Bitcoin Price Rally Still Has Legs

Bitcoin continues to show strength as it bounces back from profit-taking overnight, making yet another new swing high moments ago. The question on traders mind everywhere is, no doubt: ’How far will this go?”

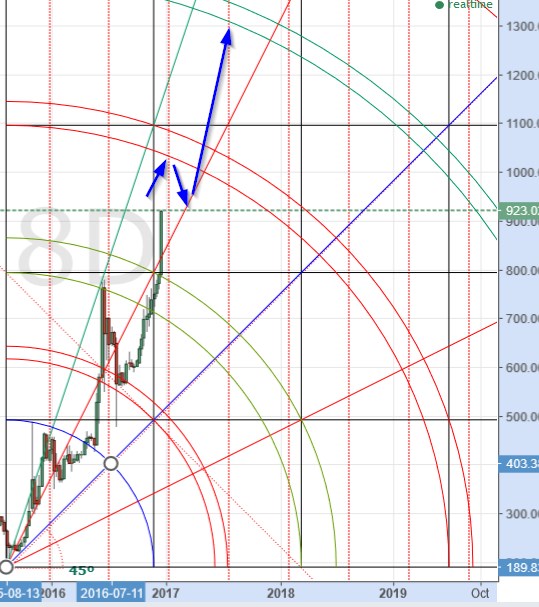

While I have no definitive answers to that question, I can postulate guesses based on what the charts seem to be saying. Let’s look first at the long-term 8-day chart:

We have seen this chart a few times in the past few days. The 3rd arc pair will presumably be met in the $1030 area. This arc is typically strong resistance, so my guess is that there will be profit-taking there. However, depending on what happens when price gets there, as of this writing, I tend to doubt that this advance will stop there. A rally this strong seems destined for the 5th arc. But let’s wait to see what happens at the 3rd arc first.

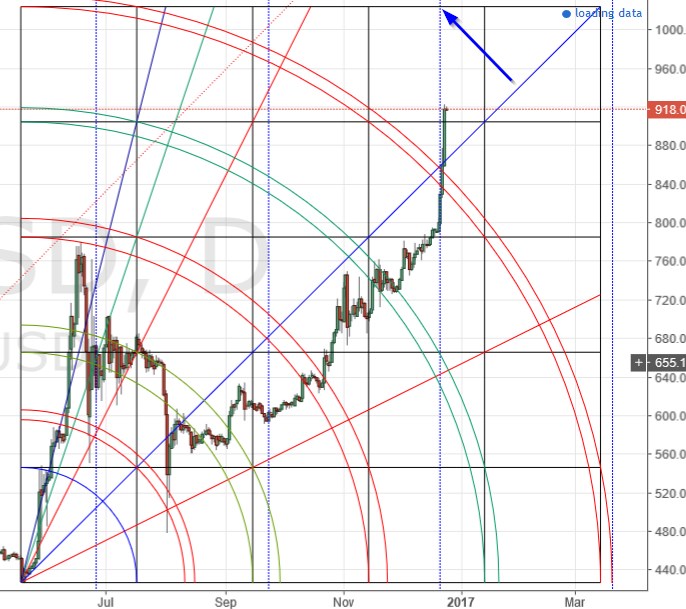

This chart is showing the next resistance at the top of the 5th square, now that the 4th square has been convincingly beaten. Interestingly, as is so often the case, the resistance on this chart is in the same area as resistance on the weekly chart – ~ $1025.

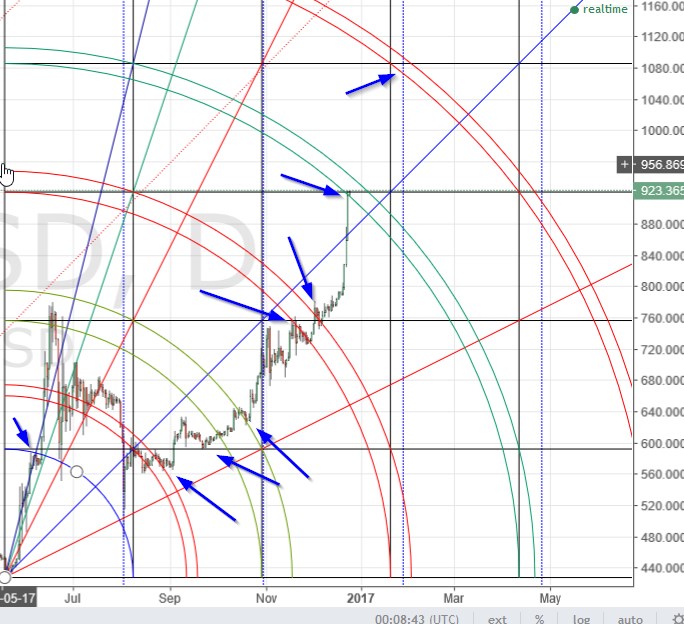

If this setup proves too small, i.e. if we get a convincing close above the 5th square, we will need to re-size our setup to the next larger size. Doing so will move the 5th arc significantly higher. While it is premature to do that now, I have done so anyways, just to see it. Interestingly, the fractal nature of the market is demonstrating a remarkable affinity to this setup, as indicated by the multitude of blue arrows:

(On this setup, the 5th arc pair is in the $1080 area, and the current resistance is exactly at the 4th arc pair and top of the 4th square. But let’s not get ahead of ourselves…)

(On this setup, the 5th arc pair is in the $1080 area, and the current resistance is exactly at the 4th arc pair and top of the 4th square. But let’s not get ahead of ourselves…)

Happy trading!

Remember: The author is a trader who is subject to all manner of error in judgement. Do your own research, and be prepared to take full responsibility for your own trades.

Image from Shutterstock.