Boeing’s Earnings Missed Wall Street’s Expectations Yet Its Stock Is Rising

Investors gave Boeing a massive pass on its terrible third-quarter earnings results. | Credit: Reuters/Brendan McDermid

Investors gave Boeing a massive pass on its terrible third-quarter earnings results that ordinarily would have sunk the company’s stock. The company didn’t disclose any additional bad news about the 737 Max.

Net income at the Chicago-based company fell 51 percent to $1.17 billion, or $2.05 per share. Excluding one-time costs, per-share profit was $1.45. On that basis, Wall Street analysts had expected Boeing to earn $2.09. Revenue plunged 21 percent to $19.98 billion, beating expectations of $19.67 billion. Free cash flow, a closely watched metric, was a negative $2.89 billion.

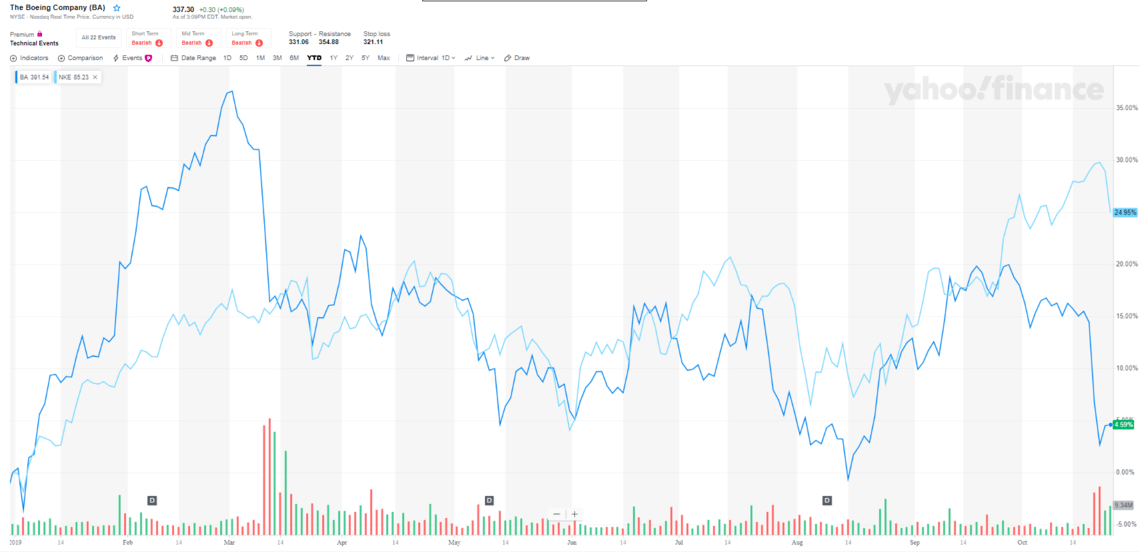

Stagnant Boeing Stock Lifts Off

Shares of Boeing (NYSE: BA), which have gained 7 percent this year, rose about 2.5 percent to $345.76 in early afternoon trading. As a result, the Dow Jones Industrial Average rose 69.10 to 26,857.80. The stock has underperformed the broader S&P 500 index, which has gained about 20 percent since January.

Investors breathed a sigh of relief that the company maintained an optimistic tone about the 737 Max. The aerospace giant continues to expect the aircraft to return to service by the end of the year. It also maintained its monthly production output for the 737 Max at 42 and will gradually increase the rate to 57 by the end of next year.

Boeing’s financial problems are the result of the worldwide grounding of the 737 Max after two fatal crashes killed 346 in Indonesia and Ethiopia. Though the company has fixed the flight control software blamed in both accidents, regulators haven’t set a timeline for returning the aircraft into service. The aerospace giant took a $4.9 billion after-tax charge in the previous quarter to compensate 737 Max-owning airlines for costs associated with the groundings.

Lots of Turbulence Lies Ahead

Questions have emerged recently about whether Boeing was alerted to safety concerns years before the crashes and delayed providing the information to the Federal Aviation Administration. The agency’s head Stephen Dickson reportedly is livid, firing off a letter to Boeing CEO Dennis Muilenburg demanding an “explanation immediately regarding the content of this document and Boeing’s delay in disclosing the document to its safety regulator.”

Muilenburg, who is scheduled to testify before Congress next week on the anniversary of the first 737 Max, was stripped of his position as chairman of the board. According to the Washington Post , he will get questions about texts from a senior Boeing executive about the “egregious” problems with the 737 Max’s flight-control software. Kevin McCallister, the Boeing executive responsible for its commercial aircraft business, was recently ousted.

Boeing has already paid a steep price for the 737 Max issues, burning through more than $2 billion in cash over the past three months. The company also is offering olive branches to airlines affected by the aircraft’s problems with discounts on future sales and services. Whether these gestures will help restore Boeing’s tattered image remains to be seen.