Bitcoin Price Spikes 10% in 2-Day Rally Despite Lacking Retail Investor Flurry

Bitcoin price is seeing good winds again. | Source: Shutterstock

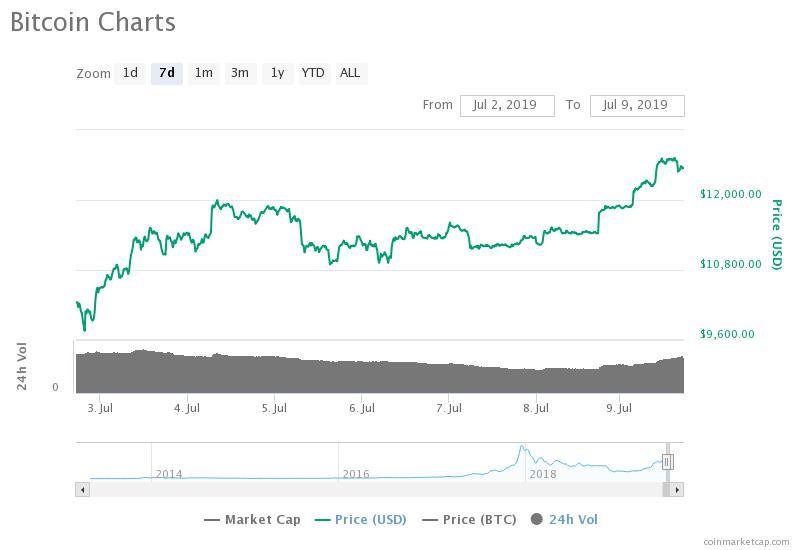

Over the past 48 hours, the bitcoin price has surged by more than ten percent against the U.S. dollar from $11,328 to $12,545 on regulated crypto exchanges like Coinbase Pro and Kraken.

Earlier this month, the bitcoin price dropped to as low as $9,700 in a relatively large pullback that was anticipated by traders for quite a while.

Prior to its near 30 percent pullback on July 2, the bitcoin price had increased by more than 250 percent year-to-date, leading investors to become more cautious on the near term trend of the asset.

Fast recovery but retail interest towards bitcoin remains low

Several analysts have expressed optimism towards the pace of the recovery of the dominant crypto asset in the past week which is likely have been primarily affected by the opening of the CME bitcoin futures market.

Despite the swift recovery of bitcoin from occasional pullbacks and its strong year-to-date gain, according to global macro analyst Peter Tchir, Google Trends has shown that search engine interest for BTC remains nowhere close to 2017 levels, unlike the asset’s price.

Tchir said that he remains unclear of the factors behind the lack of growth in retail interest towards bitcoin. But, the analyst noted that if the bitcoin price is sustained at its current level, investors are likely to begin “dabbling” with the market once again.

Nodesource chairman Joe McCann, citing the report of Tchir, said that the trend of BTC continuing to strengthen above the psychological $10,000 level without big interest from individual investors is “so bullish.”

It is widely believed that the recent rally of bitcoin and the rest of the crypto market has been mainly triggered by the consistent inflow of institutional capital via strictly regulated channels such as Grayscale’s Bitcoin Investment Trust (GBTC) and CME’s bitcoin futures market.

Institutions tend to invest in emerging markets and new asset classes with a long term strategy and are less likely to liquidate their holdings with a short term outlook over the market.

Due to the increasing institutional interest which the growing volumes of GBTC and CME’s bitcoin futures market have evidently portrayed, the dominance of bitcoin has grown over 64 percent.

“Bitcoin Dominance on its way above 66%. This is why you always keep a healthy percentage of your portfolio in Bitcoin especially in a bull market,” cryptocurrency technical analyst Josh Rager said .

Max Keiser, who has been vocal about the bitcoin price breaking its record high and achieving $28,000 by the year’s end, has said that $28,000 is “still in play,” showing positivity on the asset’s medium-term trend.

What potential catalysts are awaiting?

In the upcoming months, Bakkt is set to run the testing phase of its futures product and major financial institutions in the likes of Fidelity and TD Ameritrade are expected to roll out their custody solutions.

The increase in the number of custody solutions and institutional-grade products would further strengthen the infrastructure surrounding the market, which could make bitcoin a more compelling store of value for investors.

As CCN.com reported, hedge fund manager Mark Mobius said that if bitcoin continues to grow like it has done in recent years, he may consider investing in the asset.

“But, at the end of the day, there are many people who do believe in it and if it continues and grows, then I would probably have to be a buyer and be involved in this,” he said.

Click here for a real-time bitcoin price chart.