Newsflash: Sunday Crypto Bloodbath Sees $11 Billion Wipeout Within Minutes

After a week of marked gains, bitcoin and the wider cryptocurrency market fell steep on Sunday. | Source: Shutterstock

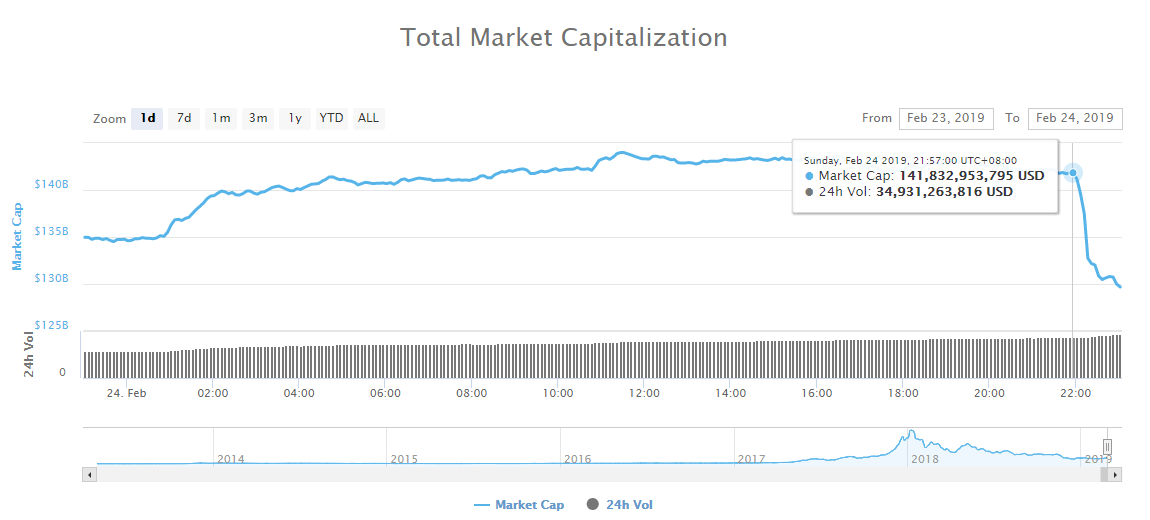

On February 24, following an impressive short-term rally from February 21 to 23, the valuation of the crypto market plunged by $11 billion from $141 billion to $130 billion.

Several analysts have suggested that the inability of Bitcoin to break out of the $4,200 mark, a crucial resistance level for the dominant cryptocurrency, led most crypto assets to retrace.

DonAlt, a technical analyst, said that alternative cryptocurrencies or small market cap assets are initiating the last phase of retracement. In the near-term, there exists a possibility the market could continue its recovery.

“All the bearish altcoins setups we’ve been discussing on stream for the last week are finally starting to play out. One more leg down should finish their retracements and make them attractive again. Staying hands off due to their weakness paid off. Patience is key,” the analyst said.

Simple Technical Movement in the Crypto Market

Last week, economist Alex Krüger explained that while charts show all indicators of a bottom for Bitcoin at $3,122, the interest in the market is minimal as shown by the relatively low volume of the cryptocurrency exchange market.

Speaking to CCN.com in an exclusive interview, DonAlt stated that investors could have been overly excited about breaking the resistance level, which caused the market to retrace.

He noted:

I’d argue the main reason why this happened was due to the entire crypto sphere getting overly excited into technical (Weekly & daily) resistance combined with the fact that there’ll probably be a lot of ‘sell the news’ coming the closer we get to the ETH fork.

Previously, CCN.com reported that the Ethereum price has increased by 60 percent since early February in anticipation of the Constantinople hard fork.

The hard fork, which includes a key update on the Ethereum blockchain network regarding the decline in block rewards, was supposed to activate in January. However, it was delayed to February 25.

In the cryptocurrency sector, investors tend to dump their holdings subsequent to the materialization of an event, update, or a product launch, and the same could occur following the Constantinople hard fork scheduled to occur tomorrow.

In the long run, the Constantinople hard fork and the decline in block rewards are bullish fundamental factors for ETH as they decrease the potential circulating supply of the asset. In the short-term, due to the behavior of many investors in the space, it could also have a negative effect on the price trend of the asset.

Still, even after the abrupt 9.5 percent decline in the price of Bitcoin from $4,190 to $3,795, fundamental factors of BTC and most major crypto assets remain strong.

Moreover, although the magnitude of the sudden drop in the Bitcoin price surprised investors, BTC cleanly broke out of the $4,000 resistance level, which it struggled to overcome for months.

Bitcoin was close to breaching the $4,200 resistance level, which traders previously emphasized that it could the asset to the $5,000 to $6,000 range in the months to come.

“Once price breaks 4200 it could move fast. Matter of watching levels, just like 3700 yesterday. Key buy level below is 3700. No longs sub 3550,” Krüger said on February 19.

What it Means For Tokens and Smaller Assets

While small assets and tokens tend to experience intensified price movements when the price of Bitcoin surges, it also tends to retrace by a large margin when the dominant cryptocurrency drops.

In the past 30 minutes, tokens recorded losses in the range of 10 to 26 percent against the U.S. dollar as BTC retraced by 9 percent.

View the live bitcoin price chart here.

Editor’s note: (25/02/2019): Article updated for clarity.