Bitcoin Has Obliterated the Top Dow, Nasdaq & S&P 500 Stocks in 2019

While Cisco, Xerox, and Beyond Meat have all delivered stellar gains in 2019, none of them can touch bitcoin's performance. | Source: (i) Shutterstock (ii) Shutterstock; Edited by CCN.com

By CCN.com: Gaining an eye-popping 135%, bitcoin has smoked even the most impressive U.S. stocks this year. Even if you take the top performers from the Dow Jones Industrial Average, S&P 500, and Nasdaq – which are Cisco Systems (CSCO), Xerox (XRX), and Beyond Meat (BYND), respectively – they can’t touch BTC/USD for returns. Here are the charts to prove it.

Dow’s Best Stock Can’t Touch Bitcoin in 2019

Cisco Systems has benefitted from a restructuring spearheaded by CEO Chuck Robbins and so far has shrugged off any threats from Trump’s trade war with China. Some analysts are now anticipating that Cisco Systems might see some upside from rival Huawei’s major political problems . No matter how good things have been for the Dow’s best-performing member this year, bitcoin has still left it in the dust by more than 100% YTD.

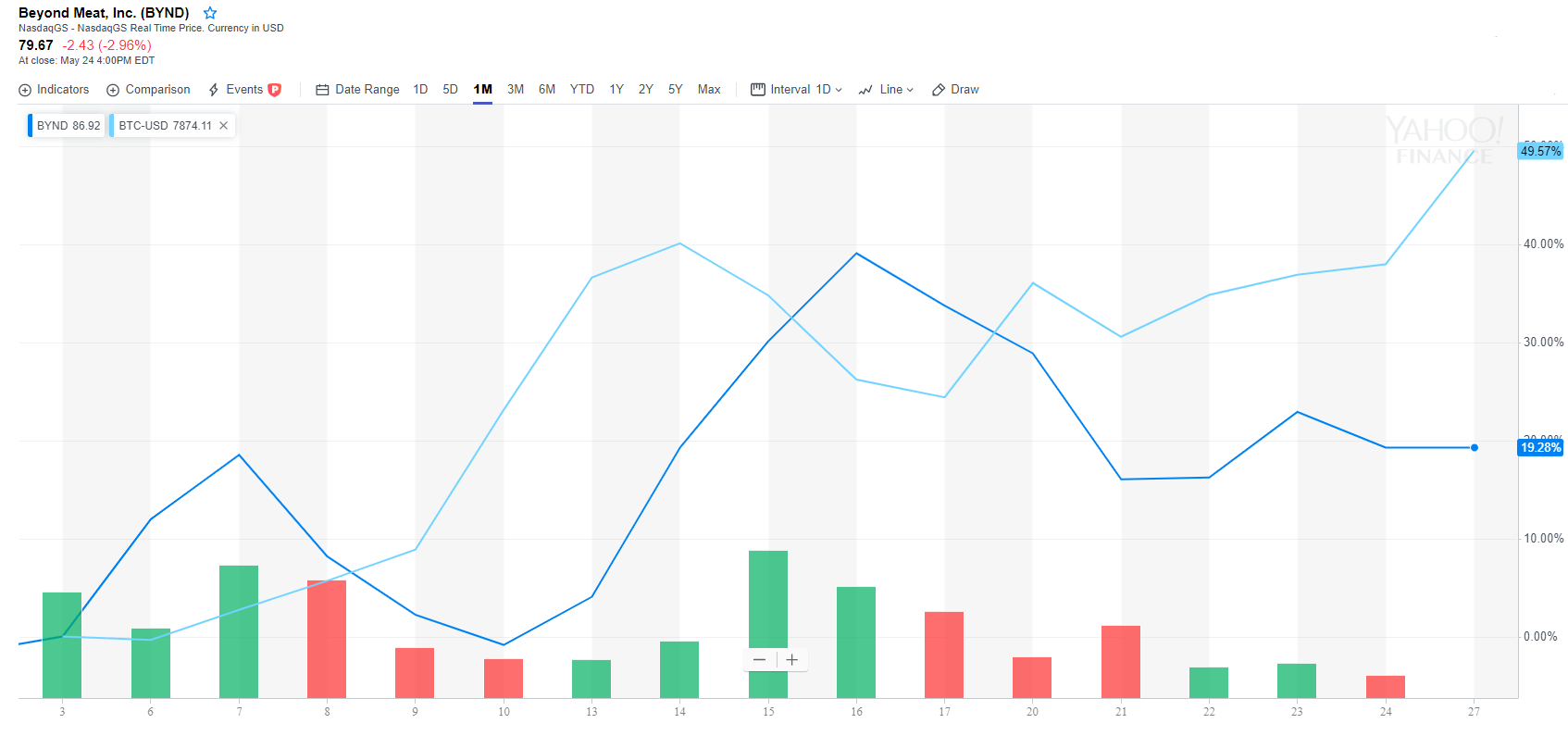

Best Nasdaq IPO Since 2000 Is No Match for BTC

Beyond Meat’s recent IPO was extremely impressive, posting the best offering for nearly two decades. As the only vegan play in town, this Nasdaq-listed burger maker demonstrated it could raise cash with the best of them. Unfortunately, like the Dow, the Nasdaq’s finest was no match for bitcoin (BTC/USD). It is worth noting that the IPO price for BYND was $25, so technically it is up 230%. But given it was almost impossible for retail investors to secure this price, Yahoo considers the opening price to be around $60.

