DeFi Exchanges: A Simple Guide

Now that you know the ins and outs of decentralized exchanges, let’s discuss how you can buy your preferred coin.

Step 1: Sign up at your preferred dex crypto

From our list of top decentralized exchanges, choose the platform that meets your needs. Then, create an account. The registration process is usually effortless, and you only need to provide a few details. Unlike CEXs, crypto dexes are user-friendly; thus, the registration process should be seamless.

Step 2: Choose your payment method

The next step is to fund your dex account. To do so, go to the cashier section and select your preferred payment methods. Top featured banking methods include eWallets like PayPal and Skrill, Visa, Mastercard, or bank transfer. Depending on the select banking method, the funds will be added to your account instantly.

Step 3: Set up a wallet like Metamask

Before you can trade on a DeFi exchange, you’ll need a cryptocurrency wallet. One popular choice is MetaMask, a browser extension wallet. Install MetaMask, create an account, and securely store your recovery phrases. This wallet will hold your crypto assets and enable interaction with the DeFi exchange.

Step 4: Connect to the DeFi exchange

Once your wallet is ready, log in to your DeFi exchange account. Then, connect your MetaMask wallet to the exchange. This step ensures that you can access and manage your funds directly from your wallet while using the exchange’s features.

Step 5: Buy your crypto

Now that you have your wallet ready, you can buy your preferred crypto and store it in the wallet. To do so, go to the trading interface and choose the crypto you wish to buy. Select the trading pair and specify the amount of cryptocurrency you wish to trade. Then, scroll down to see all the current seller and their prices. Choose the best seller with the most worthwhile rates and initiate the transaction. DeFi exchanges often have various dex markets and trading options, so take your time.

Step 6: Complete your trade

The exchange will show you the estimated transaction details, including the amount you’ll receive. Confirm the trade, and the DeFi exchange will process your order. Once the transaction is complete, the cryptocurrencies will be added to your account. You can then transfer them to your crypto wallet.

So You’ve Bought Crypto on DeFi Exchange, What Next?

Congratulations on taking your first steps into the exciting world of decentralized finance (DeFi) exchanges! Now that you’re familiar with how to use DeFi exchanges let’s explore what you can do to make the most of your crypto experience.

Hold your crypto: the art of HODLing

When you’ve bought your crypto asset, you have the option to hold onto it in your wallet. This strategy is commonly referred to as “HODLing.” By holding your crypto assets, you’re essentially betting on their long-term growth. While the crypto market can be volatile, many investors have seen substantial returns over time. Remember, patience can be rewarding in the world of crypto.

Trade your crypto: diversify and explore

At DeFi exchanges, you can trade one crypto for another. This can be an exciting way to diversify your portfolio and take advantage of market trends. Keep an eye on trading pairs and use the knowledge you’ve gained to make informed decisions. Buy when the prices are low and sell when the prices are high.

Provide liquidity: earn passive income

You can also earn some passive income by providing liquidity to a DeFi exchange’s liquidity pool. When you contribute your crypto to the pool, you’re helping to facilitate trades and transactions. In return, you earn a share of the fees generated by the exchange. It’s a win-win scenario where your crypto works for you even when you’re not actively trading.

Embrace DeFi protocols: beyond exchanges

DeFi exchanges are just one facet of the broader DeFi industry. There are various DeFi protocols that allow you to lend, borrow, and earn interest on your crypto. Lending protocols allow you to lend out your crypto assets and earn interest for each successful trade. Still, there are others that allow you to borrow against your holdings. Such features give you a chance to explore other opportunities for growth.

Stay informed: knowledge is power

It’s important to stay informed about market trends and regulatory changes. To stay ahead of the game, you can join online communities, follow reputable crypto news sources, and engage in online discussions. With the right information, you can make well-informed decisions. This also allows you to adapt to the ever-changing nature of the crypto industry.

Final Word

If you are new to crypto gambling, it can be challenging to find a reliable exchange. More so, one that is convenient for a beginner. There are three main types of exchanges that you can explore; centralized, decentralized, and hybrid. The decentralized exchanges are the top recommended trading platforms for newbies.

As you’ve seen in this guide, defi crypto sites have a simple user interface, making it easy to find your way around the site. Additionally, these platforms give you more control of your assets. There are no middlemen between buyers and sellers. Therefore, you have the flexibility to choose your preferred transaction rates.

There are different types of decentralized exchanges whose functionality varies depending on trading preferences. These include order book defi, AMMs, and hybrid dex exchange. But before you settle for a specific trading platform, be sure you understand its pros and cons.

Frequently Asked Questions

What are the benefits of using a DeFi exchange?

One of the main benefits of using dex exchanges is the fact that you are in control of your assets. This means that you’re in charge of the safety of your private key and assets. Defi crypto exchanges are also beginner-friendly, and the transaction fees are lower compared to CEXs.

How easy is it to use the best DeFi exchange?

Crypto dexes are actually easy to use, which is why they are recommendable to beginners. These platforms have an easy-to-use interface, and you can easily see the current trading pairs and the prices. Additionally, they do have innovative features like decentralized applications that give access to more financial features.

What is the best DeFi exchange’s liquidity?

The best DeFi exchange’s liquidity is determined by a variety of factors. These include the number of users, assets available, and trading volume. Generally, the more users an exchange has, the more likely it is to have a liquid order book.

What assets are available on the best DeFi exchange?

The best decentralized finance (DeFi) exchanges offer a wide variety of assets to trade. These assets include cryptocurrencies, stablecoins, tokens, derivatives, and other digital assets. Some popular cryptos you can trade include Bitcoin, Ethereum, Litecoin, and Ripple. If you opt for stablecoins, you can explore Binance Coin, Tether, and USD Coin.