Cryptocurrency Exchange Coinbase Introduces New Tax Calculator

Coinbase has added new tax features for its customers.

The new features are aimed at simplifying the often complex process of paying tax and come with a reminder that gains made from digital currencies are taxable in the US.

Under IRS guidance virtual currencies are treated as property, meaning that investors must pay taxes adjusted to the fair market value of the asset at the time of each transaction. It’s a process that Coinbase has tried to make easier in the past, providing a complete report of all transactions from which investors can work out their profit and loss. Today’s update goes one step further, however, and gives investors a one-click tax solution. Using the new first-in-first-out tool it’s possible to generate a total profit/loss figure based on historical price data, the figure that tax authorities need to see. However, Coinbase stress that they are not providing tax advice and customers should consult professionals before taking any action.

It’s important to note that the new tool is only of use to customers who have solely used Coinbase for their digital asset investments. If they have participated in an ICO or sent funds to a private wallet or another exchange (including GDAX – Coinbase’s back end platform), the tool will not function accurately, and they will be required to work out the figure manually.

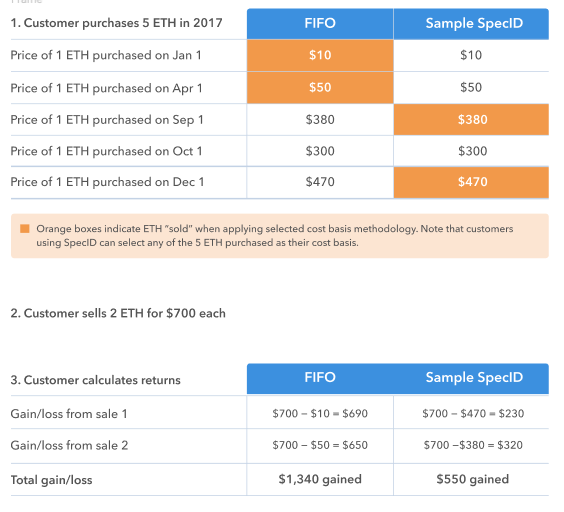

An example of the FIFO tool is provided by Coinbase, where a customer bought five Ethereum and then sold two of them:

Tax on virtual currencies is a confusing and murky area, as digital assets are still new and official protocols are not well established. According to a study of over 250,000 US digital asset investors only 0.04% are paying tax, and Coinbase’s move to simplify the process is likely an effort to change this and promote compliance. The company has increasingly been under the eye of regulatory bodies.

Last year Coinbase was ordered by the IRS to had over data related to 14,000 customers accounts, following a lengthy legal battle. The IRS initially wanted a complete breakdown of all users of the platform, but Coinbase was able to reduce the data handover to only users who had traded over $20,000 – some 3% of the total 480,000. Following the battle, David Farmer, director of communications at the exchange spoke of wanting to improve relations with the IRS and come to a fair agreement regarding the taxation of virtual currencies. The update from the company is seemingly one move to do just that and comes as a bid to improve poor relations between cryptocurrency users and tax officials.

Coinbase provides a link to this guidance from the IRS for those wishing to better understand the IRS’s stance on digital asset taxation.

Featured image from Shutterstock.