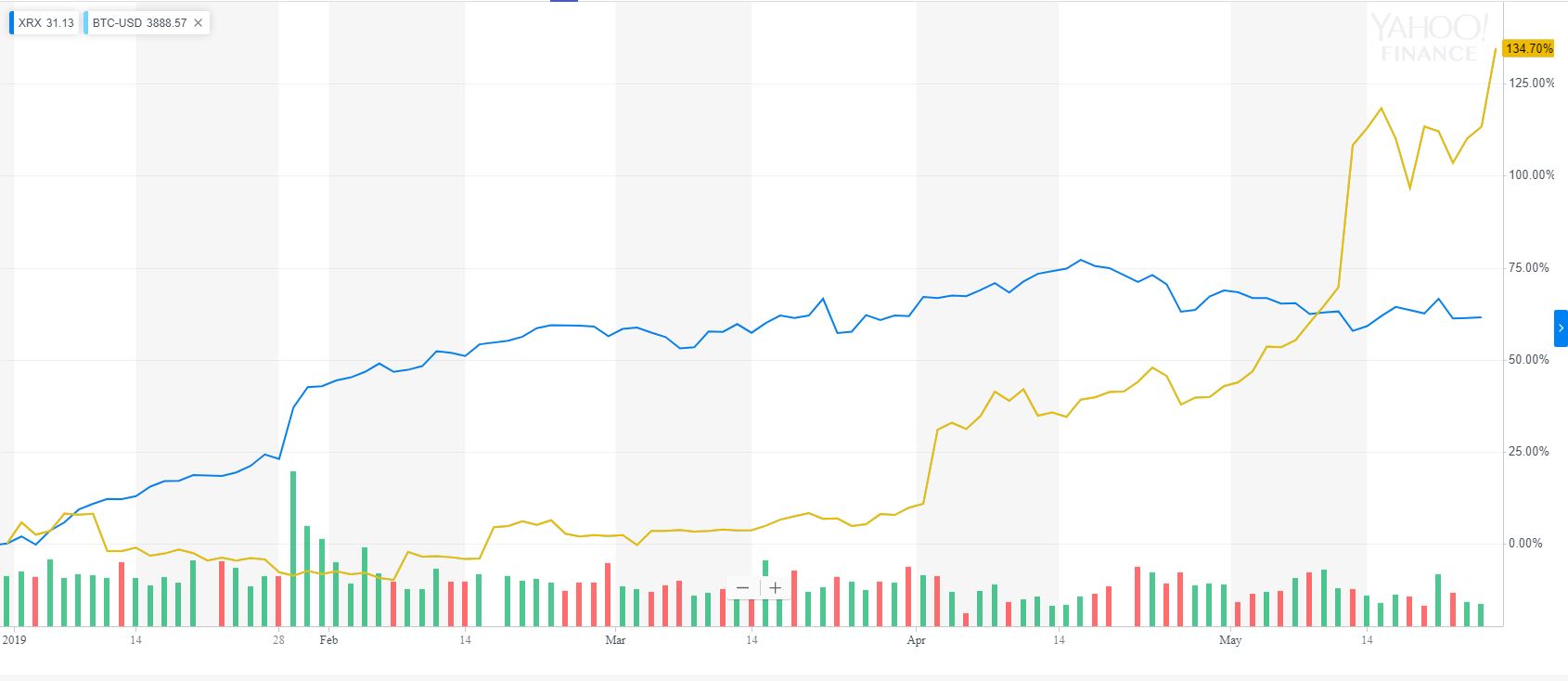

S&P 500’s Xerox Posts Impressive 60%+ Returns

Xerox has been a wonderful investment in 2019. The company expects earnings per share of $3.95 and has offered more than 60% in gains to investors. The S&P 500 has a large range of companies, and to come out on top is no small feat. Even some recent losses have done little to dent the vibrant performance. Outstripping the Dow and Nasdaq’s best, there is still no comparison with bitcoin, which boasts a nearly 80% lead on XRX.

Binance Coin (BNB) Humbles Buoyant Bitcoin

Don’t assume just because bitcoin is annihilating established performers that it is the best crypto in 2019. In fact, despite recent security issues, Binance’s native cryptocurrency BNB is up a staggering 450% – an astounding rate of return by any metric.

Dow, S&P, and Nasdaq Indices Flatline Relative to Top Cryptocurrencies

When you look at the Dow’s performance relative to major U.S. indices, the correlation is readily apparent. Bitcoin, on the other hand, continues to detach itself from these more established lines of investment. A growing diversification argument is, therefore, in motion. With plenty of room for institutional investment, increased inflows to BTC/USD seem likely while the positive crypto environment persists.