Bitcoin Price’s Meteoric 2019 Isn’t Even a Mainstream Trend Yet

Bitcoin's bullish 2019 could really take off once retail investors start paying attention. | Source: Shutterstock

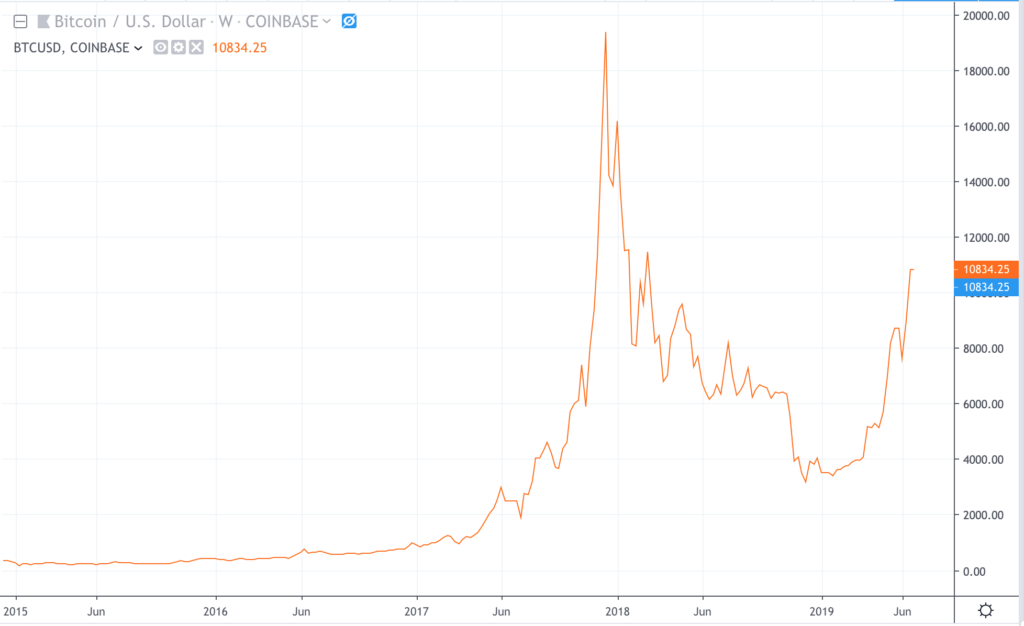

The bitcoin price carved out a new 2019 high on Sunday, piercing above $11,200. The parabolic rally marks a 250 percent recovery from the lows of October 2018. But this price rally is missing one thing: retail investors.

Judging by Google search trends for the phrase “buy bitcoin,” the mainstream is absent from the latest price rise. It’s a sharp contrast to bitcoin’s parabolic bubble in 2017, which was triggered by an influx of the general public.

Instead, bitcoin’s move above $10,000 is driven by institutions and existing players moving money back into bitcoin. If this analysis is correct, there’s significant room for bitcoin’s price to explode further.

Bitcoin price punches above $11,200

The bitcoin price shot to $11,236 on Coinbase on June 23rd, breaking the $11k barrier for the second time in two days.

On the surface, it appears that Facebook’s cryptocurrency launch, Libra, triggered the price rise. Analysts claim that Facebook’s entry to the space is a tipping point for crypto normalization and, ultimately, adoption.

In reality, there are deeper fundamental reasons for the latest price surge:

- Bitcoin transaction volume is back near record highs.

- The number of unique bitcoin addresses is at levels only previously seen near the peak of 2017’s mania.

- Bitcoin’s latest move to $10,000 was backed by more daily trading volume than the 2017 bubble.

At the same time, institutions have been “buying the dip,” providing a deeper foundation for the next bull market.

Google trends: bitcoin bull market is only just beginning

The 2017 bitcoin price bubble, which peaked at $20,000, was characterized by hype and mania among the general public. The fear of missing out (FOMO) spurred a desperate rush to buy bitcoin among retail investors.

This time is different. According to Google trends data, the 250 percent bitcoin price recovery hasn’t even sparked the interest of the mainstream yet. Global search volume for the phrase “buy bitcoin” is at just 7/100. To compare, that figure was 100/100 in early December 2017.

Bitcoin price built on stronger foundations

Bitcoin is building a stronger price foundation with rising on-chain fundamentals, increased volume, and deeper interest from institutional investors.

The 2017 bubble was a hype-driven mania rally. This time around, we haven’t even got started.

Click here for a real-time bitcoin price chart.