Bitcoin Price Breathes Again After Sharp $300 Drop

Less than 24 hours after hitting a historic all-time high of $3,000, bitcoin price sunk sharply to lost nearly 10% of its value on Monday morning, before a rebound ensued.

Bitcoin’s volatility has long been a crutch for its naysayers and Monday’s drop after the cryptocurrency’s all-time high looks likely to trigger its critics. After hitting the significant milestone of $3,000 on Sunday afternoon, prices took a surprising tumble on Monday morning. At approximately 10:00 UTC, bitcoin dropped from trading around $2,945 on a global average to a low of $2,710.

The drop was more pronounced on British Virgin Islands-based Bitfinex, which struck a daily low of $2,570.

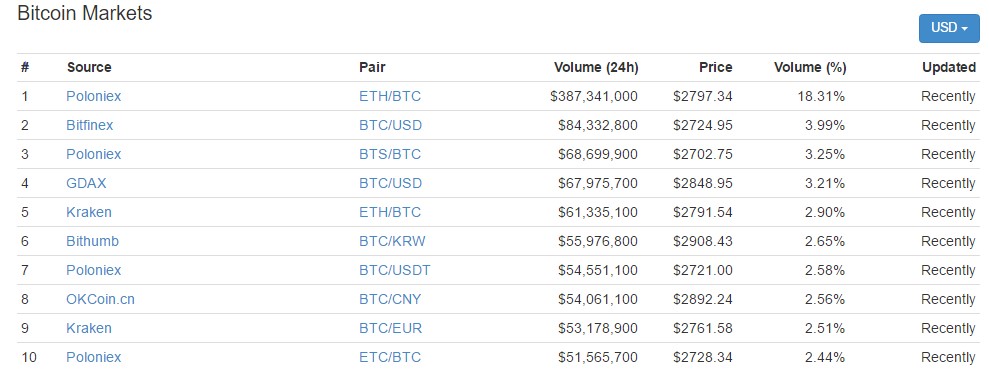

Data from CoinmarketCap reveals a significant sell-off with 6 of the top 10 trading pairs swapping bitcoin to fiat currencies in the US Dollar, the Korean Won, the Chinese Yen and Euros in a number of global exchanges. The all-time high is likely to have persuaded some investors to cash out.

However, the drop proved to be short-lived as global average prices have since rebounded toward the $2,800 mark. Today’s fall, while steep, pales in comparison to the flattening drop on May 25th when the cryptocurrency fell over $350 to $2,400 from a then all-time high of $,2760. The following day, prices fell again. In dropping down below $2,100, the two-day correction represents the sharpest fiat value fall of bitcoin this year.

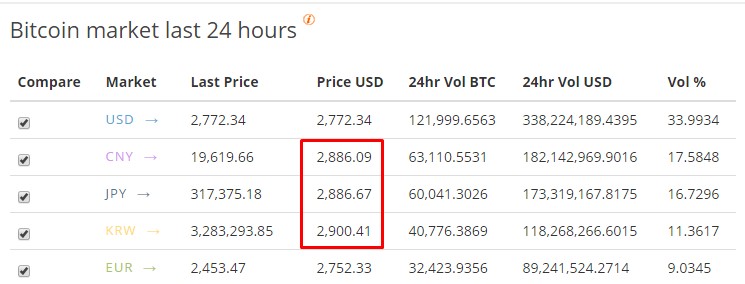

Still, today’s fall has had an impact on global markets as premium trading prices investors in Japan and Korea, which has seen a shortening spread in recent days after soaring premiums in May.

Altogether, 2017 has been a significantly positive year for bitcoin and – even more so – the cryptocurrency ecosystem. Bitcoin rang the year in at $1,000 on the first day of January and yesterday’s all-time high represents a 300% growth in a little over 6 months.

Featured image from Shutterstock.