Cryptocurrency Markets Post Recovery in Weekend Trading Respite

Cryptocurrency markets are finally showing signs of life after enduring a difficult start to the year that wiped $120 billion from the market in recent days, dragging it down from $590 to $470 billion.

At the time of writing, Bitcoin was up almost 8 percent to just under $9,000 over the past twenty-four hours, according to coinmarketcap . The largest digital currency, representing almost 35 percent of the total value of the cryptocurrency market, had fallen to as low as $8,369 only yesterday, a 17 percent drop in only a day. Having approached all-time highs of almost $20,000 in December last year, Bitcoin’s dramatic slide saw it consecutively breach critical supports levels of $15,000, $12,000, and ultimately slipping under $10,000. Today’s market movements provide some relief for the besieged currency.

Ethereum is up almost 10 percent to just under $1,000. Ethereum saw its all-time highs on January 10th, at times a rare green spot in a sea of red for the wider market in January. As the blood continued to spill, however, it proved not to be immune to the severe corrections in the crypto market, dipping below $800 on two occasions.

Having nearly halved from its all-time high market cap of $653 billion in mid-December during the current slump, crypto investors are finally enjoying some relief. Though it remains to be seen whether recent gains can be sustained.

The market has faced a number of headwinds in recent weeks. Korea finally settled on banning anonymous trading at the end of January, after months of speculation that it was set to ban cryptocurrency trading and perhaps even digital currencies themselves. The Korean decision was a relief to many investors, as it constitutes the third largest market in the world.

Only two days ago, Indian Finance Minister Arun Jaitley outlined the government’s position on cryptocurrencies, refusing to accept them as legitimate means of paying for goods and services or as legal tender:

The Government does not consider cryptocurrencies as legal tender or coin and will take all measures to eliminate the use of these cryptoassets in financing illegitimate activities or as part of the payments system.

On January 26th it was reported that the Tokyo-based exchange Coincheck had been hacked, with $530 million worth of NEM stolen. To the dismay of many, Coincheck admitted it failed to lock away most of its deposits in cold wallets, citing difficulties in doing so. It also failed to implement NEM’s multi signature smart contract system, an additional layer of security. The hack was the largest in cryptocurrency history.

On January 18th, CBOE’s first Bitcoin futures contracts settled at $10,900, with bears winning handsomely. The price of Bitcoin tumbled with the news. With futures contracts becoming the first opportunity to short cryptocurrencies, many worried the new financial instruments and Wall Street would have a negative impact on the market, with retail investors whiplashed around by market forces they barely understood, let alone being equipped to compete with them.

On Monday January 29th it was reported that Bitfinex and its auditor Friedman LLP had severed ties. The much-anticipated audit was of interest to the crypto community, as controversy mounted around the issue of whether Tether, the USD-backed token that had reached a market cap of $2.3 billion, was actually backed by fiat cash assets.

As Bitfinex announced there would be no audit released, at least in the short-term, it was reported that Bitfinex and Tether, the company behind the namesake digital token, had been subpoenaed by the US Commodities Futures Trading Commission (CFTC) on December 6th.

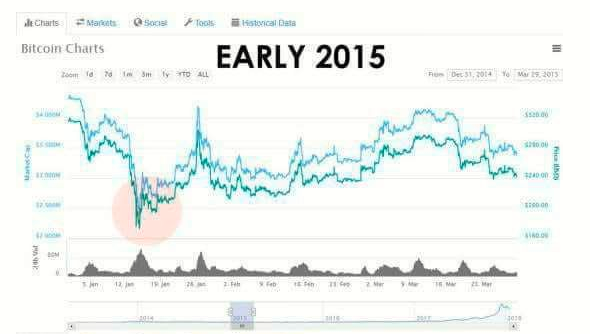

January has been a bearish month for cryptocurrencies every year since 2015. Many attribute that pattern to Asian market sell-offs with investors cashing out for Lunar New Year.

This year, however, it seems the market had a lot more issues to contend with. Let’s hope the current reprieve gathers momentum and restores some confidence among crypto enthusiasts.

Featured image from Shutterstock.