Bitcoin Flexes Safe-Haven Status as Hong Kong Protests Escalate

The rapidly-escalating Hong Kong protests, along with crippling sanctions in Venezuela, give Bitcoin the chance to be a true safe haven. | Source: Anthony WALLACE / AFP (i), AP Photo/Ariana Cubillos (ii). Image Edited by CCN.com.

Bitcoin’s blossoming inverse correlation with the stock market and other assets vulnerable to economic and political turmoil suggests that it’s finally becoming “digital gold.”

Since early May when it broke above $6,000 for the first time this year, Bitcoin price movements have been remarkably correlated with rising U.S.-China trade war tensions.

Currently, demand for the cryptocurrency is surging in two more countries experiencing crippling political turmoil – Hong Kong and Venezuela.

Bitcoin Price Premium Surges in Hong Kong

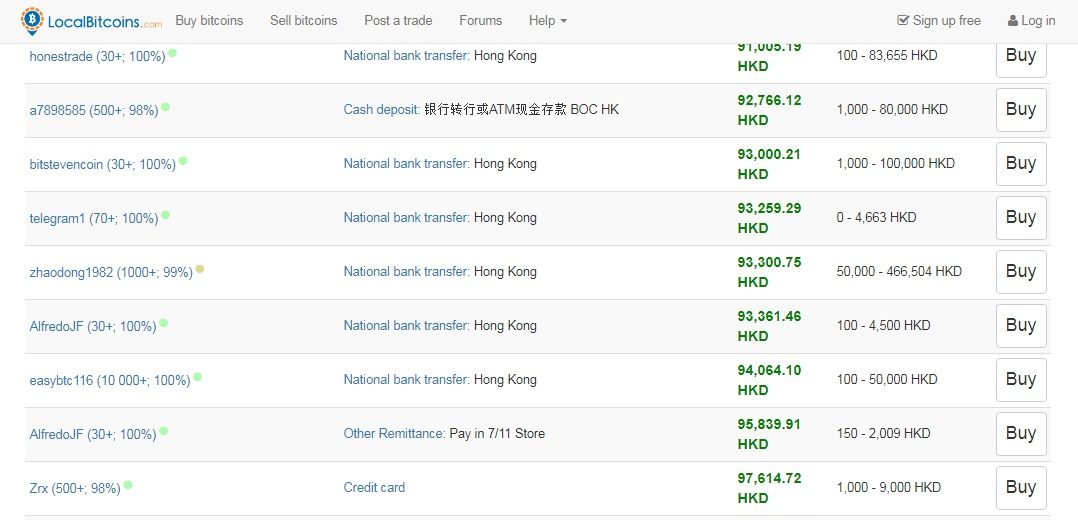

On peer-to-peer exchange LocalBitcoins, sellers of Bitcoin in Hong Kong are demanding a premium of between HK$ 1170 and HK$39,000 (US$150 and $US5,000).

This comes on the back of intensifying anti-government protests .

This morning, all flights departing from Hong Kong International Airport were grounded until Tuesday after 5,000 protesters spilled into HKIA, which boasts annual passenger traffic of 75 million. Beijing officials blasted the protests as exhibiting “signs of terrorism.”

Hong Kong also recently cut its interest rate for the first time in a decade, reducing its target to 2.5% to join the growing number of central banks throughout the world who are cutting their benchmark targets.

Trump ‘Pumps’ Crypto Purchases in Venezuela

In Venezuela, Bolivar-to-Bitcoin trading volumes surged to 73 billion for the week ended August 10, setting another all-time high for the umpteenth time. This smashed the previous record of 69 billion Bolivars, which had been set just one week prior.

The record amounts of Bolivars spent on purchasing Bitcoin in Venezuela came as the United States slapped the Latin American country with tougher sanctions. Last week, President Donald Trump signed an executive order freezing all assets belonging to the Venezuela government in the U.S.

The sanctions put Venezuela on par with U.S. adversaries such as Iran and North Korea. While the executive order was seen as placing more pressure on Venezuelan strongman Nicolas Maduro, the debilitating sanctions are likely to hurt ordinary citizens the most.

https://twitter.com/comradeyo/status/1159293373980848128

Thus, plagued with a hyperinflationary currency and constant political uncertainty, Bitcoin has proved to be a relatively reliable store of wealth in Venezuela.

Click here for a real-time Bitcoin price chart.