Binance Births its Own Decentralized Blockchain to Challenge Ethereum

Crypto giant Binance is launching its own blockchain and that should scare Ethereum. | Source: Shutterstock

By CCN.com: Binance, the world’s largest crypto exchange with over 10 million users, has launched its own blockchain – the Binance Chain mainnet today, a highly anticipated blockchain protocol aimed to support decentralized exchanges (DEX). Binance will also open a decentralized exchange next week

Binance Coin (BNB), the native token of Binance, will operate as the main cryptocurrency of Binance Chain and will be moved from the Ethereum network.

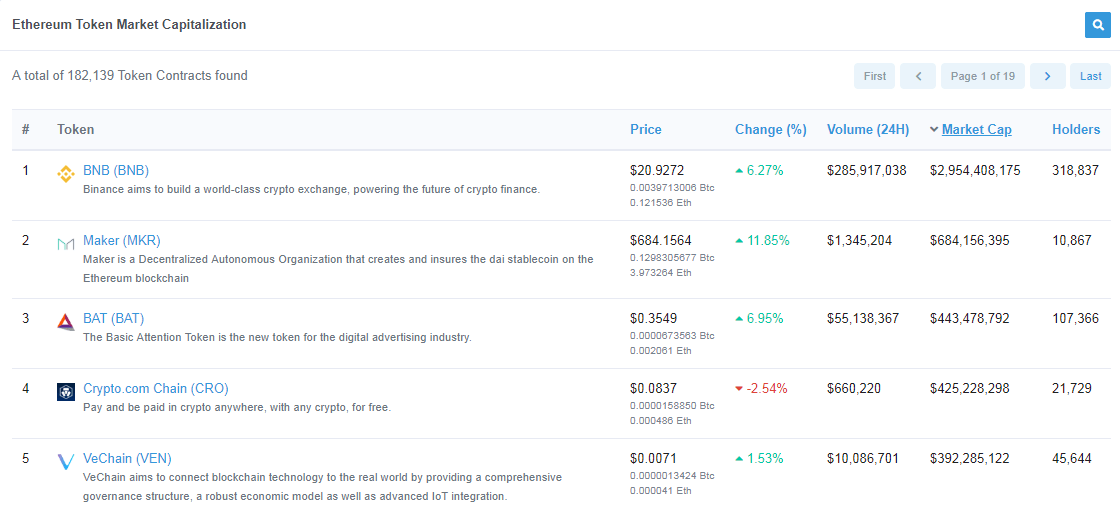

Currently, BNB remains as the most valuable token on Ethereum as an ERC20 smart contract token with a market capitalization of $2.95 billion.

Floodgate For Crypto DEX to Open

Speaking to CCN.com in an exclusive interview, the Binance team said that Binance Chain is custom-built for decentralized exchanges with low latency and high throughput, providing a more efficient protocol for decentralized applications (Dapps) that require higher transaction capacity.

The team expects the large capacity of Binance Chain to attract more Dapps and DEX with economic freedom, stating:

Binance Chain was created to support the issuance and exchange of digital assets. Any project can issue new tokens on Binance Chain, and existing tokens that don’t depend on smart contracts are welcome to migrate to Binance Chain, to natively exchange on Binance DEX and gain the benefits from this low latency and high throughput network. This will inspire more economic freedom, and more projects participating in Binance DEX will help further the long-term vision of peer-to-peer cryptocurrency trading.

During the process of the mainnet launch, BNB, which currently exists on Ethereum, will move over to Binance Chain through a mainnet switch. In doing so, Binance’s blockchain could also prove tempting for other crypto projects – many already on the Ethereum network – to migrate over.

In the upcoming days, BNB will be created on Binance Chain with a fixed supply of 200 million, and to replicate the supply of BNB on Ethereum, it will burn 11,654,398 BNB.

“The first batch of 5,000,000 BNB will be allocated and deposited into an address belonging to Binance.com in order to convert the ERC20 BNB for existing owners. Binance will burn 5,000,000 ERC20 BNB as well, to keep the total supply of BNB constant,” the Binance team said.

Essentially, Binance is executing a token swap between Ethereum and Binance Chain to transfer all BNB circulating in the market to the newly established blockchain network.

“BNB will be used as gas on Binance Chain, to assist network transactions. Also, for background on the migration: ‘BNB will be converted from ERC20 tokens into native BNB tokens running on Binance Chain via the exchange platform at Binance.com, a pragmatic and efficient way to perform the initial token swap,” the team further explained.

Are DEXes Decentralized Enough?

Several criticisms against DEXes throughout the past several years have been scalability and decentralization.

Most developers decentralized exchanges or DEX protocols describe a DEX as a platform on which users have full control over their funds in a non-custodial ecosystem.

That means, even during trading, users always have control over their funds and the risk of a potential hacking attack putting user funds at risk is non-existent.

“It’s different from a centralized exchange because these relayers are not holding user funds at all. They are completely non-custodial. We have seen a lot of relayers starting to make open source market-making tools,” Amir Bandeali, CTO of 0x, previously said .

Changpeng Zhao, the CEO of Binance, responded to the criticism towards the level of decentralization of DEXes in February, stating that the focus on creating a DEX is to provide users on the platform full control over their money.

Zhao added:

“A few guys seem to be bent out of shape, take it easy. Don’t call it a DEX. Call it an exchange where users control their own funds, runs on a fast blockchain maintained by a number of nodes, plus a fast and easy UI. That’s it. Whatever makes you happy. At the end of the day, the market will vote. Let’s see how the adoption goes on the mainnet.”